The Big Picture

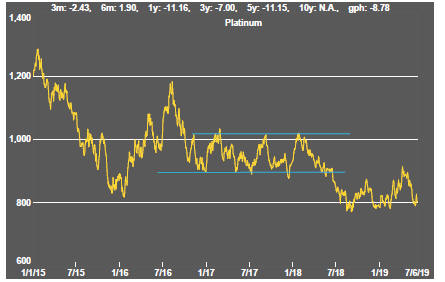

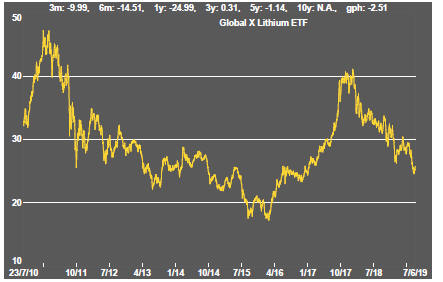

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

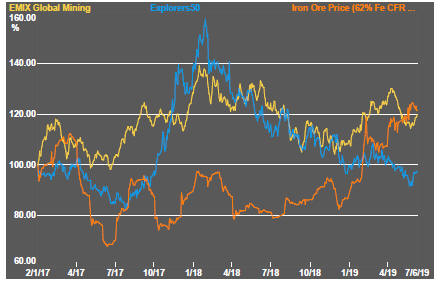

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

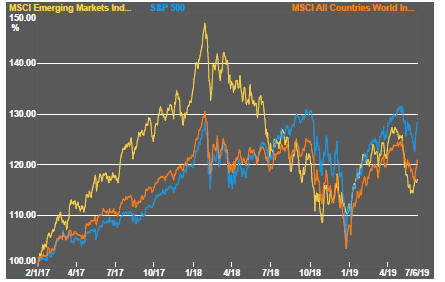

Equity markets reversed earlier losses during the week although the mixture of global growth concerns, monetary policy uncertainty and unresolved trade disputes remained influencing factors.

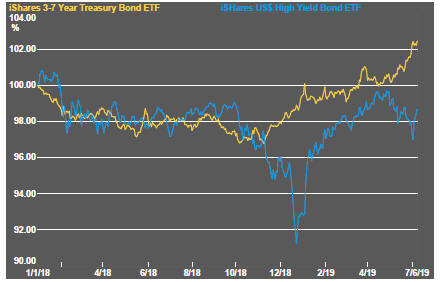

Among US market watchers, expectations of interest rate cuts by the Federal Reserve solidified.

US labour force statistics for May underpinned a rebound rally at the end of the week. The reported number of new jobs fell short of what had been expected but the result reinforced perceptions that the Fed was on the verge of a rate cut, perhaps as early as its meeting in July.

Mexican and US negotiators appeared to have reached an understanding over migration controls and, in the process, averted introduction of tariffs on imports from Mexico. Use of tariffs remains under review pending confirmation of action to stall the flow of migrants from Latin America.

US readiness to use tariffs against an ostensibly friendly economic partner will have caused doubts among Chinese officials about how much confidence they can have in an agreement with the current US administration. As talks between US and Chinese officials appear to have been placed on hold, markets will rely increasingly on a meeting, still unconfirmed, between the US and Chinese presidents to resolve differences and remove an impediment to the global growth outlook.

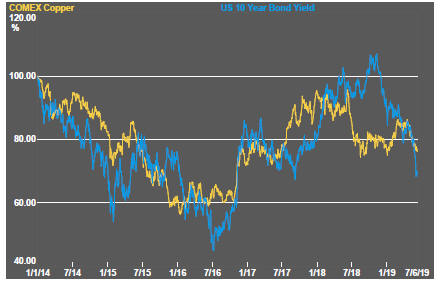

US GDP forecasts are edging lower. The latest Chinese manufacturing purchasing managers survey showed a contraction in activity. European sentiment indicators are also sliding. Overall, the evidence of a slowdown in global activity, in the absence of supporting policy measures, is growing more compelling.

