The Big Picture

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

After strong equity price increases through January, momentum waned during the past week.

Despite constant chatter about a global growth slowdown, metal prices held earlier gains and related equity prices reflected the direction of the broader market.

Resources sector stock prices continued to display a disparity between the performance of the market leaders, more aligned with movements in broader market conditions, and the bulk of companies in the sector which remain mired in a prolonged cyclical slump.

Australian gold related equity prices have remained firm with the assistance of a bullion recovery and a downward bias to the Australian dollar. A spate of recent takeover activity has added interest to the gold sector in which expectations of more merger activity to help build corporate resource bases have been building.

The direction of bond yields is favouring equity valuations but some of the shorter term policy issues with a negative impact on equity prices have also remained influential on a daily basis.

Equity markets have taken some comfort from the words of Federal Reserve Chairman Powell about the central bank’s willingness to display patience in coming to judgements about appropriate monetary settings.

Powell’s recent language, in contrast to statements in December, has allayed market fears about the Fed’s policy adversely affecting growth outcomes. At the same time, his choice of words has remained consistent with the possibility of further rate rises during 2019 if the flow of growth and inflation data warrants such action. Financial markets appear to have been given the right to set policy for the time being or, at least, dictate how policy settings are described.

The changed market attitude about the policy outlook, inferred from the Federal Reserve comments, has had a favourable impact on appetites for more risky assets. A continued recovery in high-risk corporate bond prices is one indicator.

Metal price trajectories generally imply relatively subdued economic conditions although iron ore prices showed highly unusual strength during the past week in response to short term changes in Chinese market conditions.

Crude oil prices edged higher without a corresponding move in the price of related exploration and production equities.

The battery metals segment of the resources market has continued to lose investor support despite overwhelming evidence, and a tight consensus, suggesting strong growth in battery storage needs over the coming decade.

Sector Price Outcomes

52 Week Price Ranges

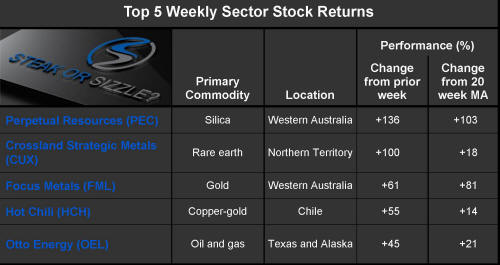

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium