The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

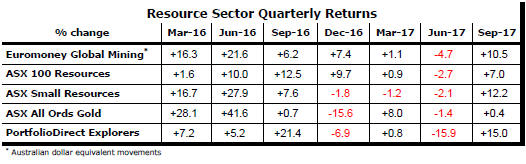

Resource Sector Weekly Returns

Market Breadth Statistics

Gains across multiple sectors propelled equity prices to new records.

Once again, US investors were placing some emphasis on the likelihood of tax cuts for US corporations.

There were signs of investors showing less interest in the more risky parts of the equity market. The Russell 2000 index of smaller US listed stocks did not maintain the pace set by larger companies. Most noticeably, emerging market equities fell..

A 228,000 increase in US nonfarm payrolls during November, reported on Friday morning, suggested an economy still expanding. The employment growth was more than required to absorb new labour market entrants and, consequently, ahead of what will be sustainable in the longer term with unemployment having been lowered to 4.1%.

Markets were also looking to the upcoming meeting of the Federal Reserve this week with high expectations that the FOMC would decide to implement another rate rise.

The US dollar strengthened slightly in response to indications of ongoing growth and accompanying higher interest rates.

Despite signs of a sustainable economic expansion in all major economic regions, financial markets have shown few signs of the strengthening growth outlook or higher inflation.

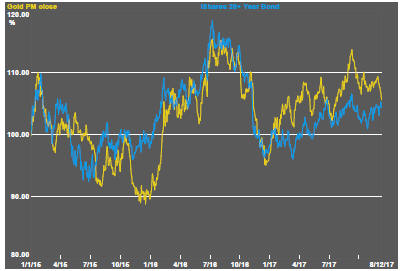

An unusually large fall in the price of gold bullion during the week ran contrary to firm financial asset prices which normally correlate with bullion prices.

The gold price is just one of the inconsistencies between financial market movements and prices of equities and commodities.

Gold related equity prices responded, as expected, to the decline in gold bullion prices.

The disparity in performance between Australian equity prices and US equity prices remained evident with the prices of stocks in both localities declining.

Australian gold related equity prices remain near the upper end of the trading range which has prevailed through 2017. US equity prices pushed below the previous lower end of their trading range.

Daily traded metal prices generally drifted lower to converge around similar returns for 2017 as the year comes to a close.

Tin prices remained outside the broader trend not having risen and having shown little volatility through the year.

Iron ore prices showed a more robust positive reaction to stronger Chinese steel prices after having moved little in response to better end product pricing in recent months.

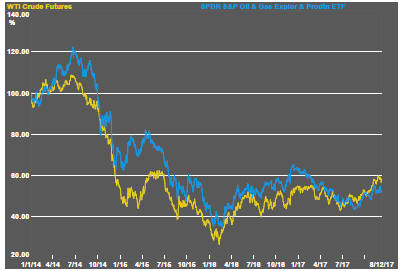

Crude oil price remained around the levels last achieved two years ago after having risen as a consequence of both voluntary supply cuts and involuntary disruptions, the most recent of which occurred in the UK last week.

Prices remain in a tug of war between the beneficial effects of production cuts by some of the world's major producers, including the owners of Aramco who hope to float the Saudi state owned producer in 2018, and the potential negative influence of US producers reacting to higher prices with increased production.

Uranium related equity prices pushed slightly higher with apparently strong bottom of the cycle returns concealing the full extent of the cyclical decline which have anchored them near historically low levels.

While two of the world's largest producers have announced production cuts, a lengthy adjustment remains underway as producers are still able to fulfill contracts by sourcing material on spot markets more cheaply than they are able to produce the equivalent amounts theselves.

A weaker Australian dollar is offsetting some of the downside from lower commodity prices but the currency moves is more likely to have reflected judgements about relative economic growth and interest rate oucomes.

.

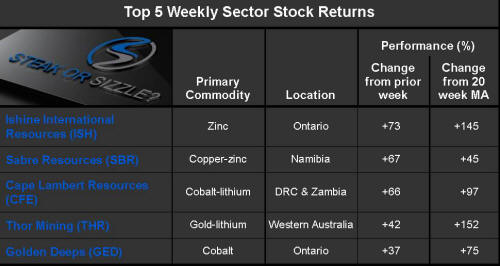

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.