The Big Picture

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

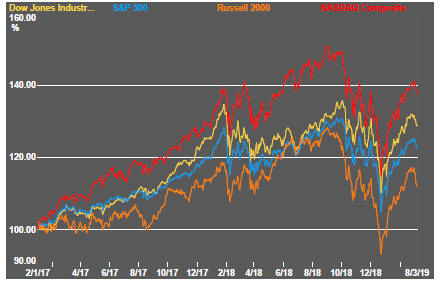

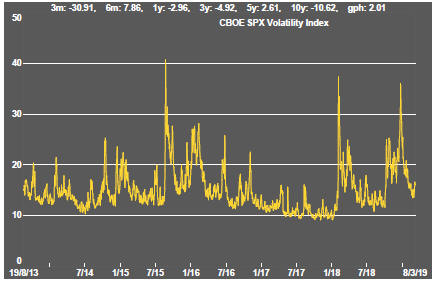

Equity prices changed direction with a succession of daily falls evident across all major indices.

Global growth became a focus of attention with evidence from several sources that a slowdown in all major economic regions was either underway or expected.

The US government reported jobs growth in February had fallen well below trend. And, although the number could prove an outlier, the latest labour force data were consistent with other recent indicators, including December retail sales, that a change in economic tempo was occurring.

Significantly, the European Central Bank announced that it would move ease constraints on bank lending. While this fell short of lowered interest rates or resumption of quantitative easing, th move was taken as a sign of anxiety among officials about short the growth outlook rather than as a confidence boosting effort leading investors to expect better outcomes.

The OECD downgraded its global growth forecasts as did the European Central Bank for the European region. A large fall in Chinese exports reinforced the trend to lowered growth expectations which had already been modified by quarterly GDP growth statistics and manufacturing survey data for the world’s second largest economy.

Expectations persist that a trade agreement between the USA and China will be hammered out although any agreement is now carrying a heavy burden as an expected catalyst to a growth recovery.

Metal price movements appear to be reflecting a judgement about the favourable effects of a trade agreement. Although metal prices were edging lower at the end of the week, widening expectations of slower global growth outcomes appear to have been discounted as likely influences on near term market conditions.

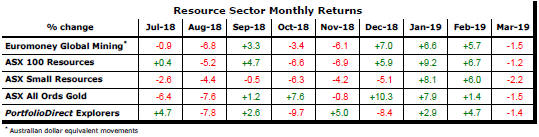

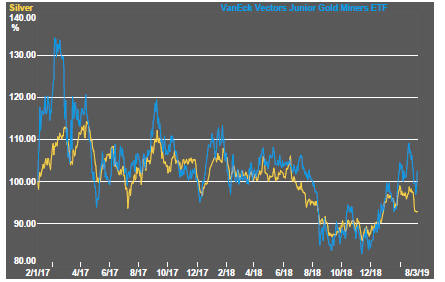

Sector equity prices have drifted lower over the first week in March after a strong showing in February with little difference, this month, in outcomes between the largest and smallest stocks in the sector.

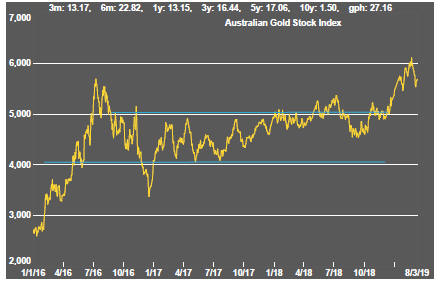

Crude oil and gold and silver prices have been the weakest parts of the commodity markets of most relevance to resource sector stocks since the beginning of the month.

A decision by the large Norwegian sovereign wealth fund to quit holdings of oil and gas related investments would have damaged sentiment toward sector equities. Oil and gas exploration and production equity prices have shown no leverage to higher crude oil prices over the past four weeks. The continuing rise in US oil production has eroded confidence in the ability of OPEC countries and Russia to sustain prices, making the market susceptible to periodic imbalances and a weakening outlook.

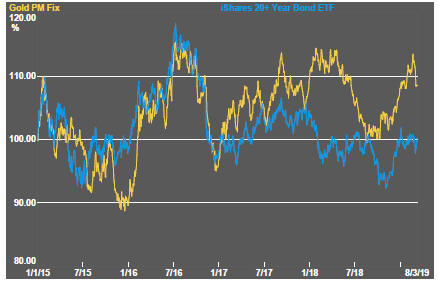

The recent recovery in the gold price appears to have hit headwinds after having approached levels previously reached in 2018 and 2016. The price action looks increasingly like the prolonged period of little change in prices which occurred after the major gold price shift which occurred over 15 years during the 1980s-1990s. Evidence is mounting that this should be adopted as the base case for the current outlook.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

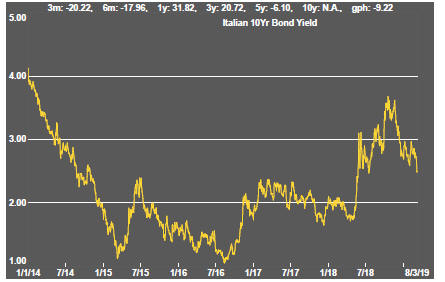

Interest Rates

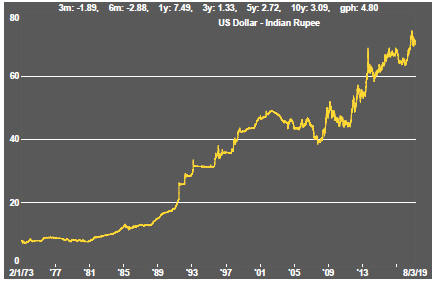

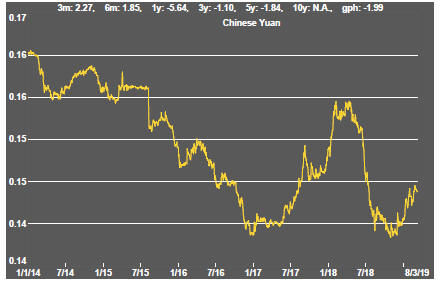

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

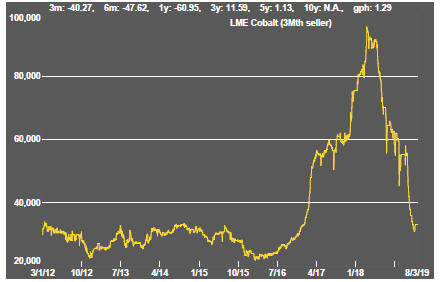

Battery Metals

Uranium