The Big Picture

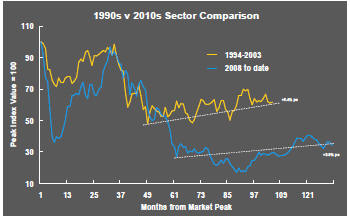

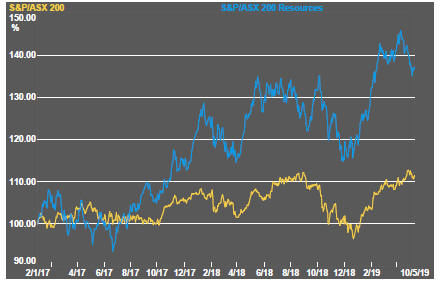

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

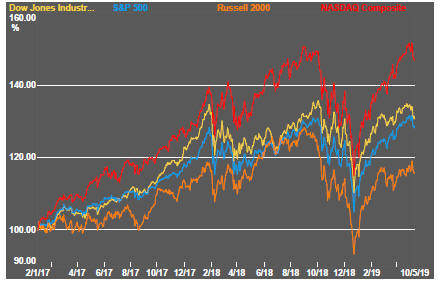

The downswing in equity prices continued apace as US-China trade talks faltered.

Chinese officials came to Washington under the threat of tariff rises on US imports. Markets continued to hope that an agreement could be snatched from the disarray but the two parties seemed as far apart as ever as the Chinese officials flew home. At the end of the week, no further discussions were planned.

Resource stocks continued their decline as fears about global growth seem to have risen. Daily traded nonferrous metal prices continued their cyclical descent. Crude oil prices also turned lower as did uranium. Iron ore and coal prices remained relatively stable.

Low volatility copper prices remain consistent with a moderate growth outlook and lower US government bond yields.

Despite widespread belief in the strength of future demand for battery metals, lithium related stocks tracked the general downswing in resource sector equity prices.

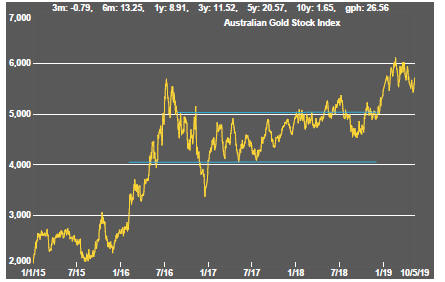

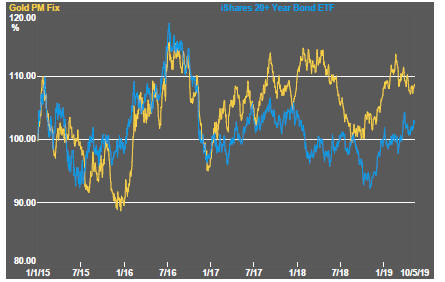

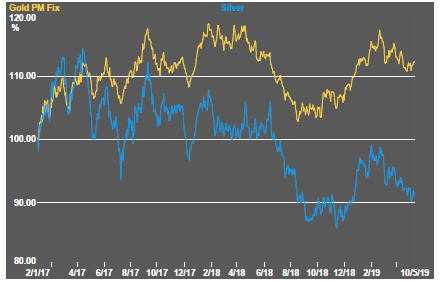

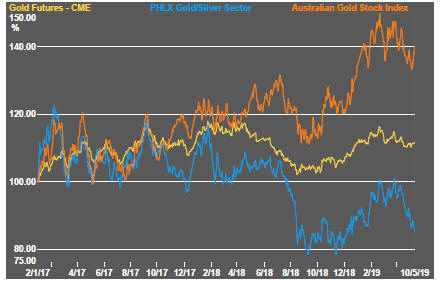

Gold prices have passed their peak but remain toward the upper end of a three year trading range. A move in bond prices could determine the future precious metal direction.

Prices of Australian gold stocks have more closely tracked bullion prices then those in North America which have been more heavily influenced by the weakening in broader equity market conditions.

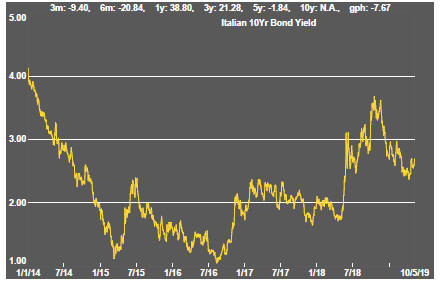

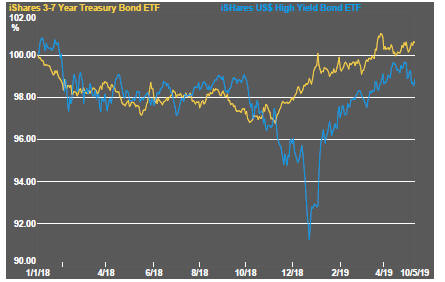

Financial market conditions did not change materially during the week although interest rates were still biased to the downside, offering a ray of hope that central banks may mitigate the negative impact of slower growth on demand for metals.

Falling prices of high yield corporate bonds suggested some marginal deterioration in funding conditions for mine developers.

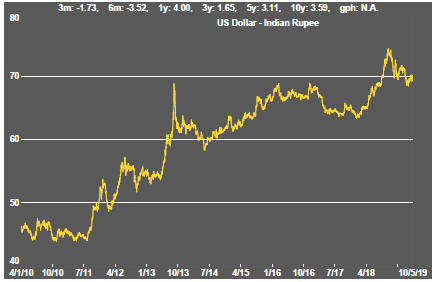

The US dollar retained its upward bias which was helping to keep a lid on import price inflation, with beneficial effects on interest rates.

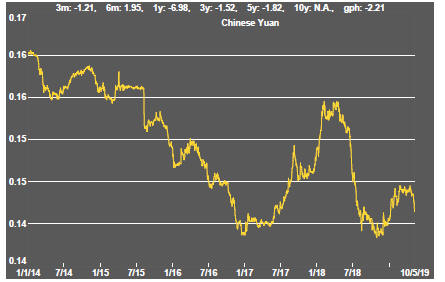

The Chinese currency weakened, against the backdrop of a failure to conclude a trade deal with the US government. The weaker yuan may alleviate some of the effects of the newly imposed US tariffs.

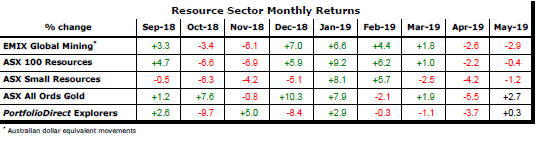

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

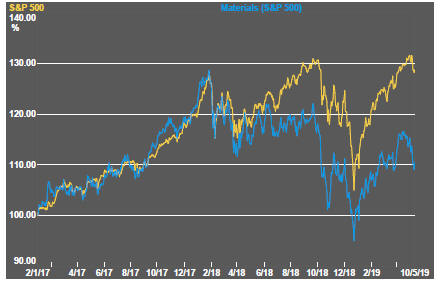

Equity Market Conditions

Resource Sector Equities

Interest Rates

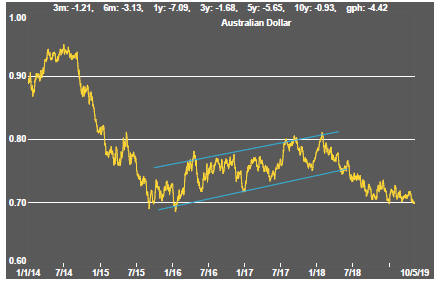

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium