The Big Picture

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

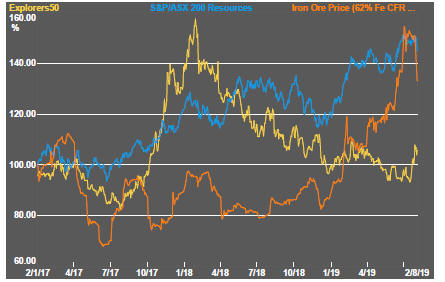

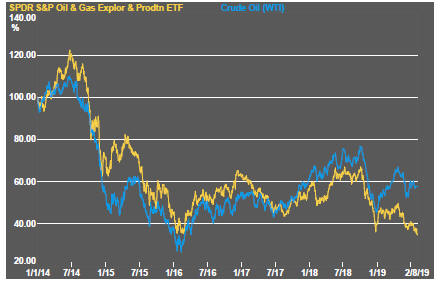

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

The US Federal Reserve met expectations with a cut in its policy rate of 0.25 percentage points and simultaneously disappointed investors.

Fed Chairman Jerome Powell fumbled his address to the press about the reasons for the rate cut and the associated forward guidance.

Going into the meeting, investors had been expecting an initial rise to start a sequence of several rises. Powell, on the other hand, described the rate cut as being a mid-cycle adjustment which should not be taken as the first of many.

Powell struggled to reconcile a positive view of the US economy, with rising employment, with the decision to reduce interest rates. The strength of his position was not helped by two voting members of the policymaking committee dissenting from the decision.

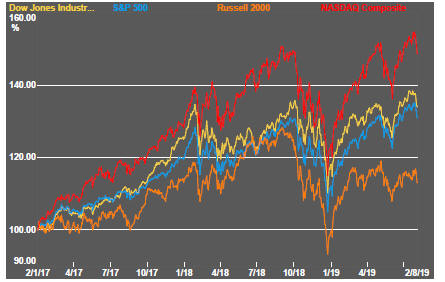

Disappointment over the Fedís reluctance to offer more stimulus caused equity prices to falter as did the loss of confidence in ho the Fed will judge the need for future policy adjustments.

In explaining the policy switch, Powell put a heavy emphasis on the uncertainty accompanying the US-China trade disagreements, although he continued to characterise the US consumer as being in good health. The primary impact of the trade dispute was on business confidence and investment plans, according to Powellís reckoning. A cut back in investment had not yet impacted employment but threatened to do so.

The implication of Powellís reasoning was that more talk of trade disruption would warrant lower rates. Almost immediately, US President Donald Trump expressed disappointment about the Fed narrative and stoked the trade rhetoric, as if to force the Fedís hand.

Trumpís threats of a 10% tariff in response to China being too slow to come to the bargaining table aggravated the market downturn as did the possibility of something more if China remained a reluctant negotiator. Chinaís threats of retaliation also opened the possibility of US companies facing non-tariff impediments to trade and investment.

As market sentiment cooled, resource sector equity prices joined the downtown after having remained surprisingly resilient in the face of so much negativity about global growth. The leading stocks in the sector produced negative returns in the past week, lagging gains among the exploration sector which until recently had been plumbing historically low levels.

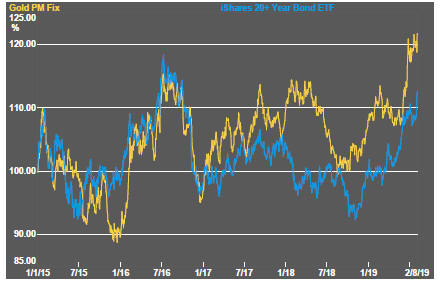

A US$100-plus rise in the gold price excited long-term gold supporters into predicting a sustained upward movement. So far, the rise has generally reflected changes in relative financial asset prices rather than any more fundamental or wide-ranging underlying appeal. That said, the gold price has further to run as the downward pressure on government bond yields persists.

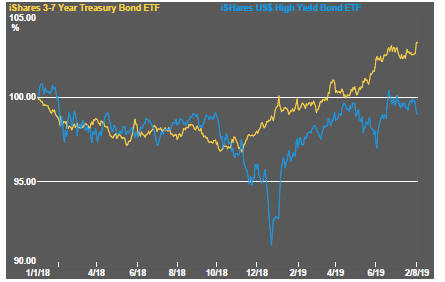

Bond markets are signalling expectations that global growth has further to fall. This may yet prove too pessimistic insofar as the pace of global growth has already slowed to longer term, more sustainable, rates.

Australian gold producers have benefited from a slump in the Australian dollar which has fallen to below the levels which had prevailed briefly in early 2016.

The silver price fell even as the gold price rose leaving the gold/silver price ratio near a historical peak despite a reversal being widely tipped among followers of the precious metals.

The downward price bias among daily traded nonferrous metal prices persisted although nickel stood out from the pack once again as it touched early 2018 levels, when the metal price cycle was last around a cyclical peak.

