The Current View

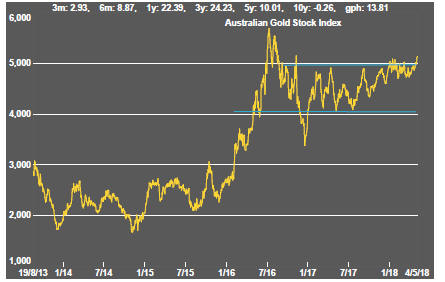

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were reversed through 2016 and 2017 although sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

The strength of the US dollar exchange rate since mid 2014 had added an unusual weight to US dollar prices. Reversal of some of the currency gains has been adding to commodity price strength through 2017.

Signs of cyclical stabilisation in sector equity prices has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development has passed its most difficult phase with the appearance of a stronger risk appetite.

Resource Sector Weekly Returns

Market Breadth Statistics

Equity Markets

The momentum which had been expected to come from a strong earnings growth acceleration failed to eventuate through the week with the S&P 500 rising on only three out of five trading days even as an unusually high proportion of reporting companies beat earnings estimates.

The countervailing influence has come from growing scepticism about the prospects for global growth which some now fear may have passed its prime.

Some inferences about the growth outlook can be inferred from the chart of the index of emerging market equity prices and the share price of Caterpillar. Both at the macro as well as at the company level, the global growth synchronisation investment theme has been losing its impact.

A somewhat similar inference can be drawn from the chart of the S&P 500 materials sector index.

Australian mining stocks have shown a strong recovery which would have been assisted by the weaker Australian dollar.

The US market indicators finished on an upbeat note after labour market data for April showed an employment gain only slightly lower than what had been expected and a still perplexingly small rise in wages. This was enough for investors to infer for the time being that growth might be slowing, or at least not speeding up, but that there were no reasons to change expectations about the interest rate trajectory.

Another help for the market was the a statement from Warren Buffett that Berkshire Hathaway had been adding to its position in Apple Inc. Apple had already produced better than expected earnings after fears had emerged of a slowdown in handset sales. The Buffett endorsement seemed to inject fresh confidence into the technology sector as well as the broader market.

Trade war fears seemed to ease for the time being although the NAFTA negotiations appear to have stalled raising the potential for some bad news on that front in the absence of ground being given by the three parties in the next two weeks.

Despite multiple crosscurrents, interest rates remain a dominant influence on markets with the potential to override other considerations.

Interest Rates

US 10 year bond yields were again nudging 3%, a level which has become a focus of attention.

In holding its Fed Funds rate steady, the Federal Reserve seemed to endorse perceptions that there was no need to change the pace of monetary tightening.

Exchange Rates

The US dollar moved lower after Federal Reserve comments about the policy outlook but reverted to its upward bias as assessments refocused on relative growth rates with Europe now being perceived as less strong.

Currency movements have become increasingly dramatic over the last few weeks with the US dollar showing a definite climb upwards. The converse has been downward moves in advanced economy as well as a wide range of emerging market currencies with significant implications for corporate profitability and relative inflation rates.

The exchange rate moves are another signal of market scepticism about the potential for global growth to strengthen beyond what has already occurred.

The exchange rate moves also suggest investors need to take care in assessing the profitability of miners depending on the location of their operations.

The gentle upward drift in the Australian dollar could remain intact as long as risks to global economic conditions remain lowered and commodity prices are in the upper end of the range of prices in the past year. That said, the Australian dollar is hovering aroiund the bottom of its trading range and now at greater risk of moving lower.

Commodity Prices

The general upswing in commodity prices over the past year remains within the bounds of a cyclical trough suggesting still stronger economic activity will be needed if the cycle is to strengthen. Unusually strong gains in the past fortnight have reflected higher crude oil prices.

Gold & Precious Metals

Precious metal prices are hovering near points with the potential for changes in direction, indicating upside for gold, silver and palladium in the short term. The potential upside could be quickly derailed by further bond price declines which have had little impact on bullion prices in recent weeks.

Geopolitical issues - such as the likely abandonment by the US administration of the nuclear weapons deal with Iran - will have helped support gold prices and most likely will continue to do so as long as there is no sign of a resolution or some attempt, at least, to start a new round of negoations.

US precious metal related equities traded lower after having lifted briefly from near the bottom of their medium term trading range. Australian gold equity prices remained close to the upper end of their trading range, helped by the lower Australian dollar.

Nonferrous Metals

Prices of the main daily traded nonferrous metals had become increasingly correlated as a broadening consensus about the lowered risks to world economic activity emerged - until the new US sanctions against Russian business interests dramatically impacted aluminium and nickel prices.

With comments from the US administration suggesting that the sanctions will not affect metal supplies as severely as had first been suspected, the two metals most affected retraced their sharp gains. That aside, strong evidence of price convergence remains a feature of the market with only tin prices staying aloof from the crowd.

Copper prices again failed to react to the re-pricing of financial assets in the way one might expect to occur if higher bond yields reflect a positive reconsideration of the growth outlook. The divergence is one of the indicators to suggest ebbing global growth exopeactations.

Bulk Commodities

Bulk commodity prices had moved lower with signs of lessening Chinese economic momentum after the first quarter. Increased Chinese steel production in the first quarter of 2018 had resulted in larger inventories.

The inventory climb and threat of tariffs affecting Chinese steel demand dragged steel prices lower and raised risks for metallurgical coal markets.

Relatively weak first quarter GDP growth suggests a ramp up in activity through the remainder of 2018 if China is going to meet its growth target which, in a centrally controlled economy in which leaders are trying to maintain cedibility, is a reasonable assumption.

Oil and Gas

Rising US production, partly in response to higher prices, had been seen as a burden on expectations about the likelihood of further oil price rises.

US producers are able to profitably hedge anticipated production contributing to the ongoing rise in their output.

On the other side of the ledger, inventories have been declining and global supplies have remained constrained through both voluntary and involuntary actions.

Fears of deteriorating political conditions in the middle east have also elicited a higher risk premium with the US president committing to bring back economic sanctions against Iran.

Energy related equities of companies engaged in exploration and production have not shown significant leverage to the improvement in crude oil prices.

Battery Metals

Eighteen months of rising lithium-related stock prices have given way to a period of market reassessment as a lengthy pipeline of potential new projects raises the prospect, although not conclusively, of ongoing supplies being adequate for expected needs.

Potential lithium producers have been able to respond far more quickly to the various market signals than has been the case in other segments of the mining industry.

Battery metals remain a focal point for investors with recent attention moving to cobalt and vanadium.

Doubts about a peaceful transfer of power occurring in the Democratic Republic of the Congo has added a dimension to cobalt prices lacking in other metals caught up in the excitement over transport electrification.

In the longer term, cobalt is the most vulnerable to substitution of the current array of battery metals.

Uranium

The uranium sector is moving along the bottom of its long term trading range in the absence of more meaningful signs that power utilities are prepared to re-enter the contract market to negotiate their longer term needs.

Slightly higher equity prices could be attributed to speculative trading since uranium prices have moved slightly lower since the end of March. Equity prices are likely to continue trading within a narrow range signifying the bottom of a cycle.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.