The Current View

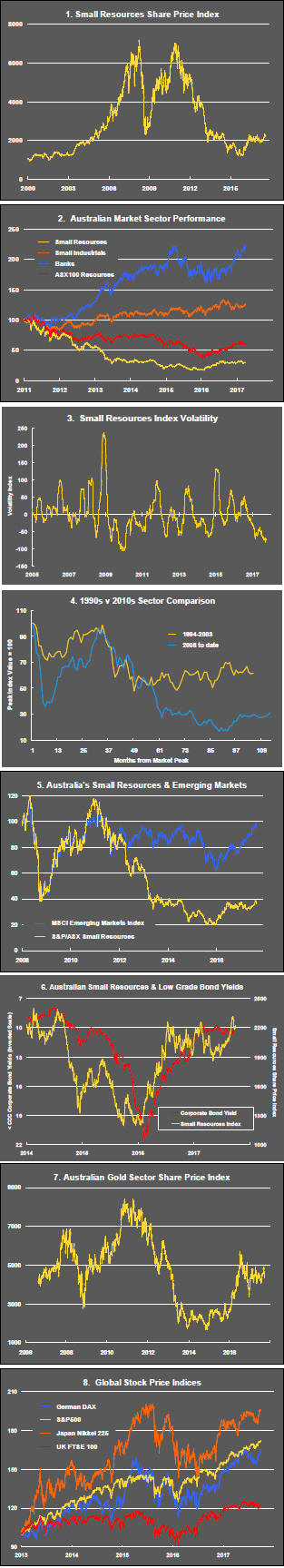

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Market Breadth Statistics

US equity markets pushed to new record levels with a wider array of previously underperforming sectors starting to contribute to the improved outcomes.

US bond yields have been trading higher suggesting some reappraisal of growth conditions although yields are also significantly lower than investors would have expected at this point in the cycle.

Some part of the most recent rise in yields would also be associated with the commitment of the US Federal Reserve to begin its balance sheet rundown.

The US dollar has started to claw back some of the recent losses as another reappraisal of relative growth and interest rates has been occurring.

A part of the prior decline in the exchange rate had come with strengthening confidence about European growth and, with that, a change in view about how quickly European interest rates would start to rise. This came after there had been a widely held view that the US economy was far more cyclically advanced than in Europe.

The consensus about Europe has not changed but there has been some rebound in confidence about the US cyclical postion.

The implied view about global growth from the copper price has been at odds with the view implied by US bond yields.

Rising yields and higher copper prices would be consistent with stronger global growth expectations.

Since the middle of 2017, higher copper prices have come with falling yields. Rising yields have been accompanied by slightly weaker copper prices.

Copper prices will have also been influenced by changes in exchange rate directions which have tended to dominate other influences.

Nickel prices were noticeably weaker in the past week. The tin price showed little change. The balance of the LME complex of nonferrous metal prices remained near cyclical and 2017 high points.

Iron ore prices have appeared to turn lower in a seemingly leveraged response to a loss in steel price momentum.

The reversal in gold prices was consistent with the decline in bond prices.

The future direction of gold prices will depend heavily on whether US bond yields remain within the broad downtrend evident through 2017 or whether the apparent reappraisal of demand growth on financial markets will become a more significant drag on the gold price.

Gold related equity prices have underperformed rising bullion prices over the course of 2017 as they have missed out on the leverage which might have been inferred from historical data.

Equity investors appear to have been discounting the sustainability of the gold price rises.

Australian gold-related equity prices have shown no significant net change though 2017 despite improved gold bullion prices.

A more bullish tone to oil markets has translated into stronger oil and gas equity prices with the exploration end of the market showing particular leverage to the conditions.

Equity prices have broken the downtrend in prices which had prevailed through 2017.

Although oil and gas exploration stocks have responded to higher oil prices, the mining explorers have been far more muted in their response to improvements in metal prices.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.