The Current View

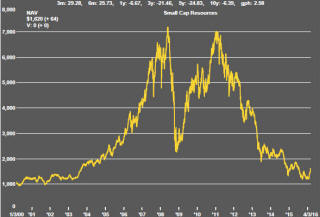

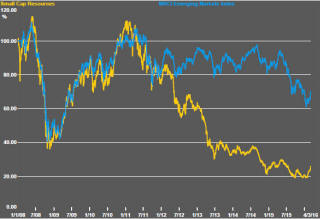

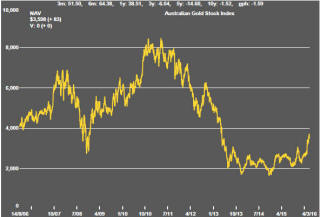

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

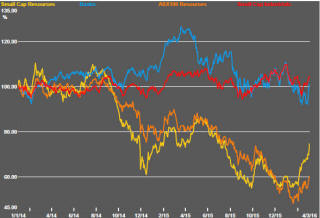

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Global equity market recovery persisted with the help of further rises in oil prices. Oil prices continued to play their role of recent months as proxies for global growth and banking sector default risk.

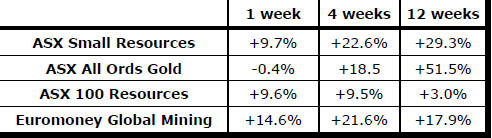

Those companies that had previously suffered some of the largest losses in the resources sector have responded particularly strongly in the latest rally. Internationally, for example, Freeport McMoran rose 31% in the past week to take to 112% its share price rise since the beginning of February. Caterpillar, having been tarred with a similar brush, rose 8.9% in the past week taking the rise since the beginning of February to 17.0%.

Within the Australian market, the recovering mineral sands miners Mineral Deposits and Base Resources have added 43% and 124%, respectively, since the end of January. Meanwhile, uranium mine developers Peninsula Energy, Bannerman Resources, Deep Yellow, Toro Energy and Paladin Energy suffered breakeven results, at best, while the more positive sentiment was evident elsewhere.

The relative performance within the sector suggests that investors are being selective in deciding which parts of the market warrant reappraisal.

More buoyant resource sector equity prices have been accompanied by gains across a wide range of risky assets. The MSCI emerging market index rose 6.9% last week. The Russian ruble and Brazilian real both rose, as did the Australian dollar. High yield corporate bond prices increased 2.1% partly reflective, no doubt, of the improvement in the price of crude oil and reduced fears about debt default within the industry. .

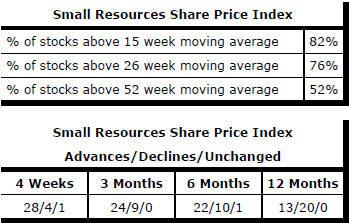

Market Breadth Statistics