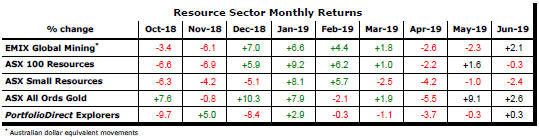

Despite the nature of the growth outlook, headline resource sector equity price indicators are proving resilient. Beyond the market leaders which dominate the indices, sector investment returns have remained subdued or weak as investors continue to largely eschew those companies whose primary activities involve exploration or early stage mine development.

Commodity prices were generally weaker than sector equity price indices indicated. Both copper prices and US bond yields, among the most sensitive growth indicators, are pointing to weakening conditions.

Daily traded nonferrous metal prices retained their downside bias although iron ore prices, helped by supply disruptions, pushed higher boosting the earnings of the market leaders and the headline price indices for the sector.

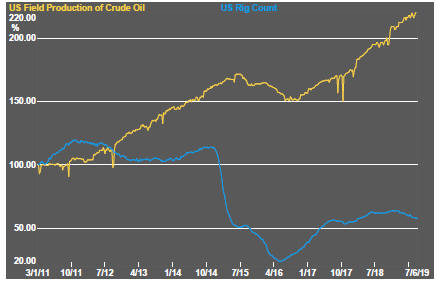

Crude oil prices dropped despite emerging geopolitical tensions as they have become increasingly influenced by a weakening demand outlook and ongoing growth in US crude oil production.

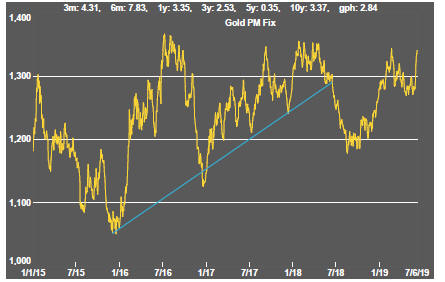

As bond prices pushed higher, gold bullion prices rose but stalled near the peak levels reached previously over the past three years. Gold appears heavily reliant on the realisation of poorer economic conditions which precipitate lower interest rates and vulnerable to a change in sentiment about the outlook.

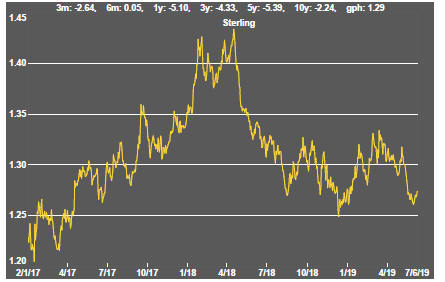

The US dollar tipped lower, adding some support to gold prices. The currency move might have reflected expectations of a cut in US interest rates. Any downward bias could prove short-lived if recourse to a safe haven is needed in the event of further evidence of slowing global growth.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

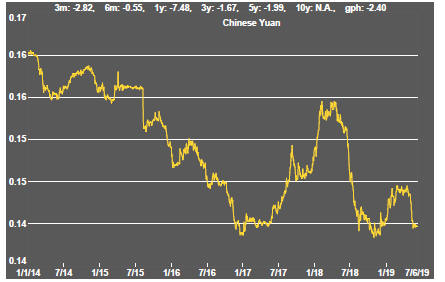

Exchange Rates

Commodity Prices Trends

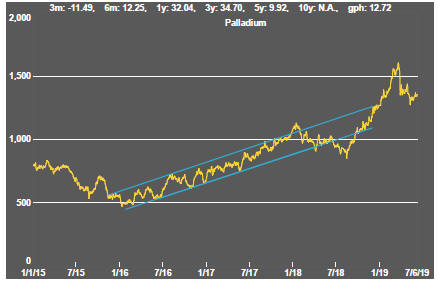

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium