The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were reversed through 2016 and 2017 although sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

The strength of the US dollar exchange rate since mid 2014 had added an unusual weight to US dollar prices. Reversal of some of the currency gains has been adding to commodity price strength through 2017.

Signs of cyclical stabilisation in sector equity prices has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development has passed its most difficult phase with the appearance of a stronger risk appetite.

Resource Sector Weekly Returns

Market Breadth Statistics

52 Week Price Ranges

Equity Markets

Equity prices rebounded in the latter part of the week after persistent declines during October. Gains were evident in advanced country markets as well as developing economy equities.

Sector gains were broadly based, including among materials stocks.

Perceptions about future volatility remained elevated but overall conditions were helped by earnings reports which left valuations attractive in a wide range of market sectors.

A potential respite from Sino-US trade tensions also buoyed market sentiment after US President Trump suggested he could strike a deal with his Chinese counterpart. Other US officials appeared to downplay this possibility, causing some confusion, but investors seemed to consider this better than the unambiguous prospect of a prolonged trade war. Trump and Chinese president Xi are expected to meet at a gathering of G20 leaders in late November, a prospect likely to add volatility to markets.

US labour market conditions remain strong and, importantly, wage growth has accelerated, according to the latest monthly labour report from the US government. Labour market conditions imply higher US interest rates but the implications for stronger consumption growth are, for the time being, enough to offset worries about higher interest rates.

US investors were also told by analysts that split control of the US Congress - as expected after elections on Tuesday - has been no bad thing for markets in the past, possibly because of the pressure it places on bipartisan initiatives.

Resource Sector Equities

The resources sector joined the broader equity rally despite the sector’s reliance on an expanding global economy and the backdrop of slowing growth.

The largest companies in the resources sector again led the performance rankings. The PortfolioDirect measure of price performance among exploration companies rose by less than half the rate of the larger stocks. The index is now showing a net negative change over the past year after posting relatively large losses over the past three months.

Interest Rates

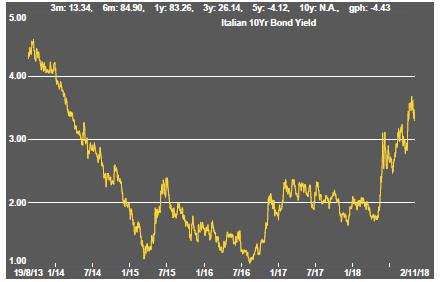

Interest rate movements were marginally less important in the past week although policy movements remained an ongoing background factor, with the tendency for tightening in Europe and the USA.

The upward movement in low grade corporate bond yields has become more pronounced. While yields are well below the cyclically high levels reached in 2016, the trend is negative for miners looking for US dollar funds in capital markets.

Exchange Rates

The US dollar slipped slightly lower at the end of the week although it retains an upward trajectory against weaker the euro, sterling and yuan.

Developing country currencies, as well as the Australian dollar, moved higher at the end of the week after more optimistic sounds coming from Washington about the prospect for a Sino-US trade pact after presidents Trump and Xi reportedly spoke by phone.

Commodity Prices

The general upswing in commodity prices since mid 2017 had been given added impetus by stronger crude oil prices.

Diminished momentum has left prices within the bounds of a cyclical trough, albeit at the upper end.

The flip side of the benefits for commodity producers and exporters of higher commodity prices is the cost pressure now being experienced by users of agricultural and raw material commodities. Reporting companies have been suggesting this as a source of margin compression.

Business surveys closely watched by central banks are showing signs of upward pressure on selling prices as a result of higher raw material prices.

Gold & Precious Metals

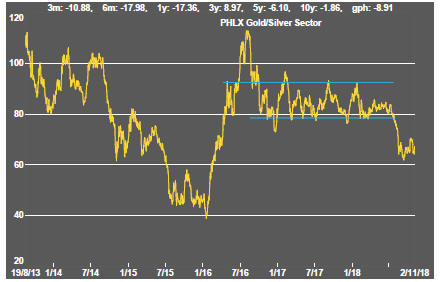

Despite lower bond prices being suggestive of lower gold prices, rising US government bond yields have not had a noticeable effect on gold bullion prices although, offsetting the interest rate effects, has been the surge in equity price volatility during October.

Other precious metals have shown differing degrees of recovery since the mid-year slump. Palladium prices have retrieved all their losses. Platinum prices made the strongest gains during the week, among all the principal mining commodities.

The prices of gold related equities did not reflect broader equity market conditions, with a negative overall return during the week.

The prices of Australian gold stocks remain near the upper end of the range from the past two years while their North American counterparts continue to trail significantly.

Nonferrous Metals

Daily traded nonferrous metal prices picked up slightly at the end of the week - with the majority posting small weekly gains - even while tending weaker over the longer term, after having peaked in February 2018.

The copper price remains at odds with rising bond yields which normally signal strengthening inflation and growth. The normally growth sensitive metal price appears to be taking a back seat as an indicator of market conditions for the time being.

Bulk Commodities

Chinese economic growth reports show the national economy meeting its targets, as one would expect for a centrally planned economy, but without any overt signs of upside risk. The tariff fight with the USA is beginning to take a toll on activity rates in an economy with a bias toward less strong growth in the years ahead.

The latest manufacturers purchasing managers index for China, measuring conditions in October, implied continuing slowing in momentum with some evidence of the Sino-US trade dispute taking a toll on conditions.

Growth was slowing in any event leading the Chinese authorities to once again resort to pumping up the economy through more infrastructure spending.

Reported GDP growth in the September quarter was consistent with official forecasts although hitting the targets is becoming more challenging by the year.

Iron ore prices continued to gain ground and, among the main mining commodities, are now one of the few sources of metal price strength over the past year.

Coal prices, which had shown signs of losing momentum - albeit after some strong gains - slipped further during the week. China reported growth in coal output between September and August and over the year to September with plans to open new capacity proceeding as the country switches to larger more efficient sources of coal production.

Oil and Gas

Crude oil prices dropped again as concerns about demand growth loomed and supply constraints appeared looser.

OPEC has been losing control of the market as US and Russian production has become more significant and while several OPEC members lose their historical clout.

Reimposition of Iranian economic sanctions by the US government has put upward pressure on prices. The failure of effective government in Venezuela has been another contributing influence on higher prices.

The Iranians have been lobbying European countries to prevent more widespread application of sanctions but the likelihood of relief appears slim as long as funds must circulate through US banks. The US government provided some relief by announcing that it would not apply sanctions against some importers of Iranian oil, at least for the time being.

US production, in any event, continues to rise and is now matching output from Russia and Saudi Arabia. Texas alone is positioned to be the third largest producer after Russia and Saudi Arabia. Export infrastructure limitations may be the greatest impediment to US production having a greater effect on international energy prices.

Rising US stock holdings have impacted the structure of WTI futures prices.

OPEC also disclosed in its last monthly market report that it expected demand for crude to grow less strongly in 2019 than it had previously forecast in another sign of the decelerating global economy.

The prices of oil related equities have reacted negatively to the weakening market conditions with added pressures coming from slumping equity prices during October. There was a slight respite at the end of the week.

Battery Metals

Eighteen months of rising lithium-related stock prices have given way to a prolonged period of market reassessment as a lengthy pipeline of potential new projects has raised the prospect of ongoing supplies better matching expected needs.

Potential lithium producers have been able to respond far more quickly to market signals than has been the case in other segments of the mining industry where development prospects have been slowed by reticence among financiers to back development.

Movements in lithium related equity prices had been aligned more closely with overall sector equity prices in recent weeks with the lithium stocks tending to display a greater leverage to changes in market sentiment about the mining sector.

The median fall from their 52 week high within a large sample of 80 Australian and Canadian listed stocks with lithium exposure, mostly with an exploration orientation, has exceede 50%. Every one of the stocks is trading below its peak price from the last year.

Battery metals remain a focal point for investors with recent attention moving to cobalt and vanadium.

Doubts about political conditions in the Democratic Republic of the Congo (and instances of Ebola) have added a dimension to cobalt prices lacking in other metals caught up in the excitement over the longer term impact of transport electrification. Short term market tightness relating to non-battery demand is easing.

In the longer term, cobalt is the most vulnerable of the battery related metals to substitution with high prices likely to stimulate research in that direction.

A spokesperson for Panasonic, manufacturer of batteries for Tesla motor vehicles, has been quoted as saying that the company intends to halve the cobalt content of its batteries because of uncertainties over supply although, offsetting such a move, will be the rapid increase in the number of units produced.

Uranium

The uranium sector is in the midst of forming a prolonged cyclical trough as market balances slowly improve. Power utilities have been reluctant to re-enter the market for contracted amounts of metal to meet longer term needs although an upward bias in prices has been evident in the past month.

Slightly higher equity prices from time to time, in the hope of improved conditions, have not been sustained but could be repeated as speculation about improved future demand ebbs and flows.

The effect of an announcement by Canadian producer Cameco to extend the duration of its previously implemented production cut gave the market a very slight but quickly lost lift.

News that the Kazakhstan government intends to list its state owned uranium producer, also the world's largest producer, may suggest greater responsiveness to market conditions and less emphasis on production to maximise government revenue.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.