The Big Picture

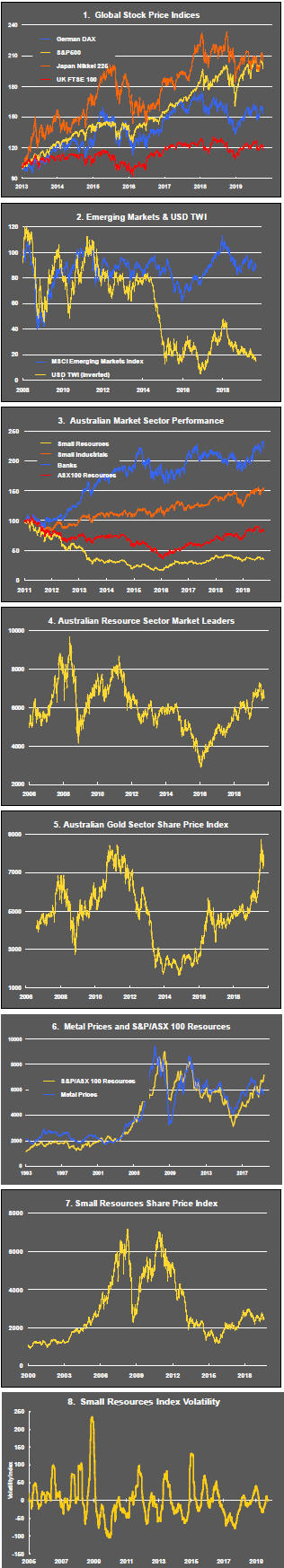

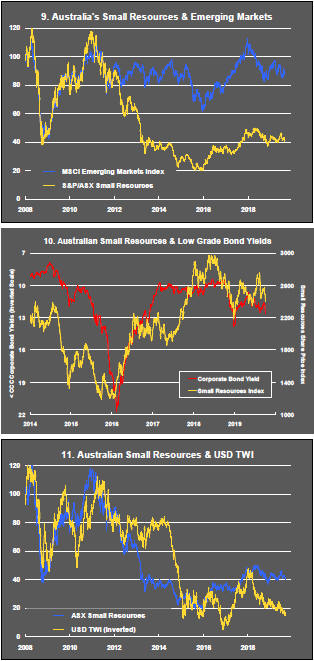

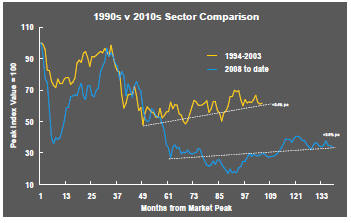

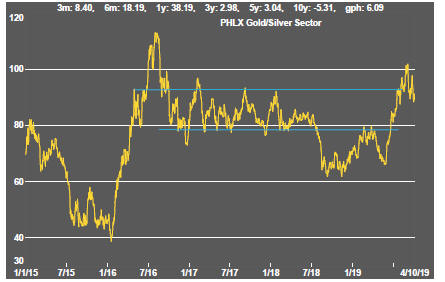

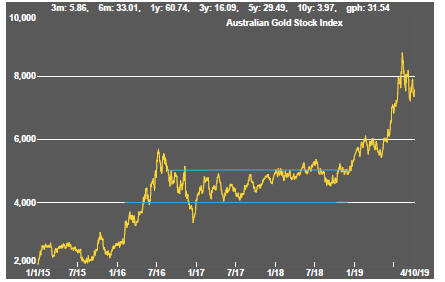

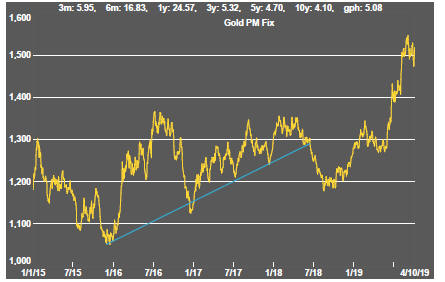

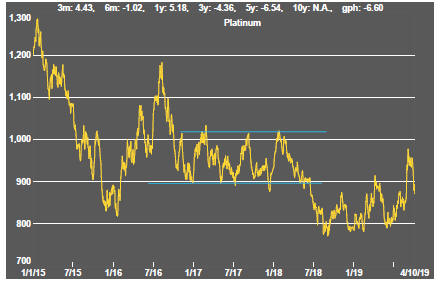

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

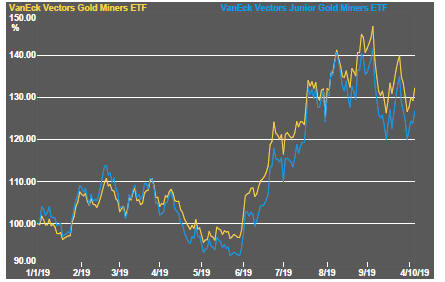

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 as global growth accelerated although, for the most part, sector prices did little more than revert to 2013 levels which had once been regarded as cyclically weak.

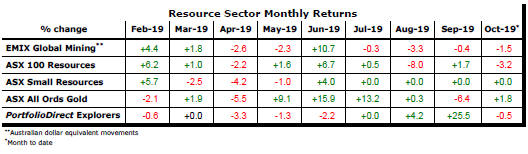

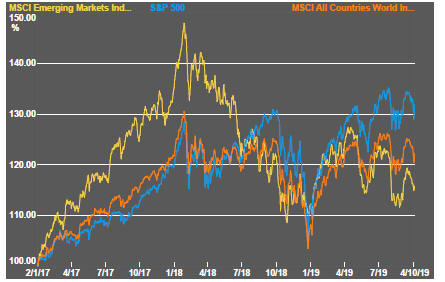

Global growth, having peaked in late 2017, the sector has been in cyclical downswing since early 2018.

With a median decline in prices of ASX-listed resources companies since the beginning of 2011 of 89% (and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

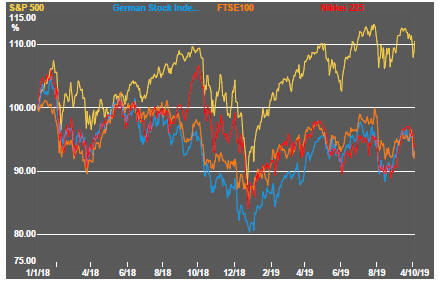

Equity prices partially regained lost ground near the end of the week after large losses earlier.

European and Chinese economic data had already reinforced evidence of a growth slowdown. US manufacturing and services data seemingly confirmed that the world’s biggest economy could not avoid the impact of what was happening around the world.

US employment data for September, released on Friday, stalled the negative momentum. Employment growth was strong enough to give investors some comfort about the course of company earnings but not so strong as to endanger one or more further cuts in interest rates by the US central bank. A record low unemployment rate offered a base for continued optimism among consumers.

While the labour data was a welcome relief for a fragile market, the reaction also highlighted the possibility of far greater market weakness being no further away than a single disappointing labour market report, a possibility with a rising chance of occurring as the cycle matures.

Also helping market sentiment was a speech by Federal Reserve chairman Jerome Powell in which he said that the Fed would do whatever was necessary to keep the US economic expansion underway, adding to the sense that further interest rate rises are ahead.

Within the resources sector, prices continued to take their direction from the broader market.

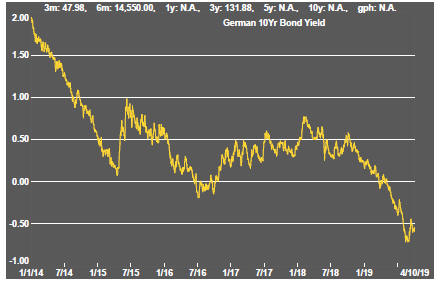

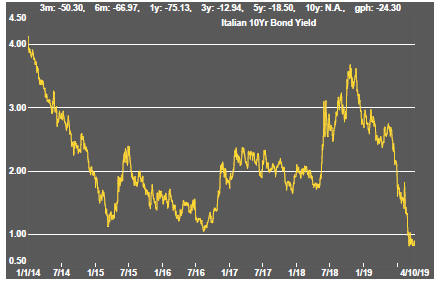

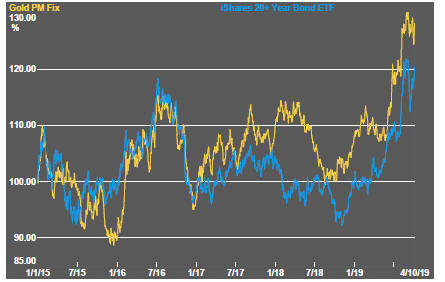

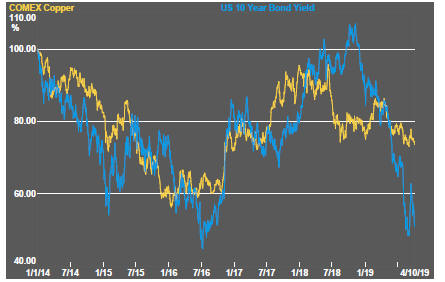

Gold prices have lost their upward momentum, at least for the time being, consistent with the pattern of bond yield movements. The metal price remains vulnerable to any reappraisal of the interest rate outlook as long as it depends so heavily on financial market conditions and in the absence of independent drivers of fresh demand for gold from investors.

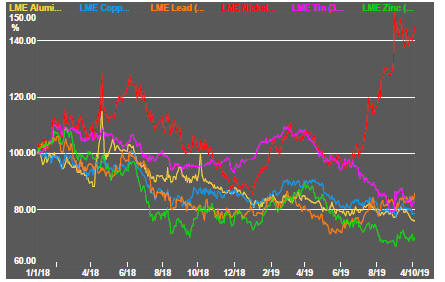

Daily traded nonferrous metal prices generally held firm during the week still leaving them at odds with signs of deteriorating global growth conditions.

Although metal demand has been cyclically weak, supply tightness - partly due to voluntary cutbacks and partly through historically constrained investment in new capacity - has limited the extent of the cyclical decline in prices.

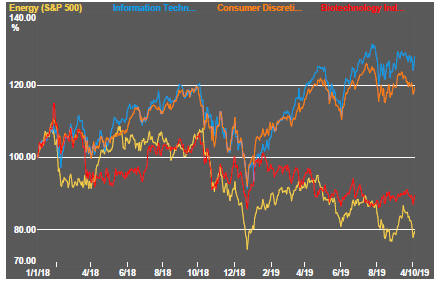

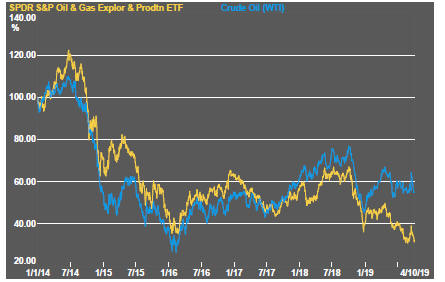

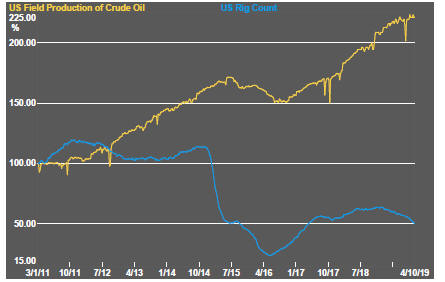

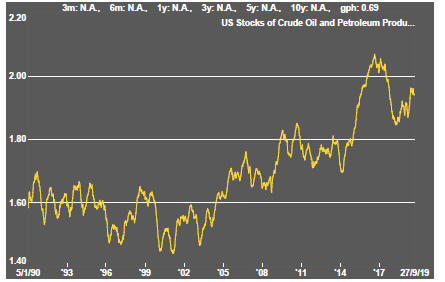

Weaker crude oil prices were a drag on related sector equity prices. The threat of disrupted supplies from Middle East geopolitical rivalries has been discounted amidst signs of weakening demand growth and continued expansion in US crude oil production capacity.

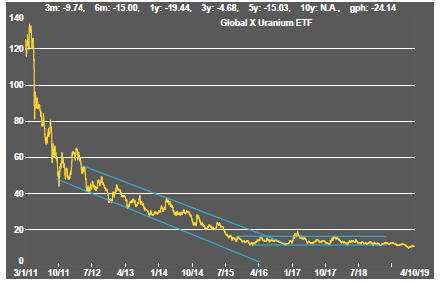

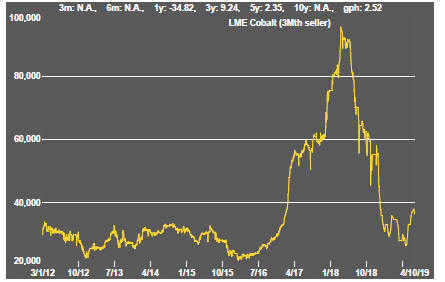

Battery metal related investments reflected weaker equity market sentiment through most of the week. Along with uranium exposed equities, battery metal investments have continued to disappoint against the backdrop of favourable long-term demand for the underlying raw materials.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

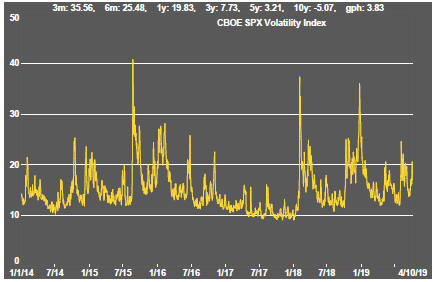

Equity Market Conditions

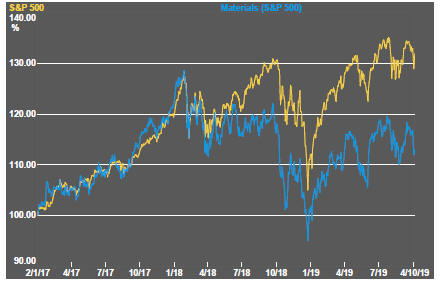

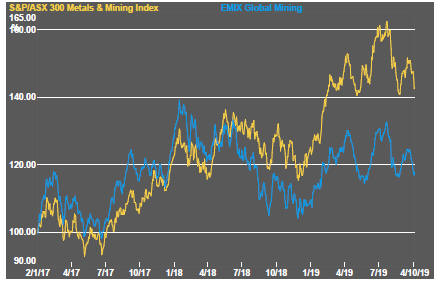

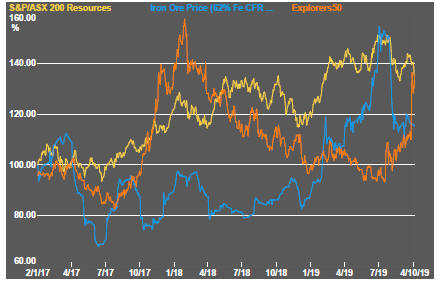

Resource Sector Equities

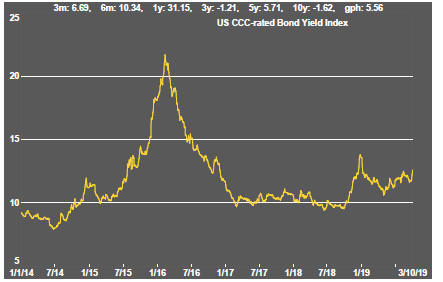

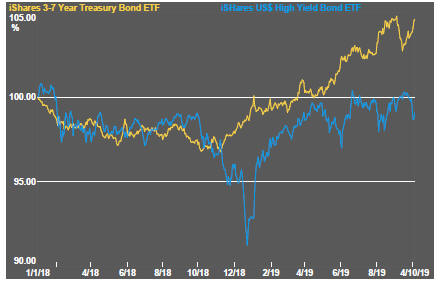

Interest Rates

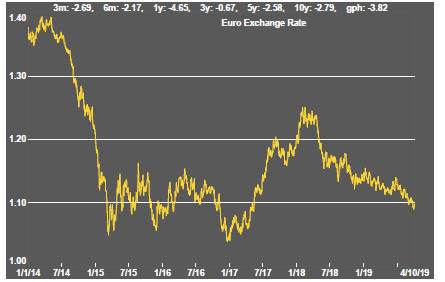

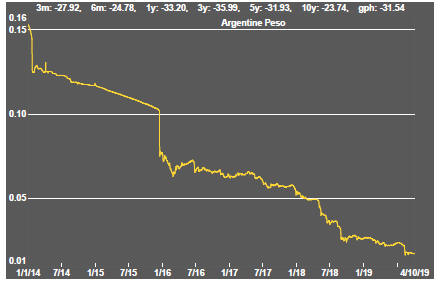

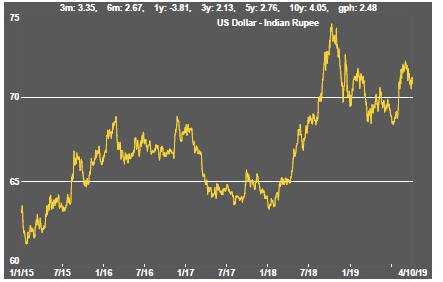

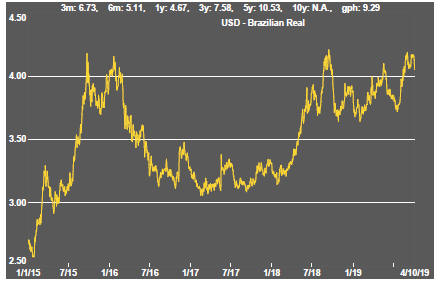

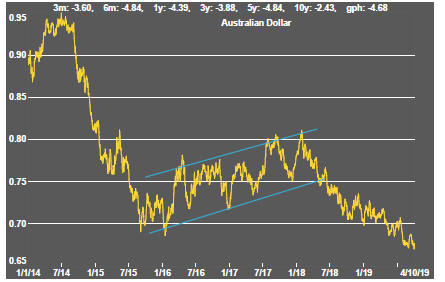

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium