The Big Picture

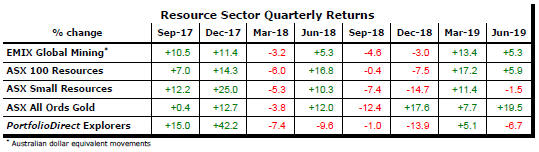

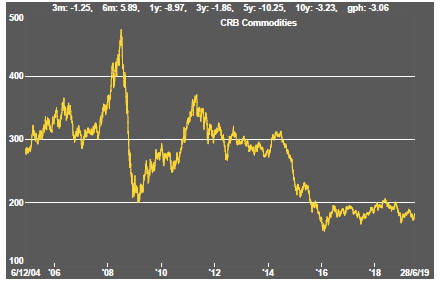

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

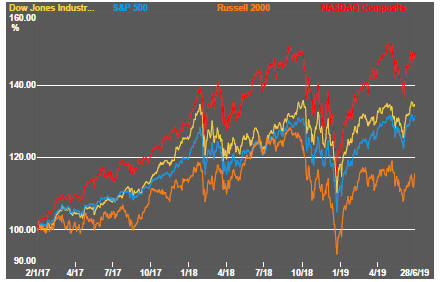

Markets had been waiting for the G20 meeting of leaders in Osaka for a breakthrough in trade negotiations between China and the USA but little was achieved. At best, things did not get worse.

The USA and China appear to have put off an escalation in the trade conflict with rescheduled talks due to commence during July. A breakthrough still appears out of reach without one party assessing the costs of an ongoing conflict being too great and giving ground.

Markets will have more opportunities for nervousness in coming months over whether any meaningful change in policy, from either side, will eventuate.

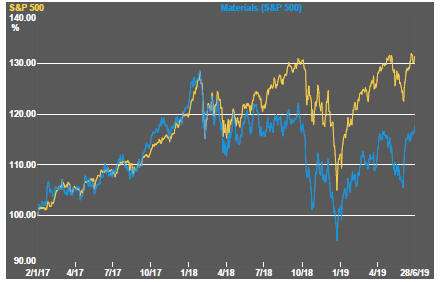

Mining sector stocks made gains despite the broader market treading water, albeit near record levels for the S&P 500.

The strength of the iron ore price was an important contributor to the performance of the mining market leaders and, consequently, the headline market indices.

The share prices of the bulk of the sector continued to languish near historically low levels.

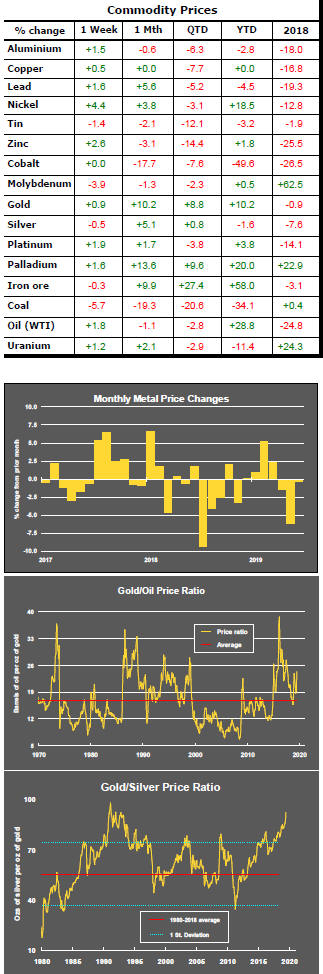

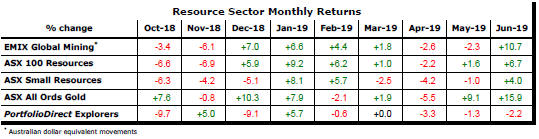

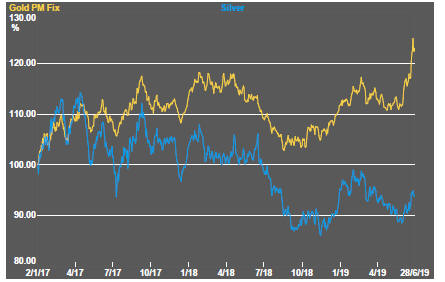

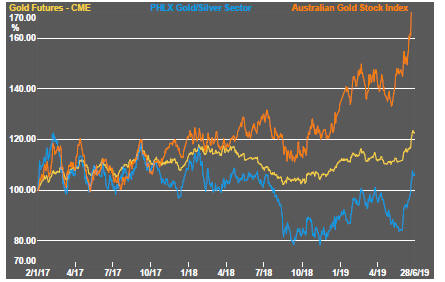

Falling bond yields and lowered interest rate expectations have helped push the gold price to the highest level in six years. The Australian gold sector has shown stronger leverage to the improved bullion price than its North American equivalents.

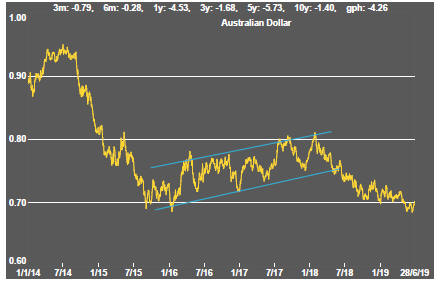

The Australian dollar made up some ground lost in the past few weeks, no doubt helped by the prospect of improved iron ore export revenues but remains hindered by a decelerating domestic growth profile and the likelihood of further reductions in Reserve Bank interest rates.

The silver price continued to lag gains in the gold price leaving chartists of the gold/silver price ratio scratching their heads about the timing of a turn in the ratio which has been delayed well past the time and level traders had expected.

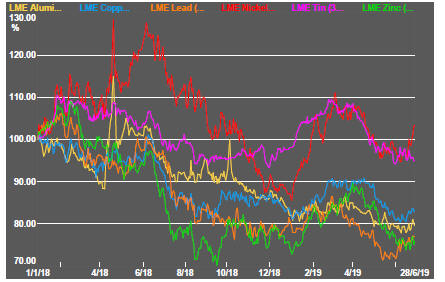

Daily traded nonferrous metal prices edged slightly higher. The overall price bias remains downward but the momentum of decline appears to have eased, at least for the time being.

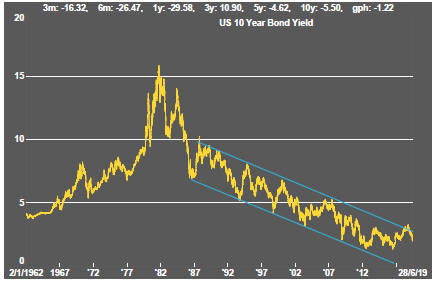

The copper price has remained relatively stable for the best part of 12 months. It had been pointing to a weaker economic outlook than bond prices had been signalling. The recent sharp decline in yields is now indicating a more pessimistic outlook within the financial markets, raising the prospect of an upcoming relative price adjustment to resolve the difference.

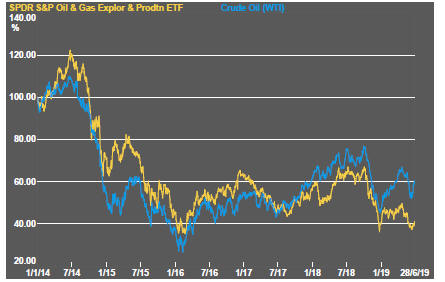

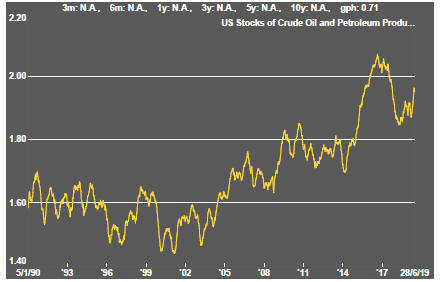

Crude oil prices ran up following commitments from oil exporters to retain supply constraints amid still threatening geopolitical disruptions. As evident throughout the year to date, equity prices for oil and gas exploration and production companies have displayed little leverage to improvements in crude oil prices.

The battery metals sector has remained in the investment doldrums, despite an outstanding long-term future for energy storage applications.

Also within the energy theme, uranium and coal have both lost momentum. .

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

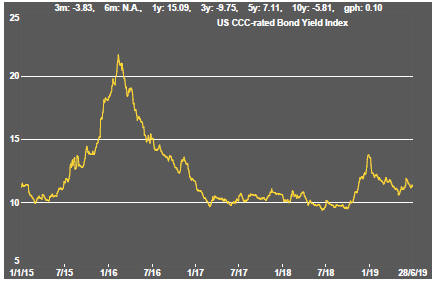

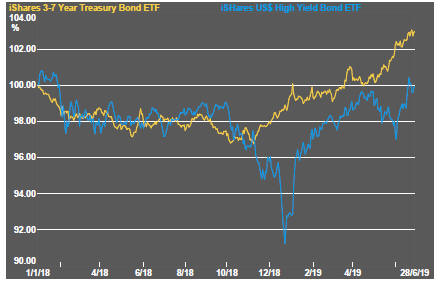

Interest Rates

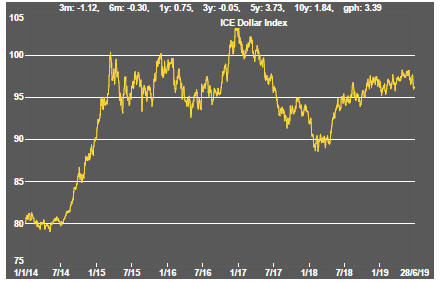

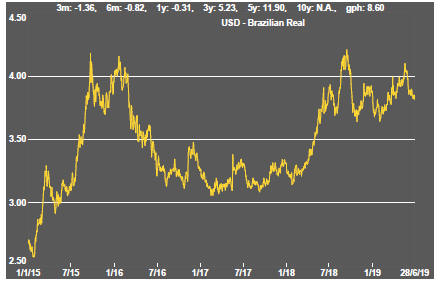

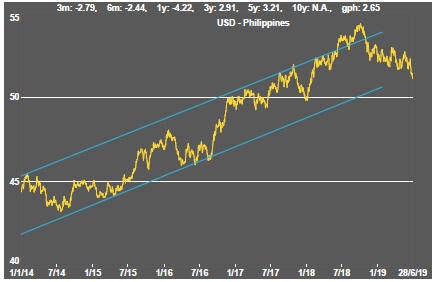

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium