The Big Picture

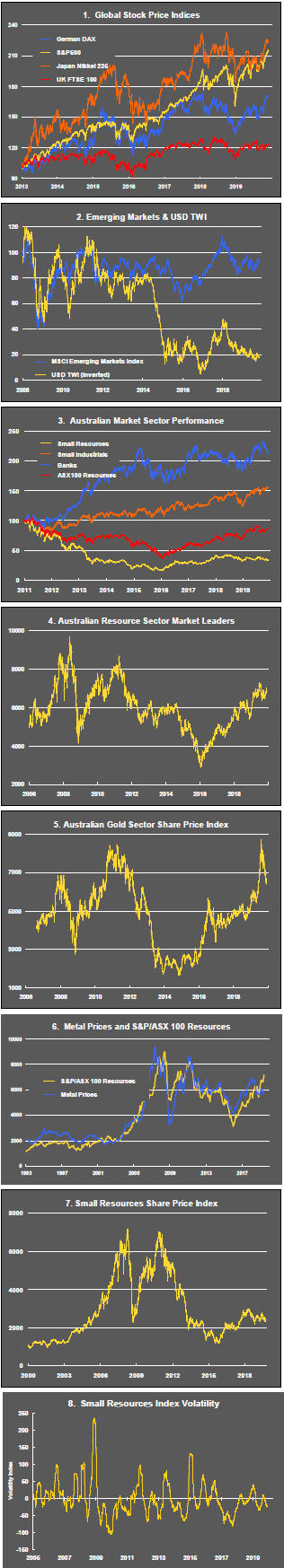

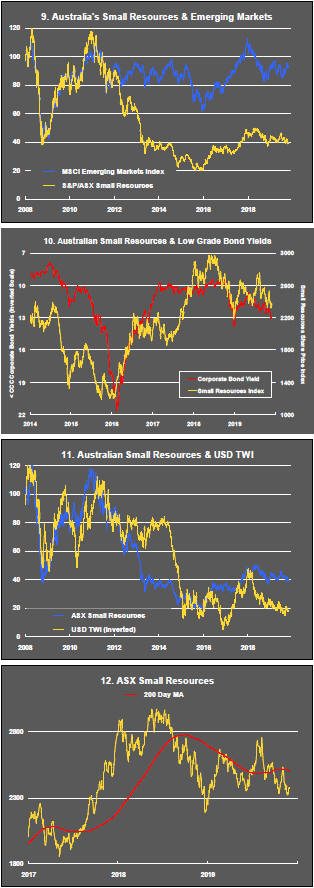

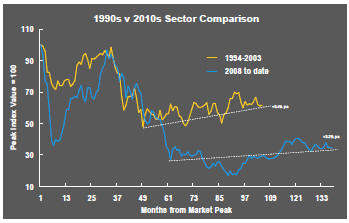

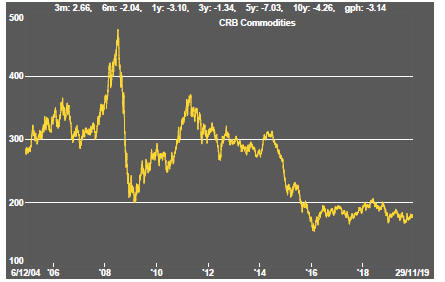

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 as global growth accelerated although, for the most part, sector prices did little more than revert to 2013 levels which had once been regarded as cyclically weak.

Global growth, having peaked in late 2017, the sector has been in cyclical downswing since early 2018.

With a median decline in prices of ASX-listed resources companies since the beginning of 2011 of 89% (and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

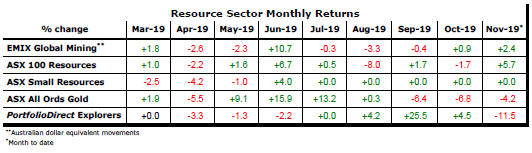

US equity price indices continued to track higher with smaller stocks joining the upward surge after having lagged through much of 2019.

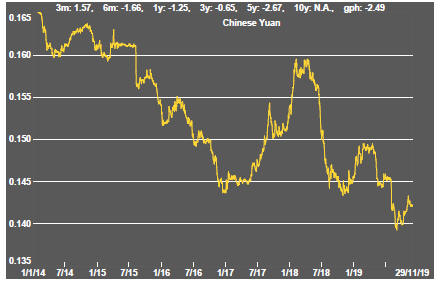

Markets were assisted initially by comments from President Trump about trade policy. He foreshadowed, once again, that a deal was very close. By the end of the week, however, optimism about a deal had again swung in the opposite direction with news that the Chinese government was upset over US legislation supporting democracy protesters in Hong Kong.

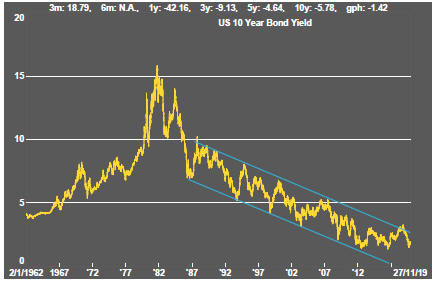

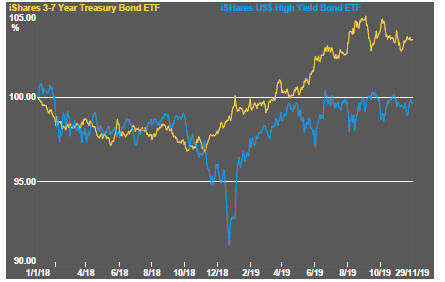

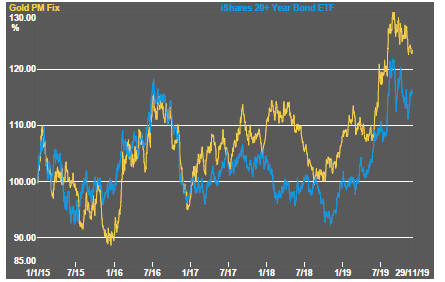

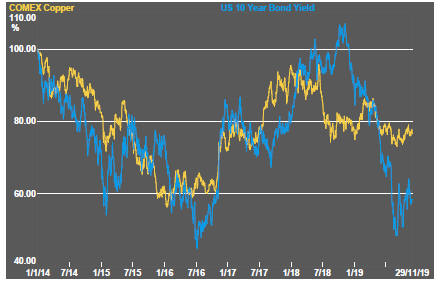

Treasury yields remained firm, consistent with a more optimistic view of the growth picture.

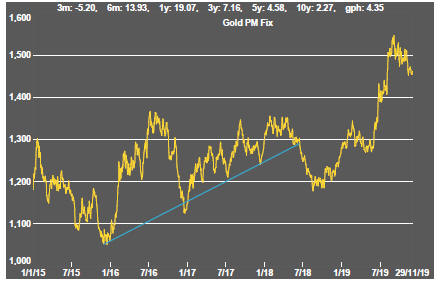

Stronger bond yields have been putting downward pressure on gold prices. Gold prices picked up slightly at the end of the week after news questioning the validity of trade talk optimism ratcheted up scepticism about the growth outlook and the yield trajectory.

Data from the US government confirmed that growth continued to hover around 2% with consumption holding the line while investment spending lagged. New data showed slightly stronger than expected durable goods orders in the prior month.

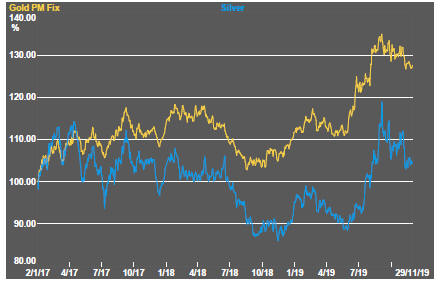

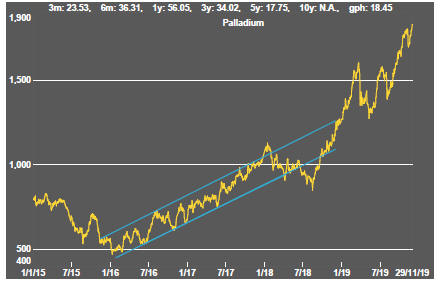

Metal prices were mixed. Nickel and zinc prices were especially weak. For the week overall, gold lost ground slightly while platinum, palladium and silver prices were higher. Iron ore, coal and, to a lesser extent, oil prices also rose.

