The Big Picture

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

The week finished with a strong US labour market report for April but flagging equity price momentum.

US equity price indices hovered near record levels but performance has been dominated by a handful of high-profile contributors leaving the bulk of stocks under-performing, limiting the available sources of fresh momentum.

Implied option volatility continues to suggest a benign outlook with little to disturb the widespread sense of optimism.

Equity markets have been counting on continued Federal Reserve support and a trade deal with China to sustain the recent performance.

Federal Reserve Chairman Powell has restated his view that policy settings are appropriate but inflation remains stubbornly below the Fedís 2% target. The inflation shortfall includes some transitory elements, according to Powell, but much of his recent post-meeting press conference was taken up with questions about the circumstances under which rates would be lowered in response to inflation remaining below target.

The US president has since thrown a favourable trade negotiation outcome into doubt with claims that the Chinese side has reneged on previous commitments and threats of higher tariffs on imports from China.

Concerns about global growth appear to be catching up with the mining sector after having been generally shrugged off in prior weeks. Daily traded metal prices have fallen with the overall trajectory consistent with a cyclical downswing with another 10-12 months to run.

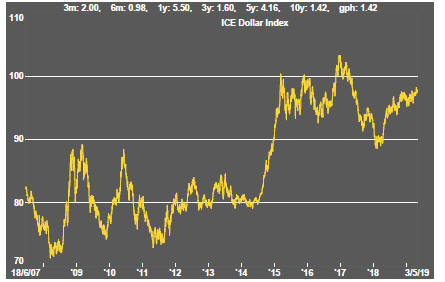

A strengthening US dollar is another negative influence on metal prices. The exchange rate move puts pressure once again on developing country growth potential.

Despite the impasse in the UK over Brexit and the drubbing in local elections for both major parties, sterling moved higher, presumably on the assumption that the chance of remaining a member of the European Union, or keeping a close connection through a customs union, had risen.

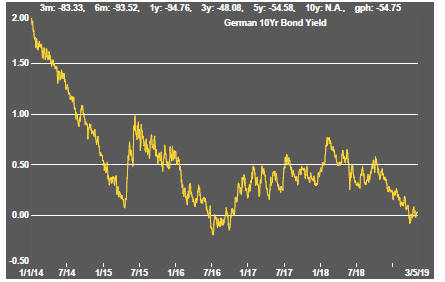

Financial market conditions continue to signal a favourable capital costs for investment in mining developments although lower metal prices will translate into reduced cash flows against which the riskiness of borrowings will be judged.

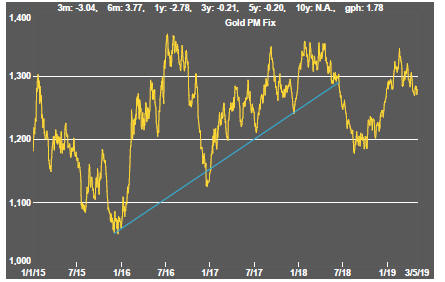

Within the resources complex, gold prices were relatively strong but still awkwardly poised for a downward move. The prices of gold equities have continued to move lower in the absence of stronger gold prices.

Similarly, oil and gas related equities have fallen despite crude oil prices not having moved significantly lower, as equity prices are responding to changes in momentum rather then levels.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

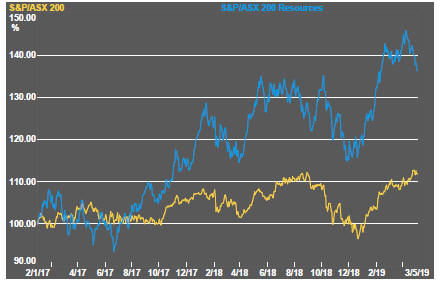

Resource Sector Equities

Interest Rates

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

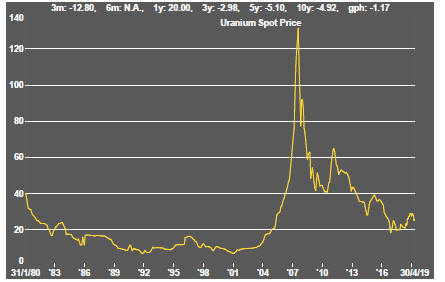

Uranium