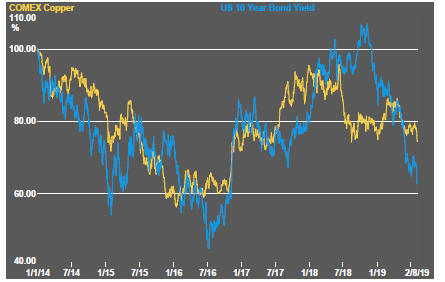

While bond prices might be signalling weakening growth, the copper price suggested only modest, if any, deterioration in conditions. Scope for rectification of the disconnect between these two widely watched indicators of growth remains.

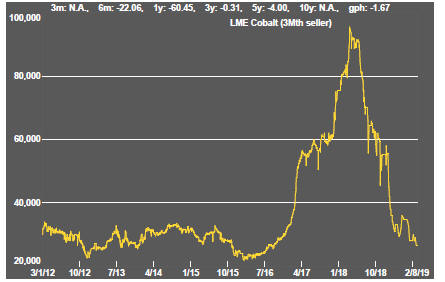

Among other commodity groupings, downside bias was also evident in iron ore, coal, battery metals, crude oil and uranium markets.

The US dollar was generally stronger with sterling returning to levels associated with the immediate aftermath of the Brexit vote in 2016 as Britainís new prime minister reaffirmed his intention to take the UK out of the European Union at the end of October 2019, no matter what, and EU officials steadfastly refused to negotiate changes to the existing withdrawal agreement which has been rejected by the UK parliament.

The yuan moved lower at the end of the week setting the scene for a more acrimonious turn in the US-China trade dispute, with Trump having already been critical of countries taking advantage of currency moves to boost their trade balances.

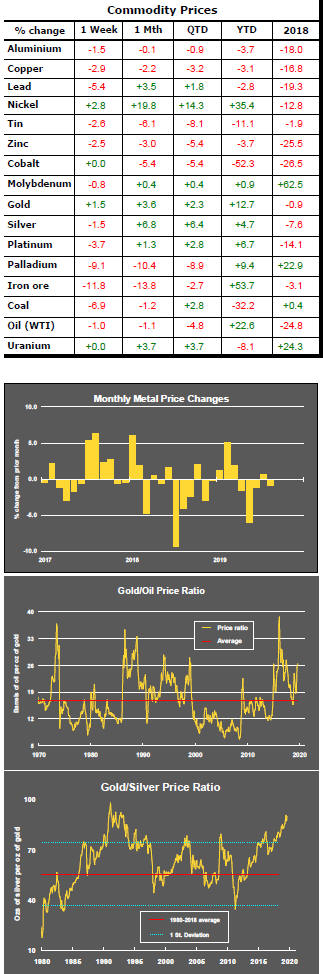

Sector Price Outcomes

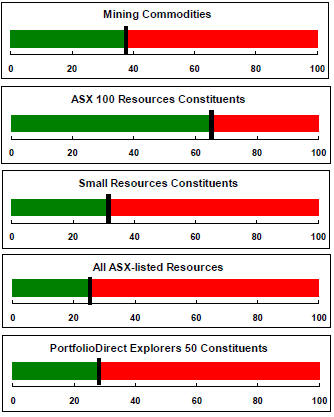

52 Week Price Ranges

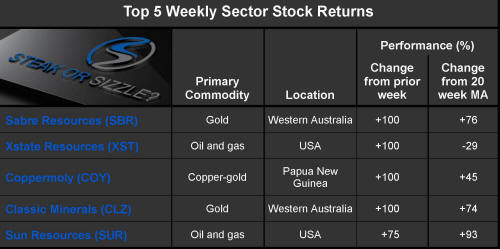

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

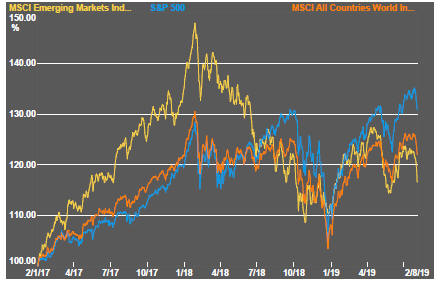

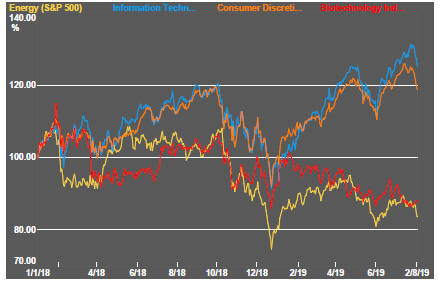

Equity Market Conditions

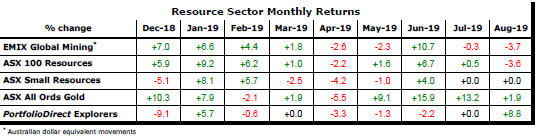

Resource Sector Equities

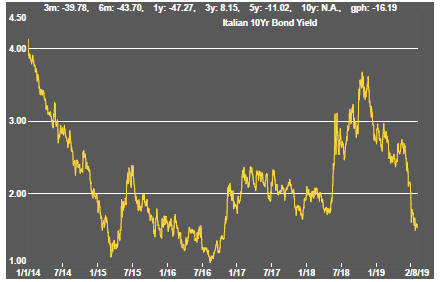

Interest Rates

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium