The Current View

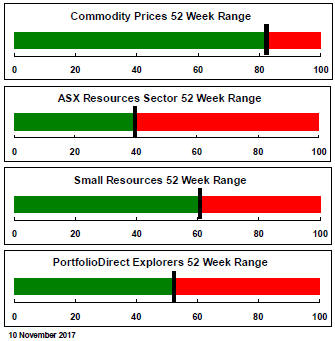

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Resource Sector Weekly Returns

Market Breadth Statistics

Record equity price indices have come with divergent internal trends.

The information technology sector has been a principal driver of the S&P 500. At the other extreme has been the telecommunications sector which has had to cope with highly competitive business conditions.

The materials sector had recently been closing the gap with the top performing segments of the market but lost momentum over the past week.

Expectations about US tax cuts have been an ongoing influence on US markets.

While Congressional Republicans believe that they need tax reform to restore their legislative credibility, cracks are appearing in their unity over policy options.

Significant differences exist between the bills crafted in the Senate and the House of Representatives. Of particular concern in the past week were suggestions that the Senate bill would postpone corporate tax cuts for one year to help massage the deficit impact.

Both bills are constrained by having to adhere to a maximum 10 year deficit impact. For some members, even this is too much leeway and are threatening to withhold support. Those representing states with high local taxes are also challenging the majority due to the proposals to eliminate or limit deductibility of local and state taxes.

Passage of tax reform legislation, with its expected positive impact on growth and earnings, remains critical to US market performance

Market volatility rose during the week with fears that a tax reform package may be less beneficial for corporate earnings than had been anticipated.

Doubts about tax reform also helped stall the upward drift in the US dollar.

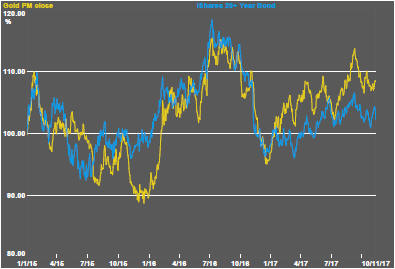

Fluctuations in US government bond prices were not reflected in gold prices which have held at higher levels than the financial market shifts might have implied.

The gold price remains at risk to a stronger US dollar and possibly higher interest rates. In that regard, it is also tied to what happens to the tax reform moves in the US legislature.

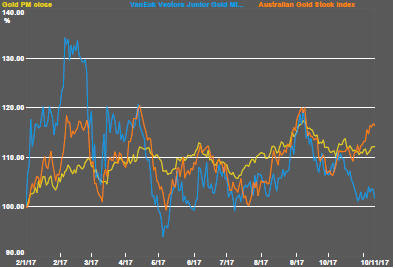

The price of gold equities in the principal US markets has shown little net change over the past two years and has displayed unusually weak reactions to higher gold prices when they occurred.

Australian listed gold equities have been on a noticeably divergent path from their US-listed counterparts.

A weaker US dollar may have made a minor contribution to the difference but the Australian companies will have benefitted from the excitement over finds in the Pilbara which have brought renewed interest to the sector.

Daily traded nonferrous metal prices have lost momentum recently although nickel prices broke from the pack a week earlier to be the best performing of the metals during 2017. Tin prices have continued to lag.

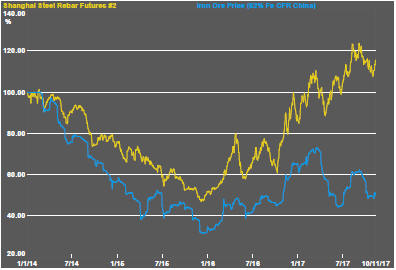

Iron ore prices were little changed in the past week although there was a modest improvement in Chinese steel prices which have helped buoy ore prices in the past year when they have risen.

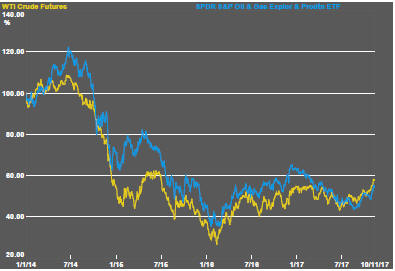

Crude oil prices continued to strengthen and, with that, the prices of the exploration and development companies improved more or less in line.

As with the other commodity related stocks, the equity market is not showing the leverage to improved commodity prices that might have been inferred from historical experience.

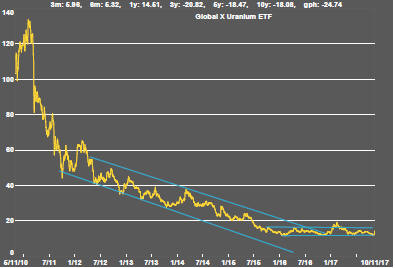

Uranium equities showed gains of 15-30% after Cameco, one of the world's largest uranium miners, announced that it would temporarily shutter its Cigar Lake mine in Canada.

The share price gains, welcome though they are, barely recaptured any of the multi-year losses with which the sector has had to contend.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.