The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

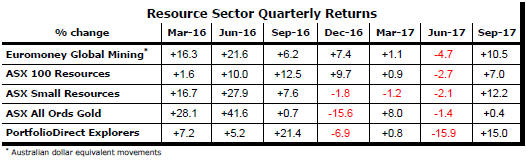

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Market Breadth Statistics

More record index levels were driven by demand for information technology stocks whose burgeoning earnings have surprised investors. The prospect of further gains from potential takeover activity arose from reports that Broadcomm would launch a takeover bid for chip maker Qualcomm.

Within the US market, the Russell 2000 has been surprisingly weak, against the background of the large moves by other indices.

The absence of high profile technology companies in the small cap index might explain some of the underperformance. The performance difference seems to also reflect some assessment of the relative impact of foreshadowed corporate tax changes.

Smaller and domestically oriented companies may have less to gain from corporate tax changes than those companies with large offshore cash assets to repatriate under changed laws.

The performance of the Russell 2000 also suggests some scepticism embedded in prices about the impact of tax changes on domestic growth outcomes.

The so-called fear gauge had been closely watched as an indicator of likely changes in market direction. In particular, investors had been taking low volatility readings as a warning of future weak markets. That interpretation has changed with what had been perceived as unusually low volatility moving still lower for the past two years.

At some time in the future, investors will surely point to low volatility once again being the precursor of a market turn but, for the time being, it is simply a measure of the extent to which investors feel comfortable about the high prices currently being paid for earnings.

The rise in US bond yields has stalled despite an improved US growth outlook and continual reaffirmations by the Federal Reserve of progress toward its inflation goals.

Scepticism about growth and inflation moving higher may remain a drag on US dollar yields but so, too, will be yields in Europe and Japan which remain so much lower than for US securities.

The US dollar edged slightly lower during the week but the balance of risks associated with tax reform proposals and relatively high interest rates is tilted moderately to the upside.

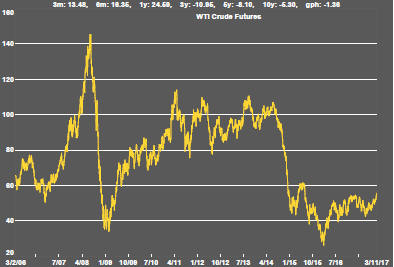

Crude oil prices which had lost some of their influence on equity markets pushed toward some the highest levels in two years as speculation rose about the willingness of OPEC members to support a continuation of production restraints.

A dramatic move to arrest high level officials in the Saudi Arabian government apparently as a gambit to consolidate the power of the newly appointed Crown Prink will have also raised the risk premium in the price.

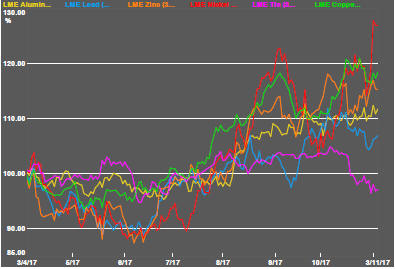

Commodity prices in general have been moving moderately higher with improvements in the global growth outlook over recent weeks although the level can still be construed as being within the bounds of a cyclical trough.

Daily traded nonferrous metal prices have lost momentum recently although nickel prices broke from the pack in the past week.

The gold sector showed divergent trends which suggest the possibility of some readjustment in coming weeks.

The gold bullion price edged lower during the week which might have suggested moderately lower equity outcomes. In fact, US gold equities were sharply lower while Australian listed gold stocks continued to move higher.

The movement in Australian equities accounted for more than the exchange rate move suggesting some scope for a relative repricing.

Overall, gold related equity prices have been displaying unusually low volatility with virtually no net change in the nearly two years since the surge in prices in the early weeks of 2016.

The iron ore pricing environment has remained subdued in line with the price of Chinese steel products.

The uranium equity sector has continued a prolonged market adjustment with stocks tending slightly weaker during the past week.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.