The Current View

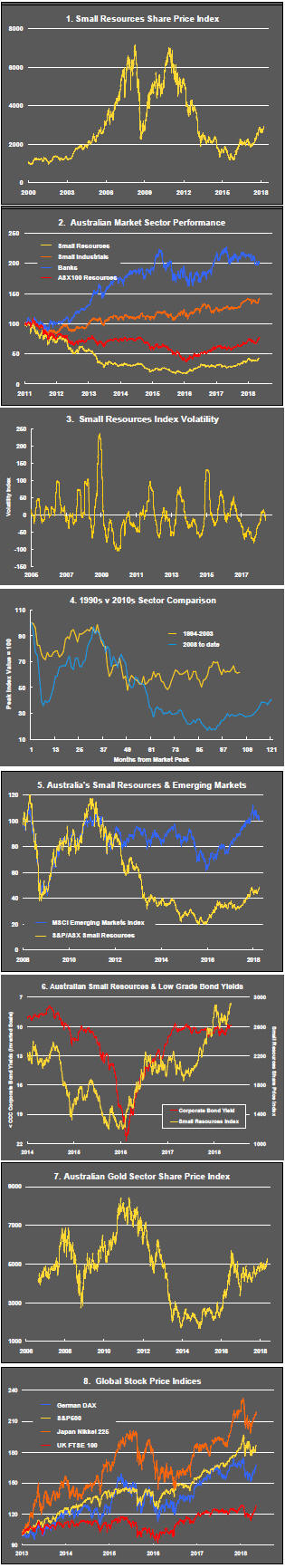

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were reversed through 2016 and 2017 although sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

The strength of the US dollar exchange rate since mid 2014 had added an unusual weight to US dollar prices. Reversal of some of the currency gains has been adding to commodity price strength through 2017.

Signs of cyclical stabilisation in sector equity prices has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development has passed its most difficult phase with the appearance of a stronger risk appetite.

Resource Sector Weekly Returns

Market Breadth Statistics

52 Week Price Ranges

Equity Markets

An unusually long sequence of days posting positive returns indicated a return to growth oriented equity investing and, with that, a decline in implied volatility in options pricing. Confidence in US markets was gained from the reaction to key technical levels.

The flow of US earnings remained supportive. Concerns about global growth gave way to a greater emphasis on valuation but switches in emphasis are becoming more commonplace and less likely to be sustained.

Energy related stocks contributed to the performance of US equity indices with selected information technology stocks, with their large index weightings, also making gains.

The positive sentiment surrounding the prospect of negotiations between the USA and North Korea contributed to firmer market conditions. While abandonment of the Iran sanction agreement raised conflict risks, it also added to crude oil prices which have a beneficial effect on US domestic economic conditions.

Resource Sector Equities

The global resources sector benefitted from the embrace of growth with the Australian resources benchmark indicators pushing back to the levels last reached in 2013.

The Caterpillar price action is one illustration of the change in investor attitude to global risk and industrial growth prospects in the past week after several months of lacklustre trading.

The gains within the sector remain biased toward the largest stocks with explorers generally seeing little additional support.

Sector gains outstripped Australian industrial stocks with the performance gap between the two market segments widening to record levels for the past year.

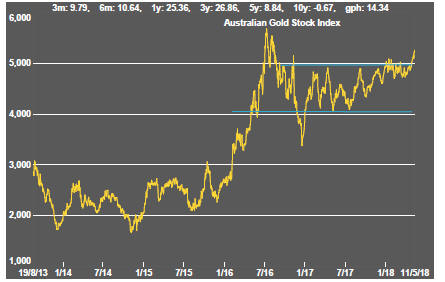

Australian gold equities rose, consistent with rises elsewhere but helped by the weaker Australian dollar which has enabled the Australian segment to run ahead of its international counterparts.

Interest Rates

US 10 year bond yields were again nudging 3%, a level which has become a focus of attention, but the momentum toward higher yields seemed to ease during the week.

The debate among US policymakers about the pace of monetary adjustment continues, leaving the market continually vulnerable to their utterances and changes in the nuance of their language.

While long term interest rates are on the rise, they are still essentially within a decades long historical downtrend.

Business has not generally been affected by higher long term interest rates as surveys point to demand for loans being low and no significant change in the financial environment for higher risk borrowers.

Exchange Rates

The US dollar was flat for the week but retained its recent upward bias against trading partner and developing market currencies.

The exchange rate moves signal market scepticism about the potential for global growth to strengthen beyond what has already occurred. They suggest that global synchronisation has come and gone.

The exchange rate moves also suggest investors need to take care in assessing the profitability and risk profiles of miners depending on the location of their operations.

The gentle upward drift in the Australian dollar appears vulnerable to further upside in the US dollar despite commodity prices remaining within the upper end of their range from the past year.

Commodity Prices

The general upswing in commodity prices over the past year has been give added impetus by stronger crude oil prices but remains within the bounds of a cyclical trough suggesting still stronger economic activity will be needed if the cycle is to strengthen.

Gold & Precious Metals

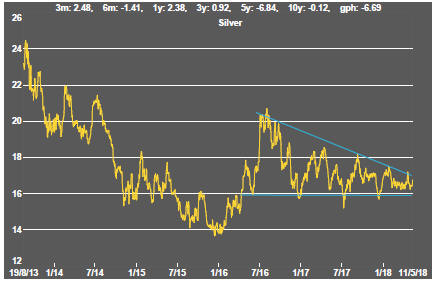

Precious metal prices are hovering near points with the potential for changes in direction. Potential upside could be quickly derailed by further bond price declines which have had little impact on bullion prices in recent weeks.

Geopolitical issues - such as the likely abandonment by the US administration of the nuclear weapons deal with Iran - will have helped support gold prices and most likely will continue to do so as long as there is no sign of a resolution or some attempt, at least, to start a new round of negotiations.

US precious metal related equities have lifted from near the bottom of their medium term trading range but remain little changed from mid-2016. Australian gold equity prices moved through the upper end of their recent trading range, helped by the lower Australian dollar.

Nonferrous Metals

Prices of the main daily traded nonferrous metals had become increasingly correlated as a broadening consensus about the lowered risks to world economic activity emerged and, then, as growth seemed to ebb.

Fresh US sanctions against Russian business interests dramatically impacted aluminium and nickel prices, subsequently.

With comments from the US administration suggesting that the sanctions will not affect metal supplies as severely as had first been suspected, the two metals most affected retraced their sharp gains. That aside, strong evidence of price convergence remains a feature of the market with only tin prices staying aloof from the crowd.

Copper prices again failed to react to the re-pricing of financial assets in the way one might expect to occur if higher bond yields were reflecting a positive reconsideration of the growth outlook.

Bulk Commodities

Bulk commodity prices had given up some of their early 2018 gains but had shown some signs of modest recovery in the past two weeks.

Relatively weak first quarter Chinese GDP growth suggests a ramp up in activity through the remainder of 2018 if China is going to meet its growth target which, in a centrally controlled economy in which leaders are trying to maintain credibility, is a reasonable assumption. Firmer bulk commodity prices may become evident later in the year.

Oil and Gas

Crude oil prices have reached the highest levels in several years.

Rising US production, partly in response to higher prices, had been seen as a burden on expectations about the likelihood of further oil price rises.

US producers are able to profitably hedge anticipated production contributing to the ongoing rise in their output.

On the other side of the ledger, inventories have been declining and global supplies have remained constrained through both voluntary and involuntary actions.

Fears of deteriorating political conditions in the middle east have also elicited a higher risk premium with the US president committing to bring back economic sanctions against Iran.

Energy related equities of companies engaged in exploration and production have started to show more significant leverage to the improvement in crude oil prices. The energy sector, dominated by the large integrated oil producers, has contributed to the stronger US equity market performance in the past week.

Battery Metals

Eighteen months of rising lithium-related stock prices have given way to a period of market reassessment as a lengthy pipeline of potential new projects raises the prospect, although not conclusively, of ongoing supplies being adequate for expected needs.

Potential lithium producers have been able to respond far more quickly to market signals than has been the case in other segments of the mining industry with development prospects.

The lithium segment rise in the past week was well within the context of improved sector equity prices suggesting ongoing scepticism about the buoyancy of the lithium market outlook.

Battery metals remain a focal point for investors with recent attention moving to cobalt and vanadium.

Doubts about a peaceful transfer of power occurring in the Democratic Republic of the Congo (an an Ebola outbreak) has added a dimension to cobalt prices lacking in other metals caught up in the excitement over transport electrification.

In the longer term, cobalt is the most vulnerable to substitution among the current array of battery metals with higher prices likely to stimulate research down that path.

Uranium

The uranium sector is moving along the bottom of its long term trading range in the absence of more meaningful signs that power utilities are prepared to re-enter the contract market to negotiate longer term needs.

Slightly higher equity prices from time to time, in the hope of improved condtions, have not been sustained but could be repeated as the speculation about future demand continues and the market defines a cyclical trough.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.