The Current View

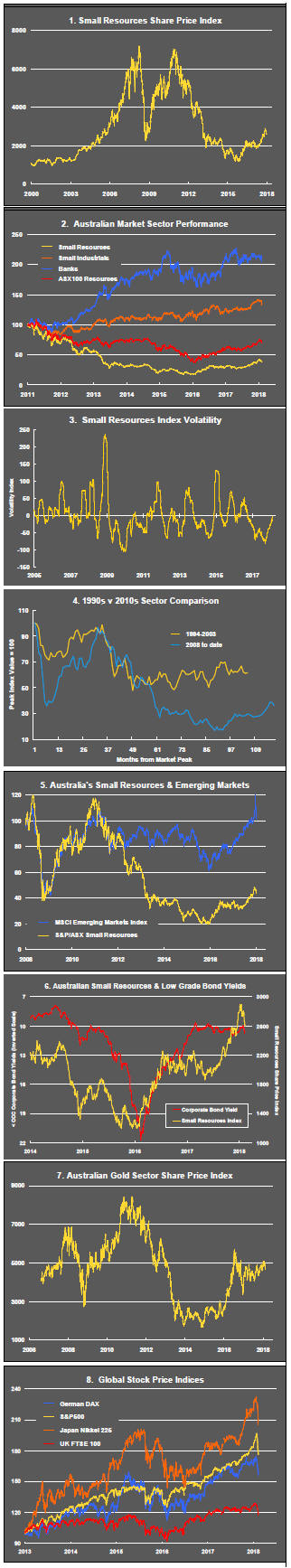

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were reversed through 2016 and 2017 although sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

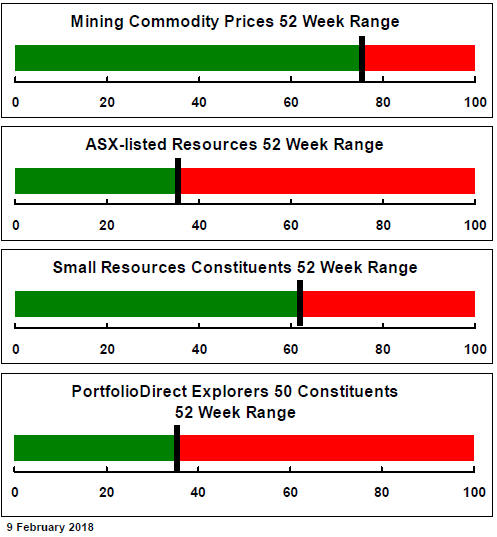

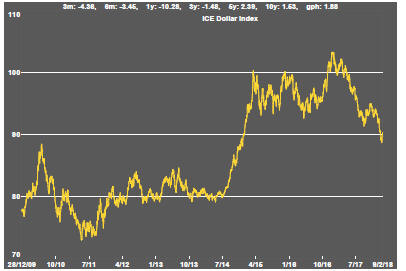

The strength of the US dollar exchange rate since mid 2014 had added an unusual weight to US dollar prices. Reversal of some of the currency gains has been adding to commodity price strength through 2017.

Signs of cyclical stabilisation in sector equity prices has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development has passed its most difficult phase with the appearance of a stronger risk appetite.

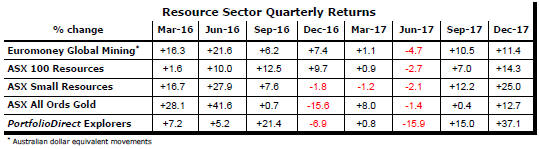

Resource Sector Weekly Returns

Market Breadth Statistics

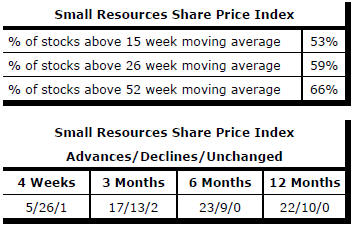

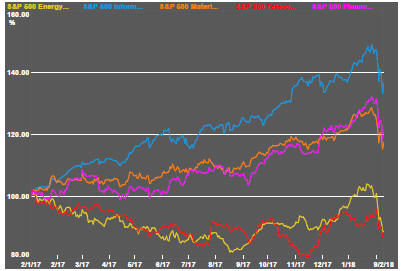

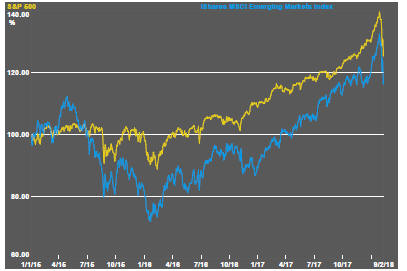

The inflation shock inferred from the January US labour market report took its toll across all US market sectors as well as international markets.

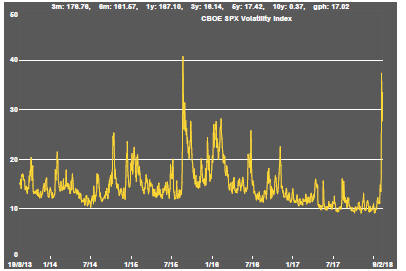

The dramatic rise in option implied volatility suggested that investors had become far too sanguine about the possible market risks.

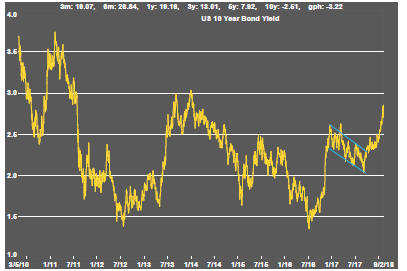

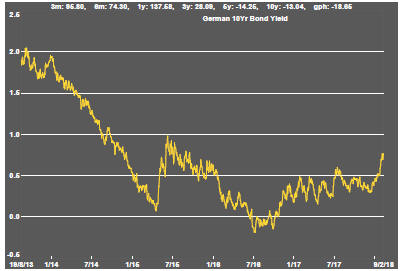

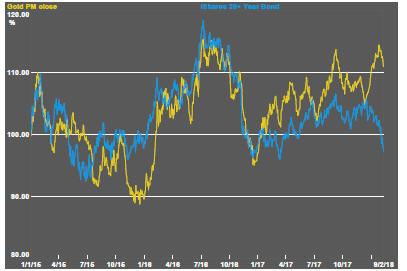

Before the US labour market report on the first Friday of the month, financial markets had already been showing signs of stress about the future of interest rates with risisng US and European government bond yields.

The subsequent further rise has accentuated the need for downward revisions to share prices for any given level of earnings.

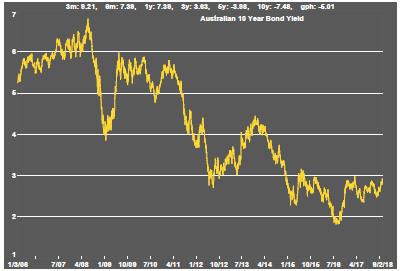

Conspicuously, Australian bond yields have not reacted noticeably to the anticipated changes in global monetary conditions. Part of the reason for the relatively subdued reaction in Australian financial markets will have been the relatively high Australian yields which have persisted throughout the cycle.

The US dollar made some modest gains last week against the currencies of the US major trading partners after the beginnings of a cyclical decline over recent months.

Among the factors affecting the US currency have been swings in sentiment about international risks. As investors became more optimistic about international growth outcomes, capital flowed in that direction reducing the bid for safe havens of the type offered by US assets.

Amidst the volatility of the past week, a slightly higher US dollar is not a surprise.

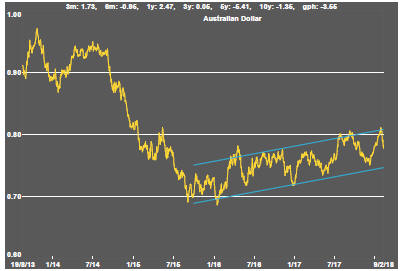

The same set of international economic conditions will have reduced demand for the Australian dollar which would also have been subjected to negative pressures by the growing spread in government bond yields between Australian securities and those of the USA and Europe.

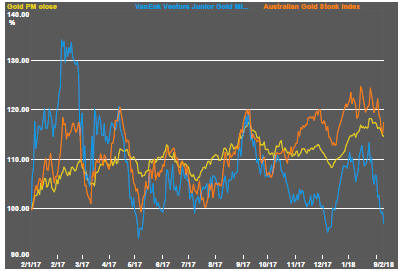

US gold equity prices pushed toward the lower end of their recent range despite relatively modest fluctuations in the gold bullion price.

US gold related equities have had a stronger correlation with other equity prices than with the price of gold bullion

Australian gold related equity prices have been more resilient partly helped by the declining Australian dollar.

Bullion prices have remained resilient against the backdrop of the sharp decline in government bond prices which, under most circumstances, would have driven bullion prices lower. The disparity in performance suggests further pressures to be absorbed by the gold price unless the US dollar happens to revert to the downtrend which had prevailed prior to last week.

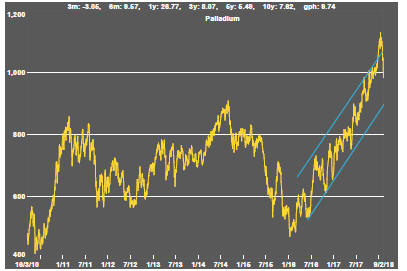

Within the precious metal segment, the palladium price suffered a sharp fall. While the macro forces will have had an impact, the palladium price had been exceptionally strong for over a year.

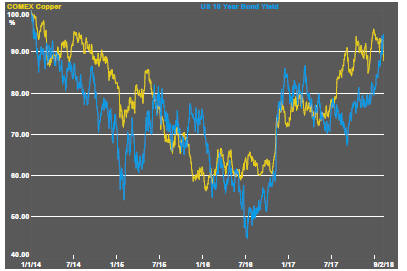

The rise in copper prices over the past year has lost momentum but hardly signals a significant deterioration in the economic climate.

Higher copper prices are frequently driven by similar forces to those that drive bond yields higher. The stronger global output growth implied by stronger wages growth should support stronger demand for industrial raw materials including copper.

Nonferrous metal prices were not immediately affected by the January employment report until the disruptive effect of the equity market correction extended into the commodity sector. Before that, commodity markets appeared to take the wage report in their stride implying it was not such a large change as to warrant having a significant impact on metal prices.

Raw material prices should benefit from expected growth in personal incomes. As long as markets are preoccupied with the effect of higher inflation on monetary settings, however, mining sector equities may underperform the improvement in underlying industry conditions.

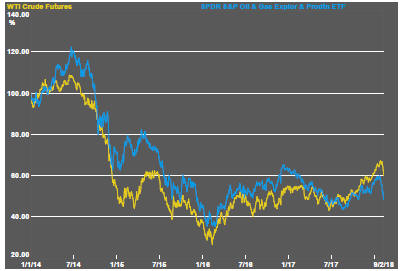

In common with other commodity investments, oil and gas equity prices have shown a stronger correlation with other equity prices than with the related commodity price move.

Oil prices have appeared to react more strongly than other commodities to the changed financial market conditions although the oil price decline coincides with data showing a large increase in US oil industry activity with more drilling rigs in operation pushing shale output higher.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.