The Big Picture

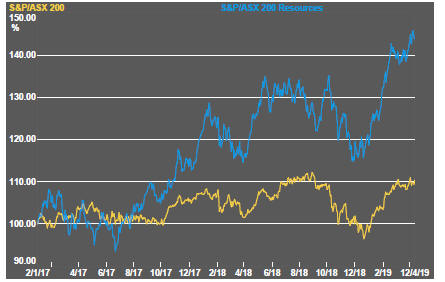

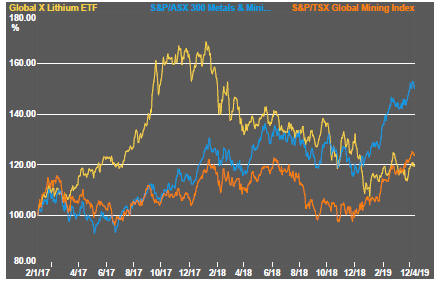

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

The upward bias in equity prices continued, underpinned by expectations of favourable central bank interventions. Investor expectations about future volatility continued to signal expectations of benign investment outcomes.

Materials and resources sectors benefited from favourable equity market conditions and the drift toward growth investments.

Mining stocks were slightly weaker at the end of the week. Sector leaders led the upward bias in headline indices which continued to outpace the smallest stocks in the sector which make up the vast bulk of listed entities.

Daily traded nonferrous metal prices lost momentum through the week after several weeks of relative strength. Oil prices remained on a rising trend although still without a significant response among related oil exploration and production equities. Uranium prices have also shown renewed weakness after a modest recovery. On the other side of the balance, coal prices improved and iron ore markets have benefitted from higher steel prices.

Overall, metal prices have defied forecasts of slowing global growth. Supply-side constraints have supported tighter market balances than would have otherwise occurred.

Data from China have been showing improving activity rates with continuing strong growth in loans underpinning a boost to activity. Narrower definitions of money reflecting day-to-day transactions have not shown similar growth, sending out ambiguous messages about the Chinese economy and, consequently, the outlook for mining commodity prices.

Other global issues such as Brexit and US-China trade relations appeared to be losing influence, at least temporarily.

Within financial markets, prices of high-risk corporate bonds continued to rise, suggesting improving appetites for funding mining projects where development cases withstand scrutiny.

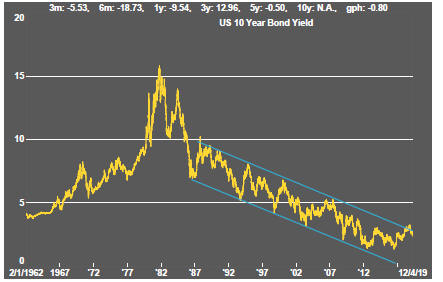

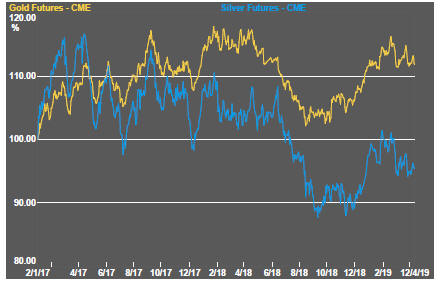

Gold prices remained near the upper end of a three-year trading range. Rising bond prices have been supportive. A downturn in bond prices, combined with an apparent headwind from having to breach previous high prices, now represents a significant threat to higher gold prices and their related equity values.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

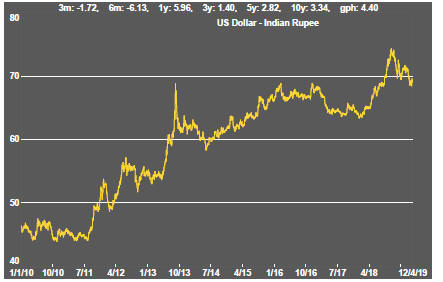

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium