The Current View

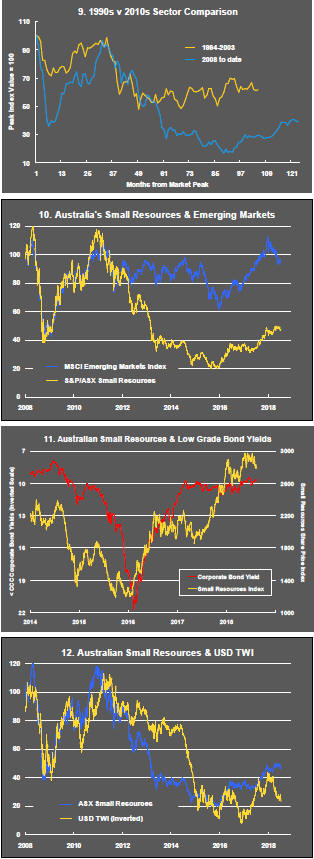

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were reversed through 2016 and 2017 although sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

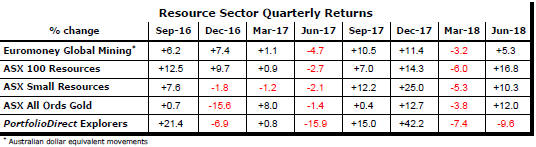

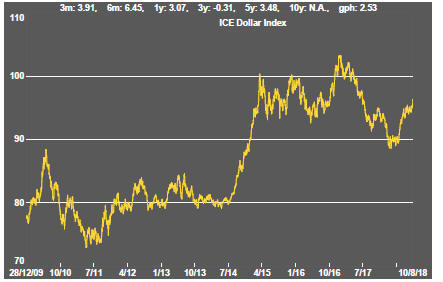

The strength of the US dollar exchange rate since mid 2014 had added an unusual weight to US dollar prices. Reversal of some of the currency gains has been adding to commodity price strength through 2017.

Signs of cyclical stabilisation in sector equity prices has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development has passed its most difficult phase with the appearance of a stronger risk appetite.

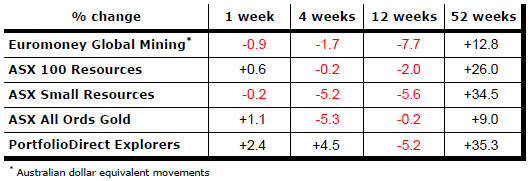

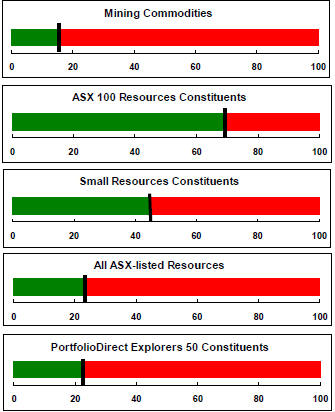

Resource Sector Weekly Returns

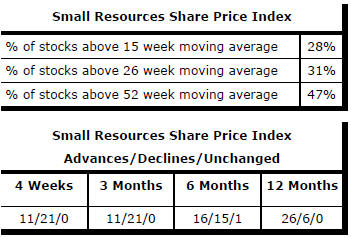

Market Breadth Statistics

52 Week Price Ranges

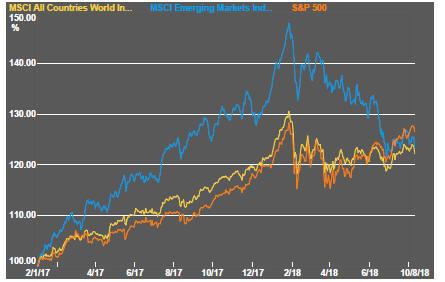

Equity Markets

Global equity prices remain near the highest values reached to date in 2018 but down on 2017 levels. Emerging market equity prices, especially those with China connections, still display a weakening bias. US markets are markedly stronger than the rest of the world and closer to previous market peaks.

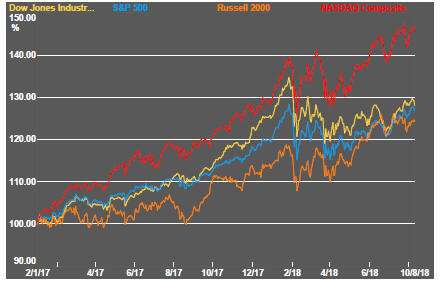

Of the major US indices, the NASDAQ composite still leads with a handful of stocks continuing to dominate its direction and outcomes.

Within the S&P 500 index, a relatively few technology companies now account for a disproportionately high weighting with the potential to dictate overall index performance. Lesser weighted sectors are offering improved performance without impacting the index significantly.

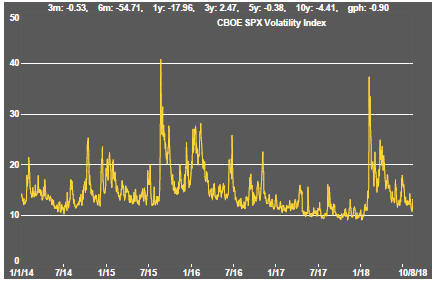

Despite a variety of political disturbances and market threats, investors are displaying a sanguine attitude to risk. Volatility measures are reverting to their lowest levels.

At the top of the list of disturbances has been the threat of disrupted trade patterns as a result of unresolved US and China trade rivalries. Comments from US officials suggest no talks to ease the resulting anxieties are planned. President Donald Trump appears to believe he has built up a large enough bank of market credits to pursue his negotiating approach with its associated short term damage to market conditions. US economic conditions are also providing helpful support for Trump’s gambit.

There is a sense in market reactions that investors do not believe Trump will pursue his policies to their limit but is manoeuvring to precipitate even a modest agreement so as to claim a negotiating success.

US employment statistics for July showed a slightly lower than expected gain but one matching perfectly with the Federal Reserve playbook of an expanding economy with few added inflation pressures. The labour market data would have also added to market confidence about the predictability of interest rates. Circumstances could change but, for the time being, the economic data are helping the upward drift in US equity prices.

In Europe, where Brexit threatens growth patterns, investors are also probably more sanguine than circumstances indicate is appropriate with UK officials more openly admitting that no Brexit agreement on trade may be finalised in the time available.

Markets were jolted late in the week by Facebook which reported lowere earnings than analysts had been expecting as a result of having to deal with demands for improved privacy protections. The Facebook predicament led immediately to questions about the sustainability of earnings among other social media companies.

Resource Sector Equities

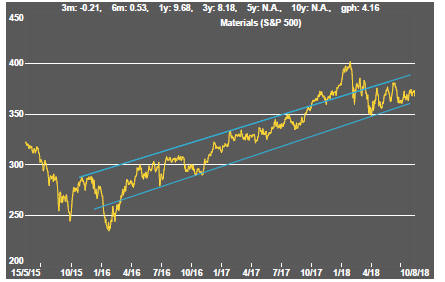

Materials sector equity prices remain in an uptrend albeit with signs of momentum loss. Price action suggests a looming test of downside potential.

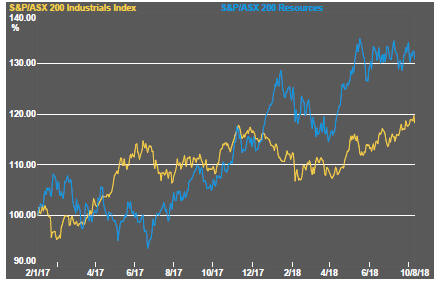

The mining segment of the materials sector has more clearly lost momentum over the past two months with global market indicators showing a more significant downward bias. In Australia, industrial sector stocks remain in an uptrend, making relative performance gains against the listed miners.

Interest Rates

Interest rate pressures remain moderate with corporate yields appearing well anchored near cyclical low levels.

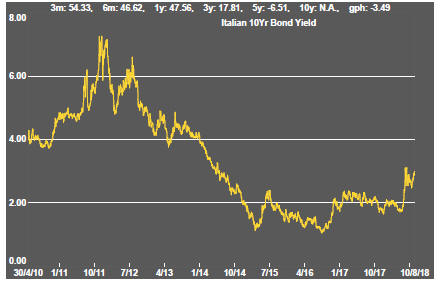

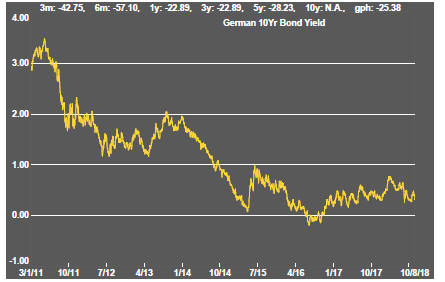

European government bond yields have moved higher as the probability of rate rises by policy makers appears to have been reassessed. US yields remain supportive of equity valuations.

Exchange Rates

The US dollar maintained an upward bias although the extent of its movements has diminished. The euro which is a potential loser in an all-out trade battle with the USA is the mirror image of the US currency.

As views about a post-Brexit trade agreement with the UK have taken a more pessimistic turn, sterling has pushed lower. The downside risks to the British economy immediately preceding and in the aftermath of quitting Europe keep rising as the chances of a formal agreement fade. The accompanying lower currency will hurt inflation but help restore some otherwise lost competitiveness.

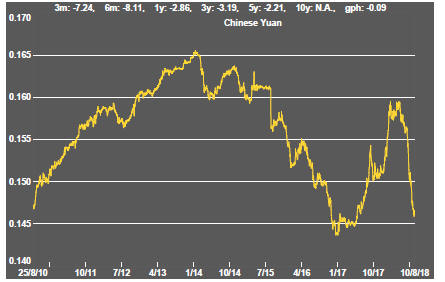

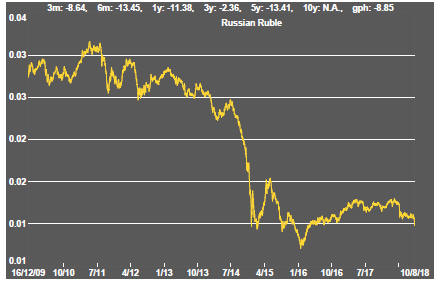

Emerging market currencies remain in a weakening trend as threats to global growth become more prominent with many of their individual economic circumstances already underpinning further weakness.

The strategically most important of these exchange rates - the Chinese yuan - continues to decline, offsetting some of the competitiveness losses from anti-China tariffs imposed by the USA.

The Australian dollar - perceived as an innocent victim in the Sino-US trade crossfire -

Commodity Prices

The general upswing in commodity prices since mid 2017 had been given added impetus by stronger crude oil prices.

Diminished momentum has left prices within the bounds of a cyclical trough, albeit at the upper end.

The flip side of the benefits for commodity producers and exporters of higher commodity prices is the cost pressure now being experienced by users of agricultural and raw material commodities. Reporting companies have been suggesting this as a source of margin compression.

Business surveys closely watched by central banks are showing signs of upward pressure on selling prices as a result of higher raw material prices.

Gold & Precious Metals

Weakening trends in gold and precious metal prices persist.

Looked at against broader financial market conditions, gold had appeared overpriced and at risk of a significant reversal. Further bond price falls are likely to aggravate the trend.

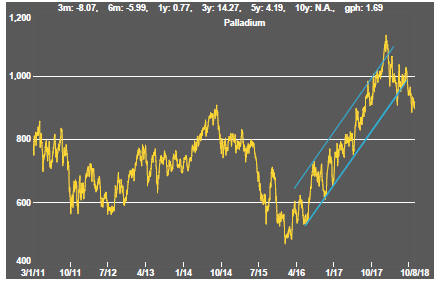

Across the precious metal sector, prices have broken through the bounds of prior trading ranges.

Gold and palladium price uptrends have been broken. Platinum prices fell below the lower bound of a two year trading range. Silver prices have proved the most resilient only by falling least.

The divergence in trend between Australian and north American gold related equities had taken a step toward convergence but the gap remains large and suggestive of relative underperformance among the Australian branch of the market.

Nonferrous Metals

The major daily traded nonferrous metal prices are converging on some of the lowest levels of the past year. The highly correlated moves suggest little opportunity for differentiation among individual metals due to any peculiar circumstances.

Metal prices moved slightly higher at the end of the week but only after a conspicuous loss of momentum and earlier price declines. Some relief from concerns about US trade policy were little more than a respite.

Industry statistics continue to signal that higher prices have been driven by unusually weak demand mitigated by lowered production rates leaving them at risk of reversal as new supplies enter the market in response to price incentives.

Much of the commentary about the decline in copper prices has focused attention on the impact of trade policy. There will have been some effect from this source but prices had shown little net change for the best part of a year amidst a clear loss of momentum before the trade policy issue began to gain traction.

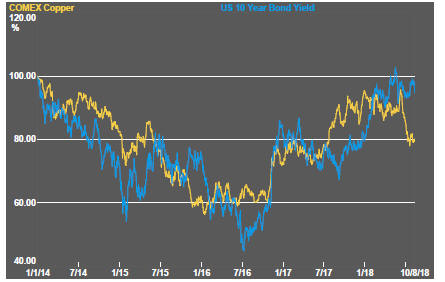

The performance divergence between the copper price and US bond yields suggesting less bullishness within the copper market about the growth outlook might be consistent with the relatively muted response on the part of market yields to the rise in interest rates by the Federal Reserve.

Bulk Commodities

Relatively weak first quarter Chinese GDP growth had suggested a ramp up in activity through the remainder of 2018 if China was going to meet its growth target which, in a centrally controlled economy in which leaders are trying to maintain credibility, is a reasonable assumption.

The difficultly of achieving its targets has now been acknowledged by Chinese officials who have conceded that second half growth may not be as strong as had been expected.

Nonetheless, the Chinese government reported a June quarter GDP growth in line with its stated target.

Coal prices havr eemained firm with strong demand growth from China where thermal coal volumes have been groing at their fastest pace since 2011. Indian port authorities have also reported strong growth in coal movements in the second quarter of 2018.

Iron ore prices had remained largely unresponsive to improved demand for steel and ongoing expansion of Chinese manufacturing output until the last fortnight when prices have pushed higher.

Oil and Gas

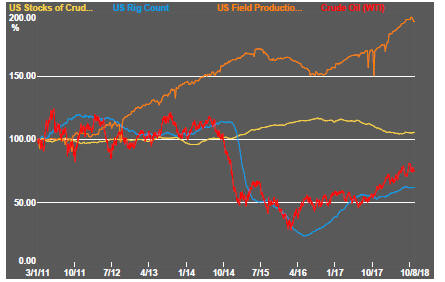

The upward trend in crude oil prices has moderated but remains intact.

While a meeting of OPEC members decided to expand production, the size of the increase was less than had been expected while the push by the US administration to re-impose economic sanctions on Iran is also working to put upward pressure on oil prices.

The Iranians have been lobbying European countries to prevent more widespread application of sanctions but the likelihood of relief appears slim as long as funds must circulate through US banks.

US production, in any event, continues to rise and is now matching output from Russia and Saudi Arabia. Texas alone is positioned to be the third largest producer after Russia and Saudi Arabia.

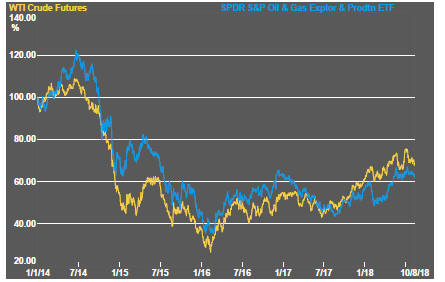

Despite the change in tone within crude oil markets, related equity prices have been muted in their responses, implicitly signaling scepticsm about the sustainability of price rises.

Battery Metals

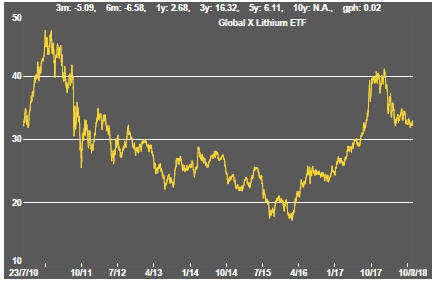

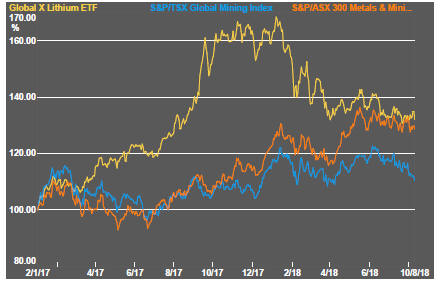

Eighteen months of rising lithium-related stock prices has given way to a period of market reassessment as a lengthy pipeline of potential new projects has raised the prospect of ongoing supplies better matching expected needs.

Potential lithium producers have been able to respond far more quickly to market signals than has been the case in other segments of the mining industry where development prospects have been slowed by reticence among financiers to back development.

Movements in lithium related equity prices have been aligned more closely with overall sector equity prices in recent weeks.

Battery metals remain a focal point for investors with recent attention moving to cobalt and vanadium.

Doubts about a peaceful transfer of political power in the Democratic Republic of the Congo (and instances of Ebola) have added a dimension to cobalt prices lacking in other metals caught up in the excitement over transport electrification. Improved political conditions left cobalt prices at risk of some retracement - as has recognition that the surge in future needs for battery storage did not warrant the near term price action which reflected more on shortages for traditional uses.

In the longer term, cobalt is the most vulnerable of the battery related metals to substitution with high prices likely to stimulate research in that direction.

A spokesperson for Panasonic, manufacturer of batteries for Tesla motor vehicles, has been quoted as saying that the company intends to halve the cobalt content of its batteries because of uncertainties over supply.

Uranium

The uranium sector is in the midst of forming a prolonged cyclical trough as market balances slowly improve. Power utilities are still not prepared to re-enter the market for contracted amounts of metal to meet longer term needs. A slight upward bias in prices has been evident in the past month.

Slightly higher equity prices from time to time, in the hope of improved conditions, have not been sustained but could be repeated as speculation about improved future demand ebbs and flows. The effect of an announcement by Canadian producer Cameco to extend the duration of its previously implemented production cut gave the market a very slight but quickly lost lift.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.