The Current View

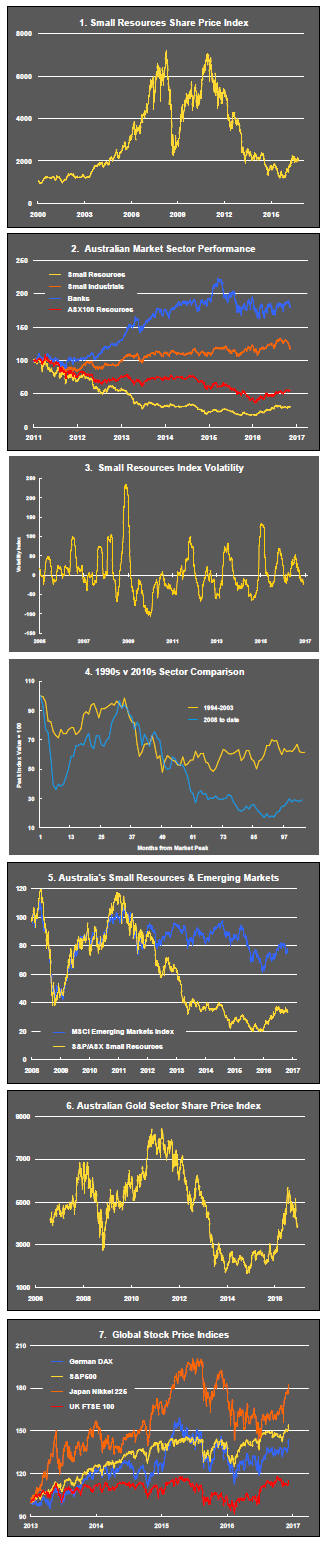

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

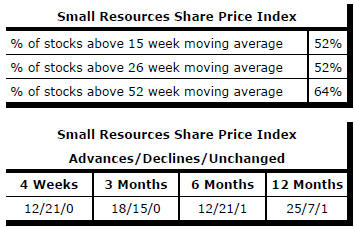

Key Outcomes in the Past Week

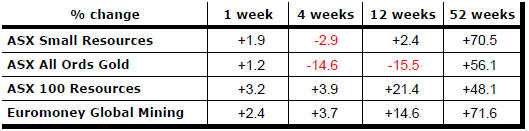

Market Breadth Statistics

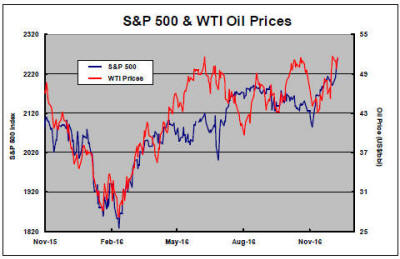

Rising oil prices coming with an agreement among major producers to curtail output has contributed to the positive market tone although the widening breadth of positive influences on market outcomes has been increasingly important.

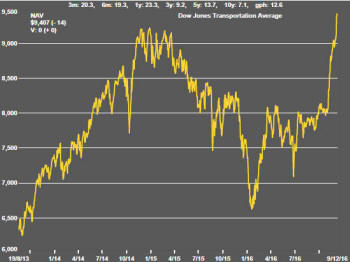

The Dow Jones Transportation Average which is widely regarded as a reflection of US domestic economic activity has rushed past its previous high water mark at the beginning of 2015.

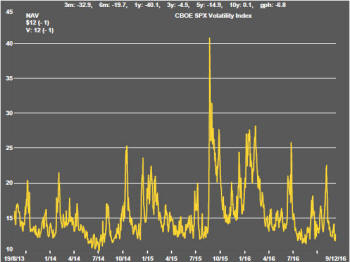

US market volatility has reverted to historically low levels consistent with strong market conditions - but also flagging such strong sentiment that the risk of a downward move has risen.

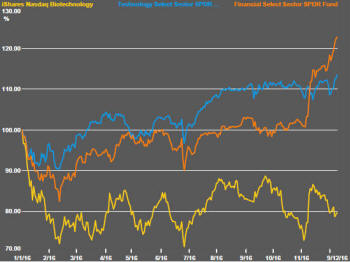

The post-Trump election effect boosted biotech and financial services stock prices which have underpinned the strength of the US equity market.

The effect on biotech share prices has faded but financial stocks have continued to benefit from expectations of reduced regulation. Higher bond prices will have started to improve the pricing power of companies in the sector.

The stronger US dollar will also have had a detrimental effect on those companies with a high proportion of their earnings outside the USA but the technology sector also appeared to join the market rally in the past week.

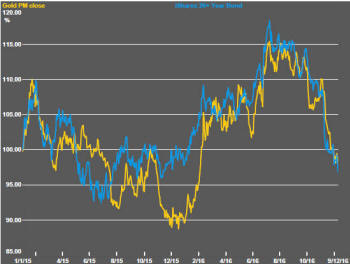

Copper and iron ore price rises, which have benefitted the sector leaders, have widened its appeal to professional money managers - one reason the larger stocks have outperformed the smaller end of the market. The rise in these two commodity prices has added to the downward pressure on bond prices from higher inflation expectations.

The rapid fall in bond prices has contributed to the slump in gold prices and the poor performance of gold related equity prices in the past four weeks.

.

The Steak or Sizzle? blog LINK contains additional commentary on the sources of the share price performance among the best performed stocks and the extent to which these near term investment outcomes might be underpinned by a strong enough value proposition to sustain the price outcomes.