The Current View

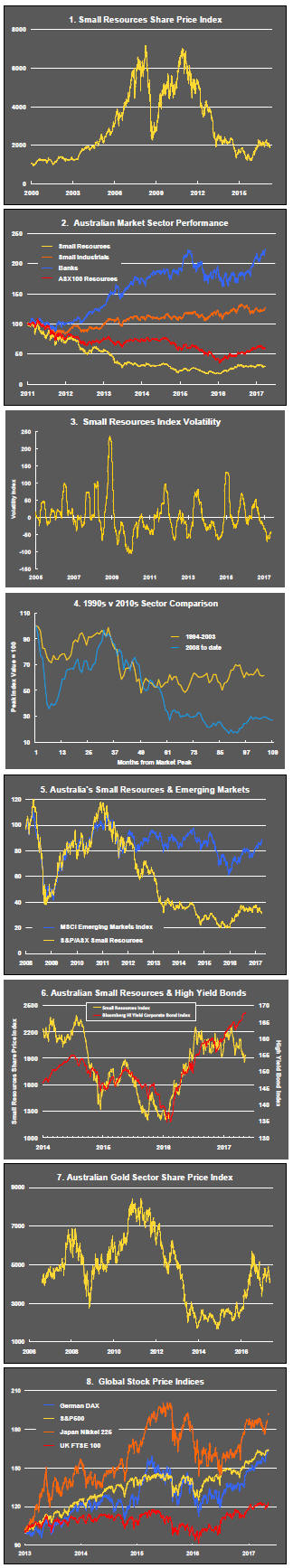

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Market Breadth Statistics

Sector prices experienced a modest rebound in the past week after a succession of negative weekly returns.

The strongest sector returns have been coming from the largest stocks in the sector which have benefited from generally improved equity market conditions.

At the smaller end of the sector, where the drivers of higher industrial and financial company equity prices have been less important, returns have been more modest.

Exploration stocks have shown the most consistent weakness over the past year.

The ASX small resources share price index continues to display unusually low volatility (see chart 3 in the right hand panel). Prices have hovered near unchanged for the past year and near levels which had prevailed in 2014-15.

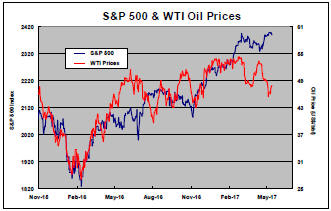

The poor sector returns have occurred despite financial market risks appearing to have fallen.

In the past week, prices of lower grade corporate bonds continued to rise (see chart 6). Investors have seemingly ignored this potential justification for an improvement in sector prices.

Another indicator of improved risk appetite, namely flows into emerging markets, is also consistent with an improved risk appetite which is not being reflected in the mining sector (see chart 5).

Several factors may be contributing to the reticence of investors to push prices higher and sector’s relative weakness.

1. Cyclical conditions, by which many investors judge the attractiveness of the sector, have not been supportive (see Page 1).

2. At the bottom of the cycle, relatively high returns can be driven by small absolute price movements. With generally diminished investor expectations, the appearance of unusually strong returns invites selling which keeps prices within narrow trading ranges.

3. Years of poor investment performance have reduced the pool of willing investors in the sector limiting the numbers available to take up any price slack from those selling.

4. Among medium sized companies, investors have appeared keen to set prices based on actual earnings and reluctant to embed prices for blue sky opportunities.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.