The Big Picture

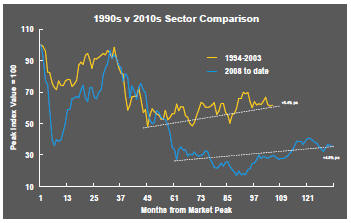

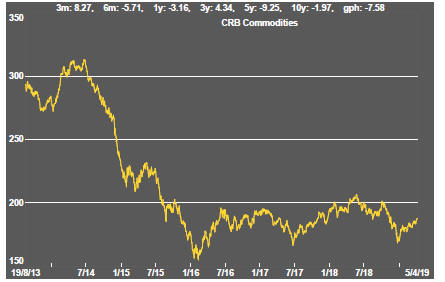

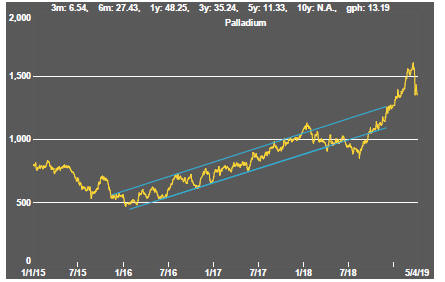

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

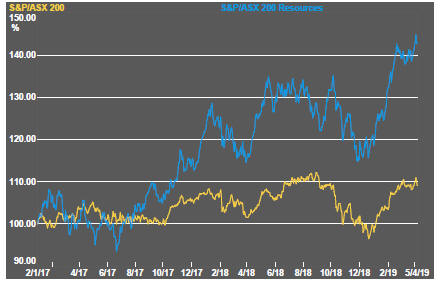

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

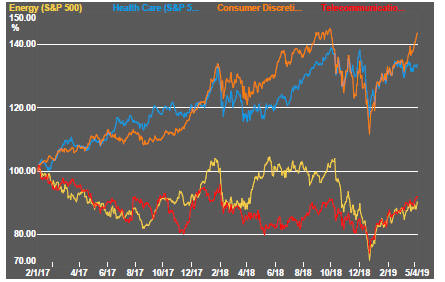

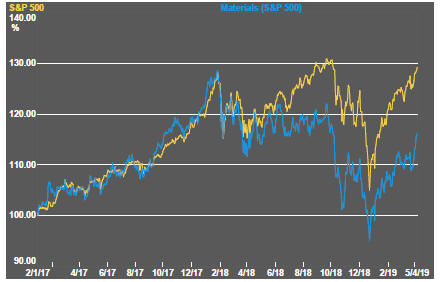

Equity prices regained their upward momentum with the growth-oriented information technology and consumer discretionary sectors leading the way.

Financial services and biotechnology within the S&P 500 brought up the with the growth oriented material sector posting a mid-range 5.2% gain for the week.

Markets have been prepared to price companies for growth despite widespread scepticism - and evidence - of a slowdown in global economic activity.

Fears about the fragility of growth have been offset by an apparent preparedness on the part of central banks to take more pro-growth stances in setting their policies. Whether the central banks can achieve a meaningful improvement in growth outcomes - without more substantial shifts in policy - remains unclear.

The US labour market report for March showed a return to strong employment growth and, importantly, growth in wages which was adding to spending power but also consistent with an ongoing lid on inflation. While the labour market data appear at odds with expectations of sub-2% US growth, equity investors are also noting the absence of lending constraints which would normally act as an important harbinger of a growth slowdown or recession, in framing judgements about the outlook.

European economic data, including poor German industrial production outcomes, reinforced evidence of an economic slowdown in Europe even in the absence of a UK exit from the political union.

Monetary policy tensions were aggravated when US President Donald Trump again expressed his preference for lower interest rates and more quantitative easing. Fed governors are unlikely to succumb to the pressure but may find themselves in a bind if they think that an adjustment is needed but also have to worry about damaging perceptions of their independence.

Trade policy remained a background factor with a positive bias as officials from China and the USA continued to meet to hammer out an agreement and as the US president kept raising expectations of a favourable and “comprehensive” deal.

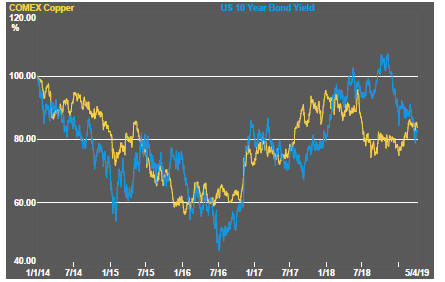

Bond yields retraced some of their previous reductions but equity investors were prepared to conclude that this was because financial markets had become too pessimistic about future growth outcomes.

Prices of high risk corporate bonds retained a favourable bias for mining companies looking to fund development opportunities.

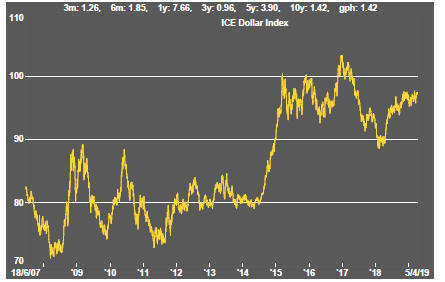

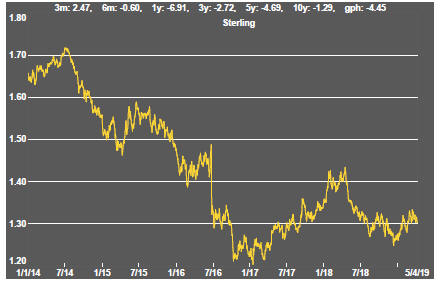

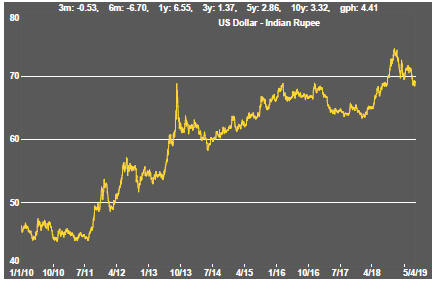

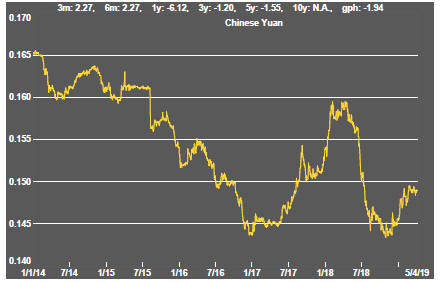

Exchange rate movements were generally within recent ranges. Sterling was helped by growing confidence that the chance of a unilateral withdrawal from the European Union by the UK was receding. The Indian currency has slipped lower as the date of its national election draws near.

Non-ferrous metal prices, with the possible exception of zinc, displayed a slight downward bias consistent with weak global growth expectations.

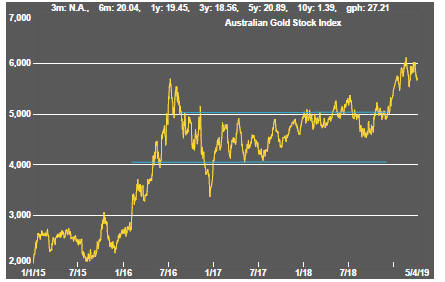

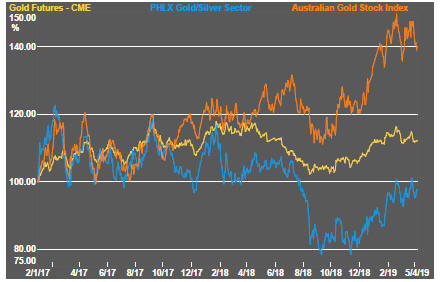

The gold price retreated, consistent with the direction of government bond prices and having stalled near previous price peaks over the past two years.

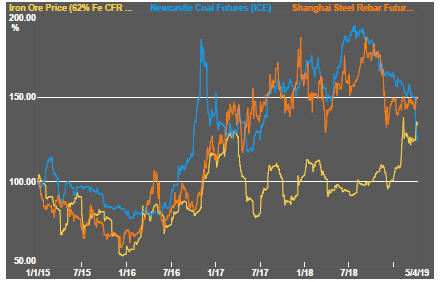

Among the bulk commodities, iron ore prices rose but coal prices were sharply lower at the end of the month.

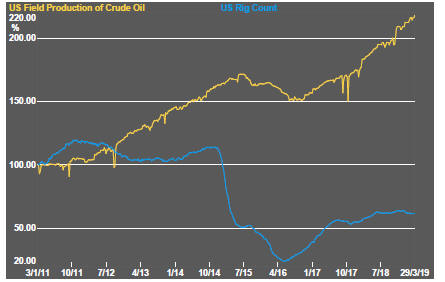

Oil and gas exploration companies continued to show unusually weak leverage to the improving crude oil price suggesting ongoing scepticism that the oil market rebalancing which had supported higher prices was not sustainable.

Battery related mining investments and uranium related equity investments generally displayed a negative tone.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

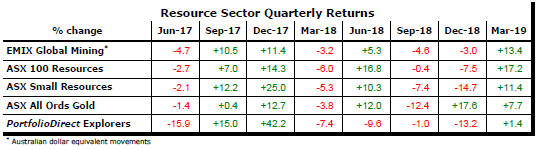

Resource Sector Equities

Interest Rates

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

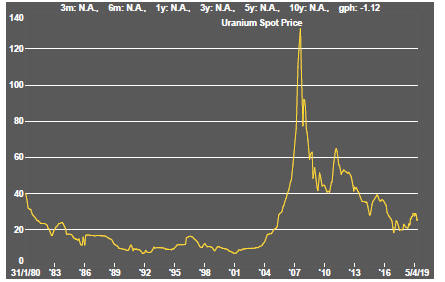

Uranium