The Big Picture

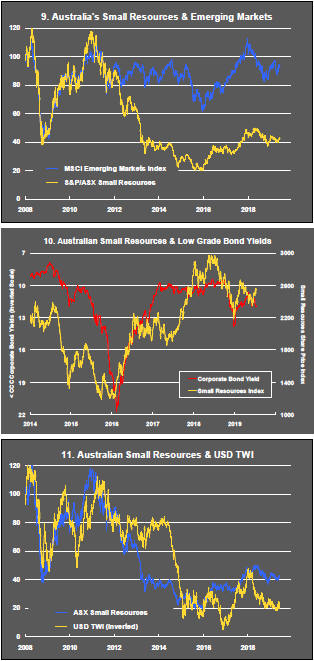

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

The main US equity market indices posted new records, as did the principal global price index, as confidence grew that the US Federal Reserve would act to support the US equity market.

The strength of the US market was not reflected in the major European or Japanese market indicators.

Market volatility indicators continue to imply an assumption of benign market conditions despite intensifying pessimism within the Federal Reserve about the US economic outlook.

Federal Reserve Chairman Jerome Powell presented his half yearly report to the US Congress. Given ample opportunity to step away from suggestions of further monetary stimulus, Powell reinforced expectations of near-term action.

The Fedís disposition to act comes despite continuation of strong US employment growth but growing anxiety about global economic conditions, including the effect of trade disputes between the US and several other governments which threaten to disrupt manufacturing supply chains.

Global growth has slipped but that was almost certainly going to happen in any event, as the recovery cycle matured and peak growth rates, heavily constrained by poor productivity outcomes, gave way to something more sustainable.

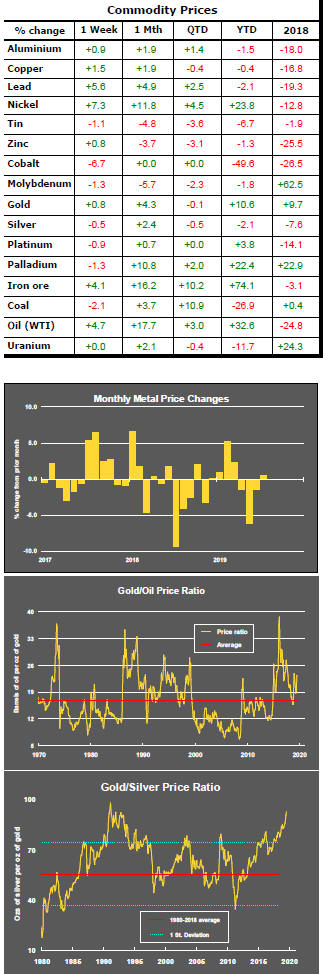

The cyclical positioning of metal prices remains consistent with a downswing, albeit one slightly less severe than average. The duration of the cycle, which appears to have commenced in February 2018, is now closer to its low point than its beginning.

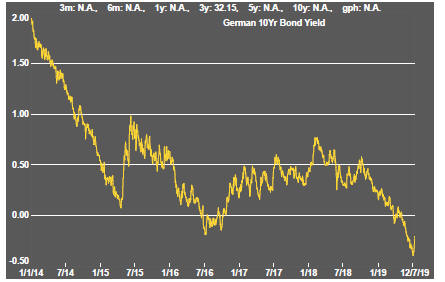

US government bond yields partially reversed the reduction which had occurred earlier in the month but remained consistent with expectations of further weakness in global growth.

Metal prices are somewhat at odds with the bond market outlook as their pace of decline has slowed in recent weeks, intimating an improvement in global growth momentum.

Among the main metals, the nickel price was abnormally strong among broad-based, albeit only modest, rises in nonferrous metals during the week.

Inconsistencies in the flow of market data imply the need for some realignment of prices between those which imply more favourable conditions with those intimating less propitious investment outcomes.

After its most dramatic rise since early 2016, the gold price has stalled at levels which had last prevailed in 2013. The breakout from a prolonged trading range has so far proven unconvincing and largely consistent with what might have been implied by movements in government bond prices during the first half of 2019.

The relationship between gold and silver prices remains stretched by historical standards and a source of frustration for those counting on restoration of a more average ratio between the prices of the two precious metals.

The rise in Australian resource sector price indices has exceeded gains made in international indices due to the heavier weighting in the Australian sector of BHP and Rio Tinto which have both benefited from higher iron ore prices and a lower Australian dollar. Unusually, the weaker currency has accompanied higher bulk commodity export revenues driven first by coal and, more recently, by iron ore market conditions.

The indicator of share price movements among listed exploration companies, with very little exposure to iron ore, remained near its cyclical low point after trailing the market leaders by more than 50 percentage points since the beginning of 2017.

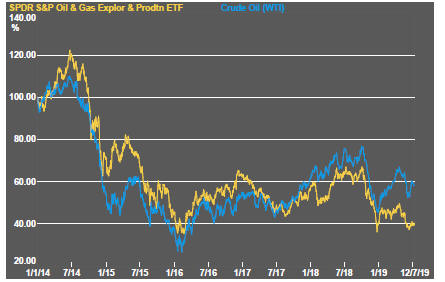

Crude oil prices tended slightly lower during the week. Oil and gas exploration and production prices remained near the lower end of their trading range over the past five years having shown little response to improved crude oil prices, when they have occurred.

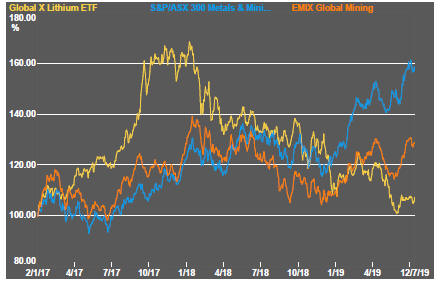

Among other key sector profit drivers, uranium, cobalt, lithium and coal prices showed little change but retained their negative bias.

The US president decided against imposing quotas on imports of uranium into the USA, benefiting those companies exporting to the USA, while initiating a wide-ranging enquiry into strategic issues surrounding the US nuclear fuel cycle.

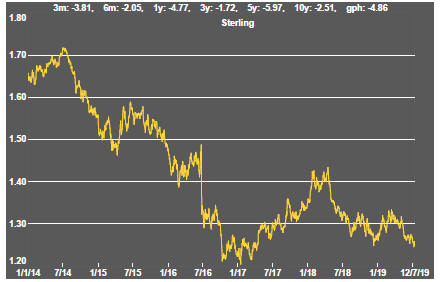

Currency fluctuations, including those involving the Australian dollar, have moderated despite changing patterns of growth and supposedly imminent movements in relative interest rates.

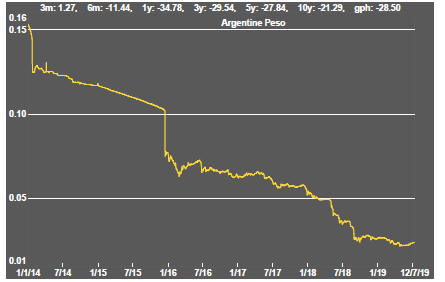

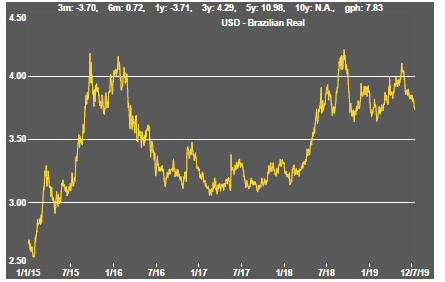

The US dollar lost ground against a range of developing country currencies including those of Brazil, India, the Philippines and Argentina in another indication that the broader global economic climate has been improving (or not getting any worse).

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium