The Big Picture

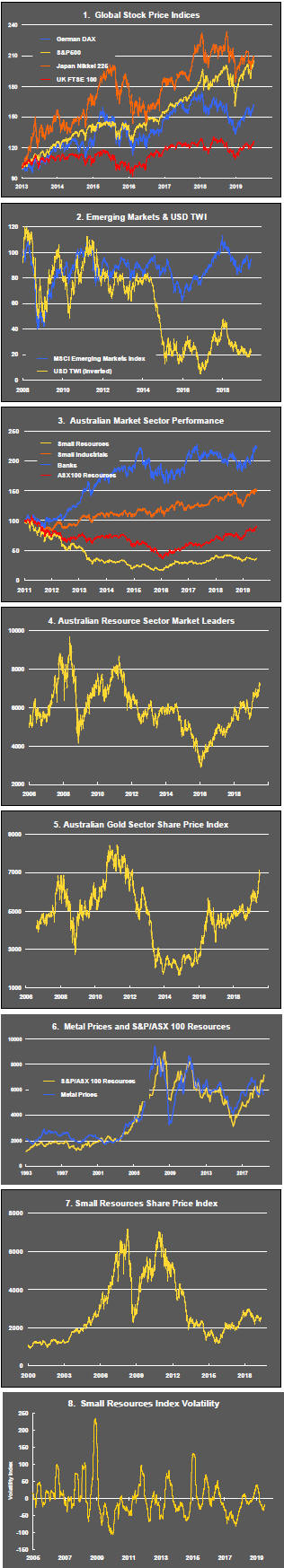

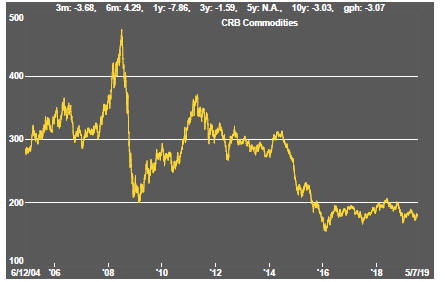

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

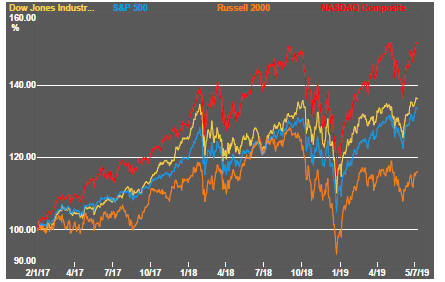

U.S. and global markets remained fixated on the likelihood of an interest rate reduction by the U.S. Federal Reserve.

The week ended with a far larger US employment gain reported for June than had been expected, taking the edge off the building consensus that the Federal Reserve may drop its policy rate by as much as 50 basis points at its meeting in July.

The larger than expected employment gain emphasised the incongruous reasoning behind a rate cut at the present point in the cycle as unemployment pushes lower than once thought possible and wage increases are on a rising trend.

Along with monetary policy settings, trade policy has been an important market influence. Overall market performance has been helped considerably by the growing conviction that the U.S. Federal Reserve will cut its policy rate. Unfortunately, trade tensions, including uncertainty over post-Brexit arrangements in Europe, are having a detrimental impact on business investment decisions and real economic outcomes, including corporate earnings.

The agreement at the G20 leaders meeting in Osaka between the presidents of China and the USA not to escalate the tariff tit-for-tat between the two countries has helped to soothe nervous markets without eliminating trade as a negative influence.

By the end of the last day of the week, the U.S. market had refocused on a favourable Fed intervention leaving US headline equity prices at or near record high levels.

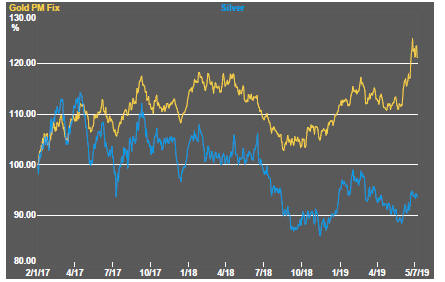

Around the world, bond yields remained on a downward trajectory suggesting ongoing concerns about the pace of economic activity. The gold price once again failed to break significantly higher despite increasingly propitious macro conditions for bullion markets.

Mining stocks faltered slightly during the week although the principal indices remained near record levels after a further gain in the iron ore price helped the market leaders.

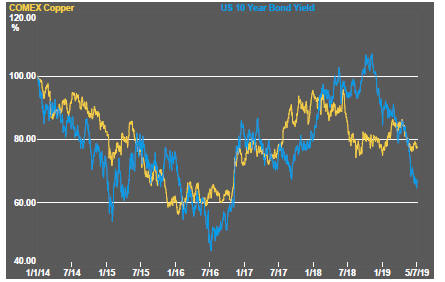

Declining bond yields remained at odds with relatively steady copper prices, another normally reliable indicator of economic activity. One of these two harbingers of changes in economic growth is likely to be mistaken in its inferences about the future pace of economic activity.

Daily traded metal prices, more generally, retained a downward bias consistent with a historically average cyclical adjustment.

Crude oil prices strengthened somewhat after OPEC decided to hold the line on production cuts and Iranian oil supplies remained constrained by U.S. and European sanctions.

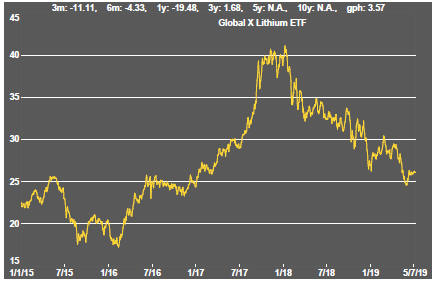

The battery metals segment remained weak despite obvious indicators of long-term physical offtake strength.

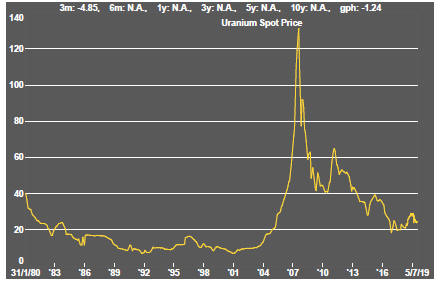

Uranium prices showed similar weakness, belying its longer term outlook.

Coal prices turned positive after having fallen for the best part of the last 12 months after strong gains a year ago.

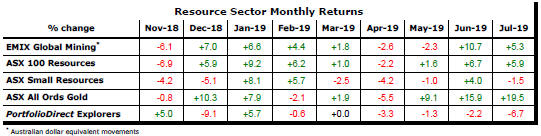

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

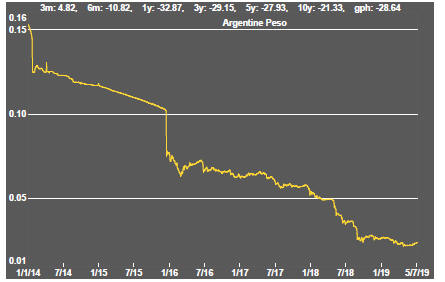

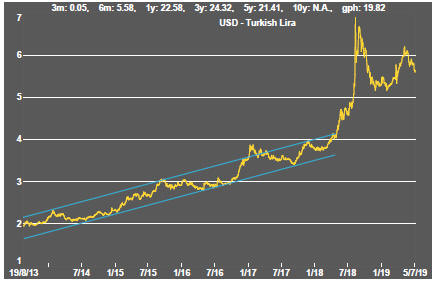

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium