The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

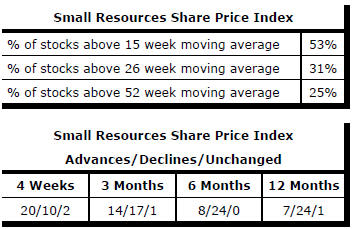

Market Breadth Statistics

Geopolitical fears imposed themselves on markets during the week. Although the North Korean nuclear missile stand-off with the USA had been looming for years, it had generally not affected markets even as US-North Korean rhetoric had been ramped up recently.

Increased market volatility which coincided with signs of both sides inching closer to conflict accompanied a broader disenchantment about the legislative effectiveness of the Trump administration and the apparent impact on policy of ongoing personality tensions at the centre of the Trump administration.

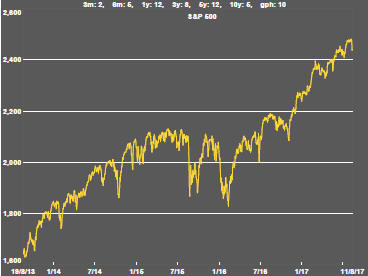

The equity market weakness evident during the week has been attributed to the effect of rising military tensions between the USA and North Korea but came after a prolonged rise in equity prices which has pushed markets to unusually expensive levels leaving them vulnerable to correction.

Such setbacks as occurred during the week, when they have happened previously since 2009, have been short lived and, with the benefit of hindsight, have been signals to buy more rather than quit the market.

The same might be true once again although the rationale becomes harder to justify as prices rise and monetary policies become less accommodating.

U.S. market weakness was felt across all sectors although, by the end of the week, the downward thrust had appeared to stall among the stocks which had contributed most to recent market strength.

The U.S. dollar fall had lost some momentum by the end of the week but the currency had reached the lower end of its trading range from over the past two years, measured by the trade weighted index for the U.S. dollar.

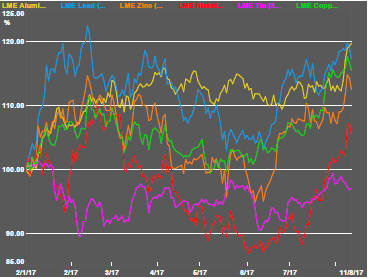

The lower U.S. dollar has had an impact on the prices of daily traded metals consistent with their historical links.

On the London Metal Exchange, the prices of all the principal non-ferrous metals except tin strengthened during the past week although the upper and lower bounds of the price performance have largely remained unchanged since the early weeks of 2017.

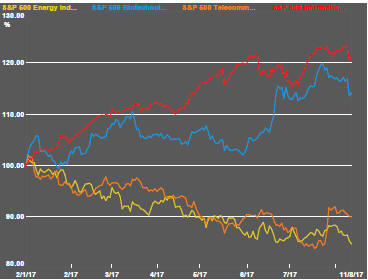

Emerging market equity performance had been improving with the weaker U.S. dollar, impressions of slightly stronger economic growth and higher commodity prices.

During the week, emerging market share prices stalled at around the peak levels achieved in the past five years.

Further share price gains may be hampered by the historical share price patterns but emerging market investments remain relatively more attractive than the more strongly performing advanced country markets.

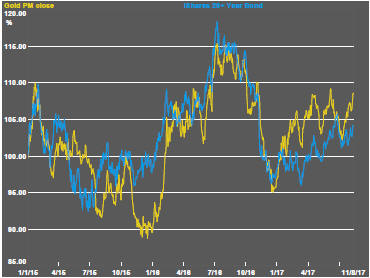

Strengthening gold prices - supported by both the weakening U.S. dollar trend and recently rising U.S. bond prices - have remained within the 2017 trading range suggesting any change in the recently supportive financial market conditions - easily possible as markets adjust to changing circumstances - may produce a reversal of the performance.

Continued improvement in Chinese steel market conditions have benefitted iron ore prices.

Slightly weaker crude oil prices resulted in further declines in oil-related equity prices which are leveraged to those conditions as well as the generally weaker equity market outcomes.

.

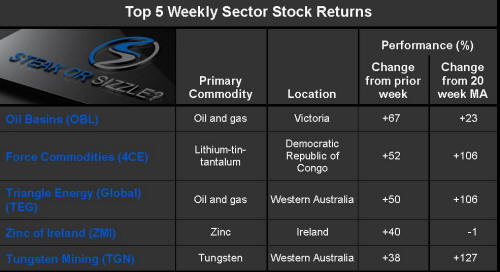

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.