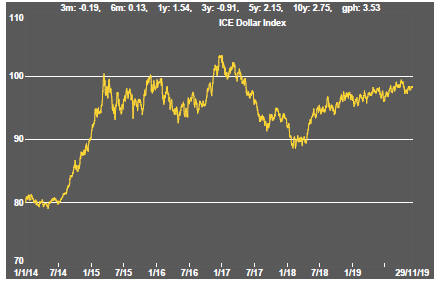

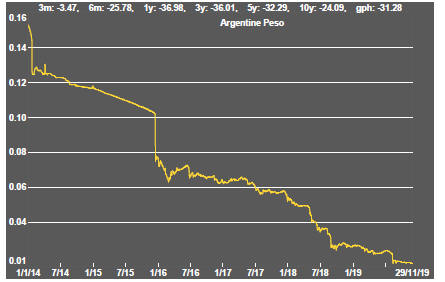

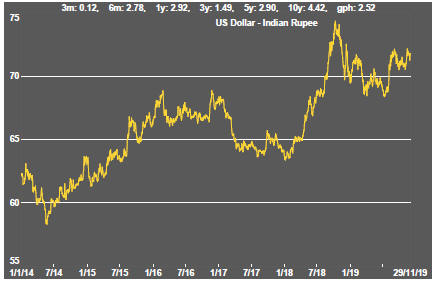

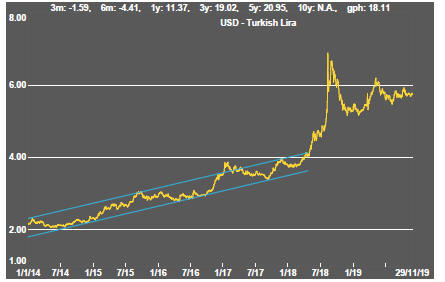

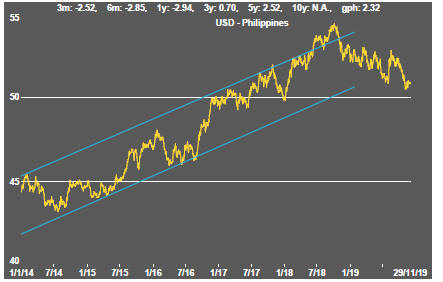

The still high US dollar remains a weight on US dollar denominated commodity prices as well as a source of irritation for US President Trump who has frequently complained that US farmers and manufacturers are disadvantaged by other countries manipulating their currencies lower.

After markets closed on Friday, the Chinese government released the results of its November survey of manufacturing purchasing managers. The report showed an unexpected expansion of activity.

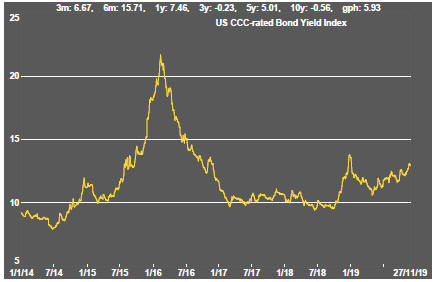

As the month comes to an end, the rate of decline in global growth has moderated, consistent with forecasts that GDP growth in 2019 will prove the low point for the cycle with slightly stronger outcomes in 2020.

Metal demand should benefit from the anticipated stronger growth but, at the same time, supply-side adjustments will be affecting market balances adversely. The anticipated growth acceleration, and already evident momentum improvement, do not appear sufficiently strong to cause a marked improvement in metal market cyclical conditions.

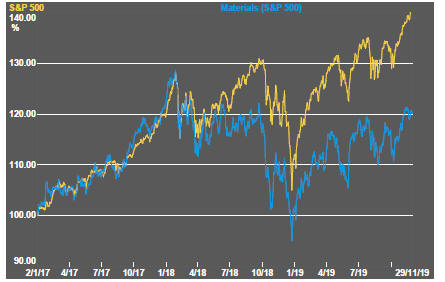

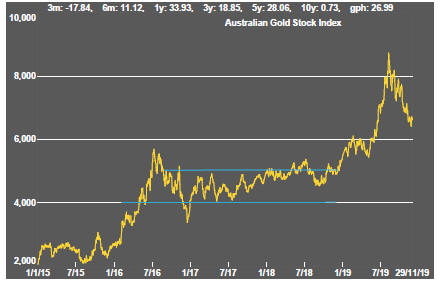

Metal and mining stock prices have not appreciated in concert with the broader market. Nor have the market leaders declined although weakness has been evident through other parts of the sector. Australian gold stocks underperformed their North American counterparts.

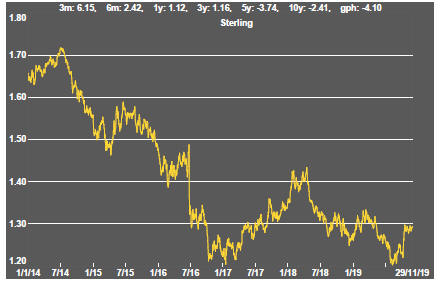

The Australian dollar has remained near cyclically low levels which have kept margins high for gold producers although the positive momentum from a change in margins is no longer an influential market feature.

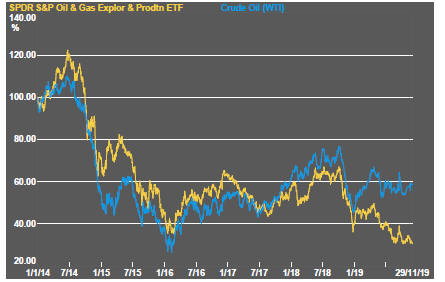

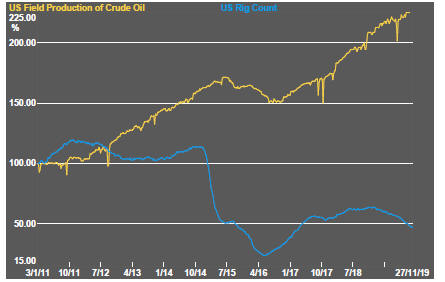

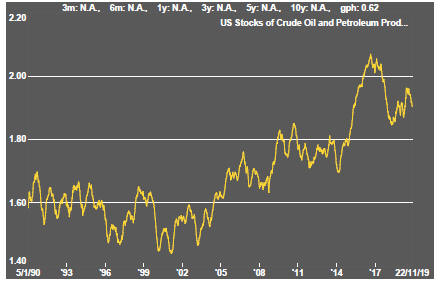

OPEC officials have intimated that the producer group might seek to extend production cuts to sustain oil prices but equity investors are continuing to display scepticism about the balance of the market. US production rates continue to edge higher as US producers benefit from the support being given to prices by OPEC.

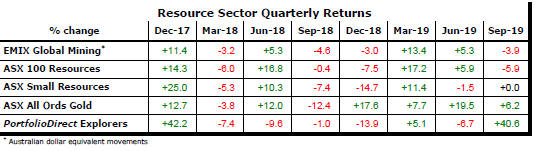

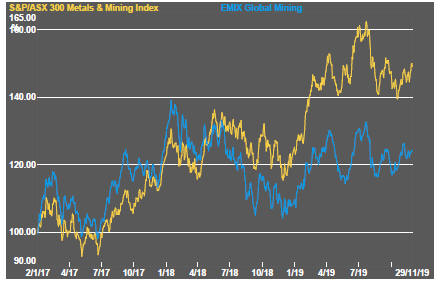

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

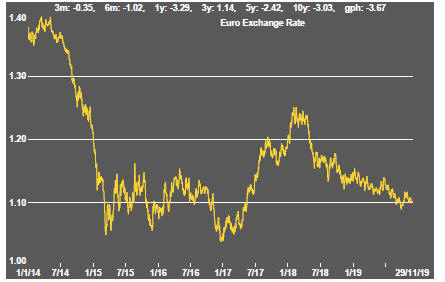

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

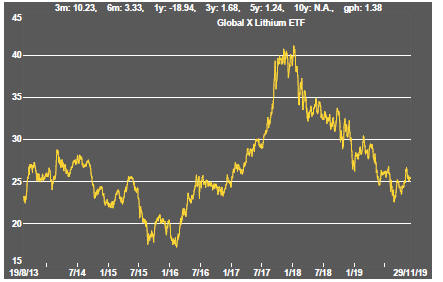

Battery Metals

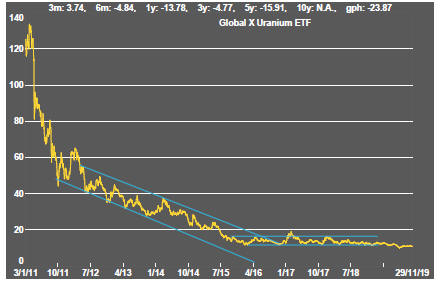

Uranium