The Big Picture

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 as global growth accelerated although, for the most part, sector prices did little more than revert to 2013 levels which had once been regarded as cyclically weak.

Global growth, having peaked in late 2017, the sector has been in cyclical downswing since early 2018.

With a median decline in prices of ASX-listed resources companies since the beginning of 2011 of 89% (and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

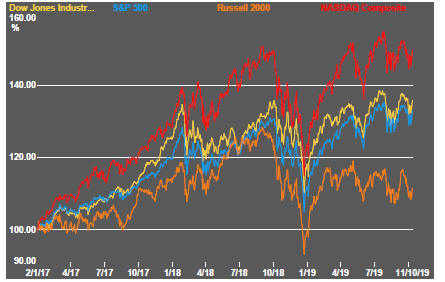

Reduced risks to global trade flows and positive comments from central bankers about monetary policy being eased are supporting equity prices, at least for the time being.

Equity markets received a filip late in the week after US President Trump announced an agreement, at least in principle, with China on outstanding trade disagreements. An agreement has yet to be drafted and will occur in at least two stages, according to the US President.

Both parties have been at this point before but are now negotiating under the pressure of obviously declining growth momentum in their respective economies. Officials are aiming to have something in writing by the time Presidents Trump and Xi are scheduled to meet in Chile in November.

The recently appointed head of the International Monetary Fund foreshadowed a cut back in its near term growth forecasts in the lead up to the annual meetings of the Fund and the World Bank.

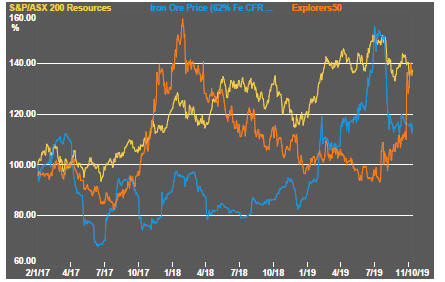

Metal prices reacted positively to the news of a US-China trade rapprochement. Metal prices have remained relatively strong against the backdrop of widespread concerns about slowing global growth and, for some, a rising threat of global recession. Restraints on metal supply have been an important element in stabilising market balances and preventing prices from following a more normal peak-to-trough trajectory.

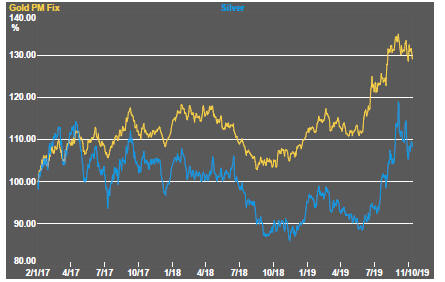

The gold price moved lower as bond yields rose. The gold price remains tied to movements in financial market prices rather than deriving support from any structural shift in gold demand.

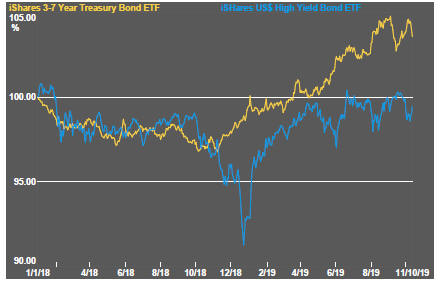

The swift rise in bond yields over recent weeks has been accompanied by positive moves in yield curves. Below investment grade yields have also been on the rise in a sign of deteriorating capital market conditions for companies, such as miners and oil and gas producers, at the upper end of the corporate risk profile.

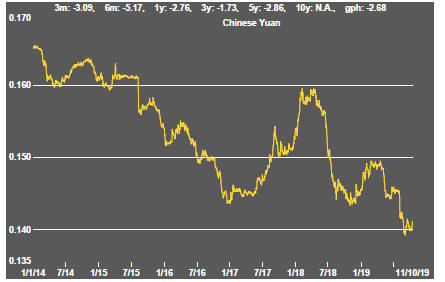

The continued upward drift in the US dollar has been a constraint on US dollar denominated metal prices. The weakening European growth outlook is being reflected in a lower euro. Growing optimism that the UK will leave the European Union with an agreement has helped lift sterling.

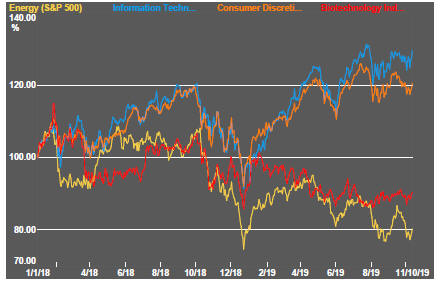

Oil and gas related equities failed to respond to broader equity market conditions, as crude oil prices eased further after the recent attack on Saudi Arabian oil facilities and signs that production will be swiftly restored.

Within emerging energy related segments of the market - lithium, cobalt and uranium -conditions remained depressed notwithstanding a modest bounce in cobalt prices from their lowest levels in three years.

Exploration companies have extended their period of relatively strong market performance despite the pessimism about global growth and the generally poor cyclical position of the industry. The strongest performing stocks in the sector have typically been those with extremely depressed share prices (i.e. more than 90% below peak levels) benefiting from the leverage to even minor bouts of speculation over news events.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

Exchange Rates

Commodity Prices Trends

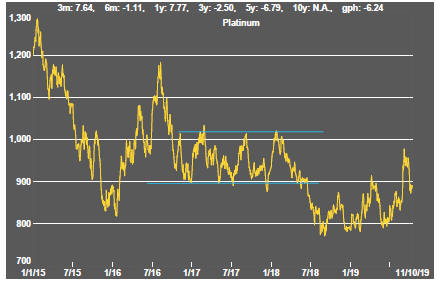

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium