The Big Picture

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 as global growth accelerated although, for the most part, sector prices did little more than revert to 2013 levels which had once been regarded as cyclically weak.

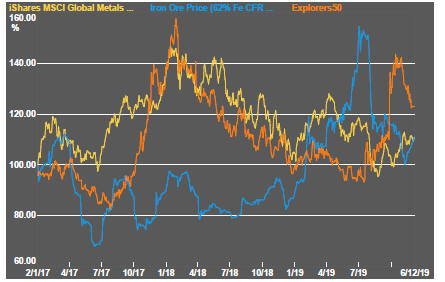

Global growth, having peaked in late 2017, the sector has been in cyclical downswing since early 2018.

With a median decline in prices of ASX-listed resources companies since the beginning of 2011 of 89% (and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

US equity prices established a new record before hitting the skids over trade policy.

US President Donald Trump initially disrupted markets by expressing his ambivalence about getting a trade deal done before the 2020 US presidential election. The Chinese side had attempted to ease the tension by cutting back tariffs on US agricultural products. By the end of the week, a market rebound had already started when Trumpís chief economic advisor Larry Kudlow said that Chinese and US officials were close to an agreement.

Uncertainties over trade policy have contributed to an upturn in market volatility after investors had been expressing optimism about the risk outlook.

On the last day of the week, the monthly employment data gave the market another shot in the arm. Estimated job growth in November was well ahead of what economists had been expecting. Fears that weak capital spending might flow into employment decisions have not been warranted so far.

The November growth in employment was significantly higher than longer-term employment growth potential. At some time in 2020, employment growth is likely to decline. A drop in the pace of employment growth to more sustainable rates could spook financial markets if it comes before a recovery in investment spending has commenced. Getting such a seamless transition may be too much to expect although, so far, the employment numbers have proven extraordinarily resilient and well ahead of what most economic forecasters had thought possible.

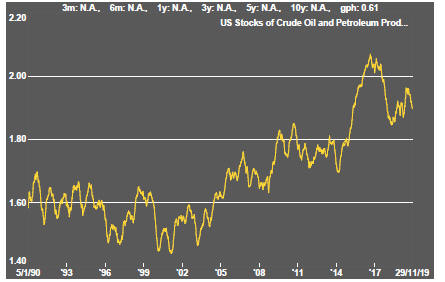

Within the US equity market, the energy sector remains a conspicuous laggard. The risks of higher interest rates and lower oil prices have been taking their toll on investor enthusiasm for the sector. Reports from the OPEC meeting in Vienna pointed to a further cut in production being attempted. Equity investors appear to think that an OPEC production cutback is simply a safety net for US shale producers who would be suffering otherwise with heavy debts, and not a sufficient reason to invest.

Although the week ended with a flow of funds to growth-oriented companies, the materials sector of the S&P 500 traded lower. Base metal price movements were mixed with nickel continuing the reversal of prior gains. Aluminium and zinc prices were also lower. Tin and copper prices were marginally higher. Iron ore prices continued to make gains.

The uplift in bond yields in recent weeks associated with improved sentiment about the growth outlook has not generally translated into support for the industrial metals.

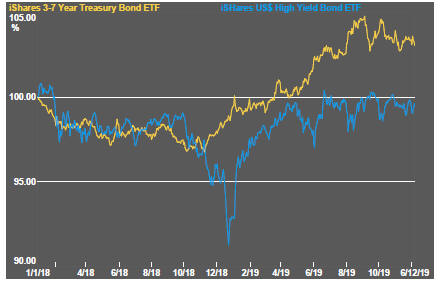

The upward drift in yields on high risk corporate bonds is a sign of tougher funding conditions for project developers and is consistent with a downward move in valuations for Phase II companies with funding needs or debt servicing obligations.

Among the precious metals, gold and silver prices were little changed against the backdrop of relatively small movements in financial market conditions. The more industrially oriented platinum and palladium prices moved higher.

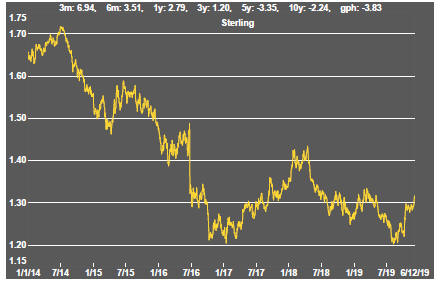

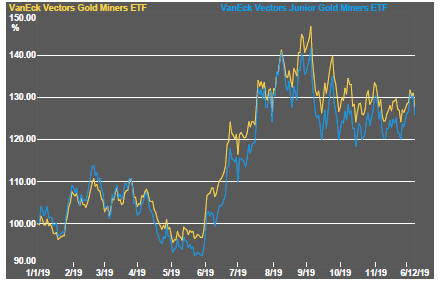

Recently divergent trends in Australia and US gold sector indices have coincided with a directional change in the Australian dollar exchange rate which is throwing into doubt the size of the operating margins among Australian producers. US gold sector investors appear to be taking their lead from equity prices rather than bullion markets.

Sector Price Outcomes

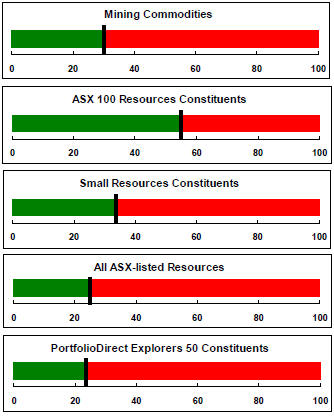

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

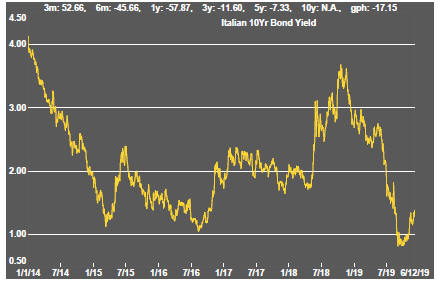

Interest Rates

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

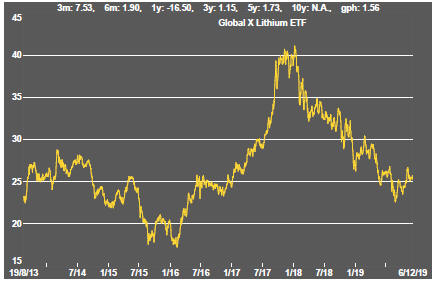

Battery Metals

Uranium