The Current View

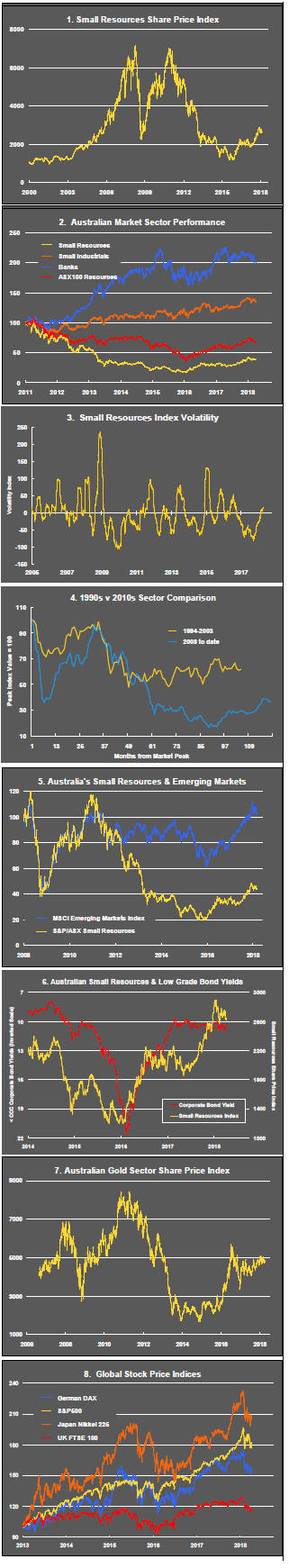

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

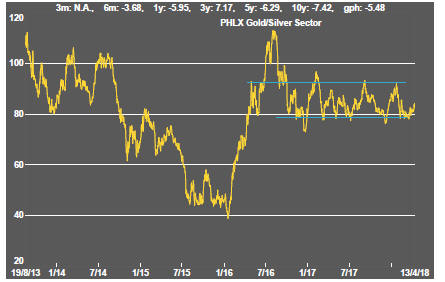

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were reversed through 2016 and 2017 although sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

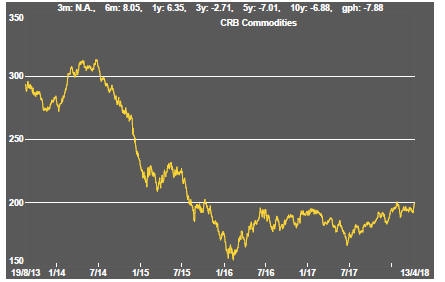

The strength of the US dollar exchange rate since mid 2014 had added an unusual weight to US dollar prices. Reversal of some of the currency gains has been adding to commodity price strength through 2017.

Signs of cyclical stabilisation in sector equity prices has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development has passed its most difficult phase with the appearance of a stronger risk appetite.

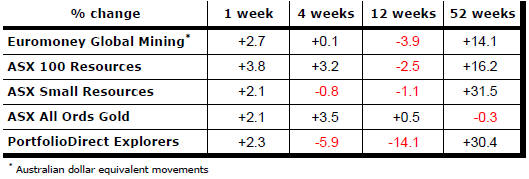

Resource Sector Weekly Returns

Market Breadth Statistics

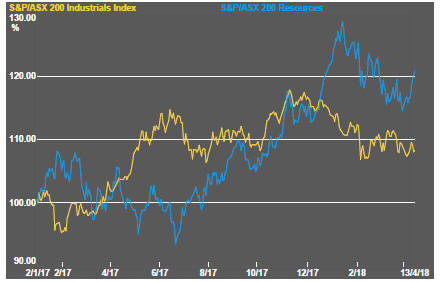

Equity Markets

Talk of a global trade war and its potential impact on growth continued to roil markets.

The Congressional testimony of Facebook chief executive Mark Zuckerberg came without obviously adverse implications for social media stocks. Regulation now seems inevitable but the platforms appear to have a lock on increasing advertising revenue, the key metric about which markets will be concerned. Regulation also usually protects incumbents. A start-up is now less likely to break the dominance of Facebook and Twitter.

Financial services companies finished lower despite better than expected earnings.

In the US market, technology pushed higher. Energy sector stocks responded more strongly to improved oil prices. Improved oil prices helped the broader resources sector which strongly outperformed the industrial sector stocks in the Australian market.

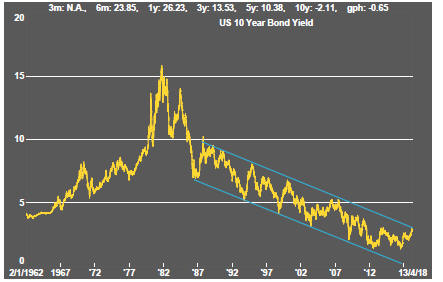

Interest Rates

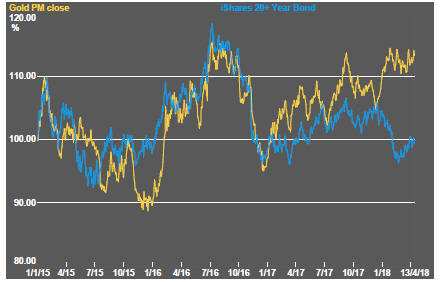

The interest rate picture remains the product of a tug of war between the likelihood of rising inflation and the continuing demand for high quality fixed interest securities. The absence of any dramatic reappraisal of interest rate directions is contributing to a favourable equity market environment.

Key indicators of the availability of finance for mining sector projects suggest no significant change in the conditions which have prevailed over the past year.

Exchange Rates

The downward directional shift in the US dollar has stalled amidst competing views about relative growth rates, fears about disruption to trade patterns and the funding requirement of the US government.

The newly legislated tax cuts and an omnibus spending bill tailored to get enough votes in both houses of the US Congress - all deficit funded - suggest longer term downside consistent with a history of a weakening currency occasionally punctuated by unsustained cyclical rises (see page 1).

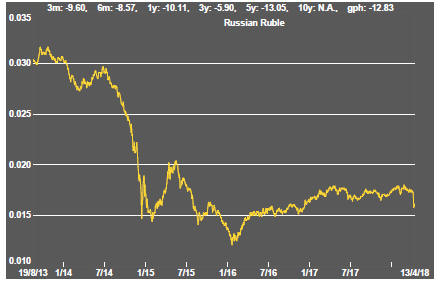

A new bout of sanctions against Russian economic and political interests as well as the exchange of sharp language at the most senior political levels has weakened the ruble.

The gentle upward drift in the Australian dollar could remain intact as long as risks to global economic conditions remain lowered and commodity prices are in the upper end of the range of prices in the past year.

Within that trend, tightening monetary conditions in the USA and, later, in Europe could contribute to within-trend fluctuations.

Commodity Prices

The general upswing in commodity prices over the past year remains within the bounds of a cyclical trough suggesting still stronger economic activity will be needed to carry prices higher. Unusually strong gains in the past week reflected higher crude oil prices.

Gold & Precious Metals

Gold bullion prices moved marginally higher and remained broadly consistent with rising bond prices over recent weeks.

US gold related equities displayed stronger leverage to the improved gold prices than they had been doing in recent weeks. Australian gold stocks moved largely in line with the bullion price movements to stay toward the upper end of their 2018 trading range.

Nonferrous Metals

Prices of the main daily traded nonferrous metals had become increasingly correlated as a broadening consensus about the lowered risks to world economic activity emerged.

The correlation broke down in the last week as new sanctions against Russian economic interests put upward pressure on aluminium and nickel prices, markets into which Russia is an important global supplier.

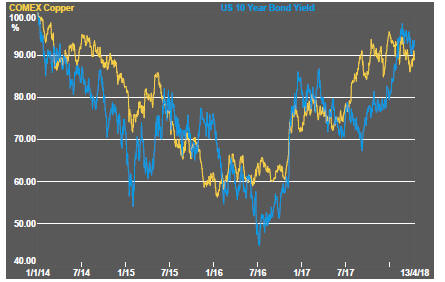

The reappraisal of copper prices since the middle of 2017 has broadly coincided with the change in financial market conditions. The flip side of that is the absence, now, of further upward momentum.

Bulk Commodities

Bulk commodity prices had moved lower with signs of lessening Chinese economic momentum after the first quarter.

Increased Chinese steel production in the first quarter of 2018 has resulted in larger inventories. The inventory climb and threat of tariffs affecting Chinese steel demand have dragged steel prices lower and raised risks for metallurgical coal markets.

A slight reversal of those near term trends was evident in the past week.

Oil and Gas

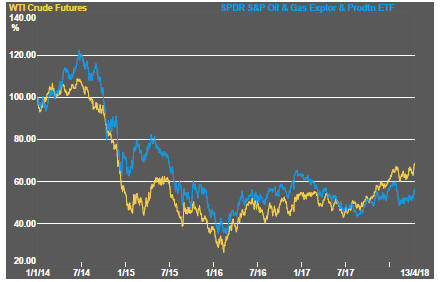

US equity prices for oil and gas explorers had been dominated by broader stock market movements rather than crude oil price changes.

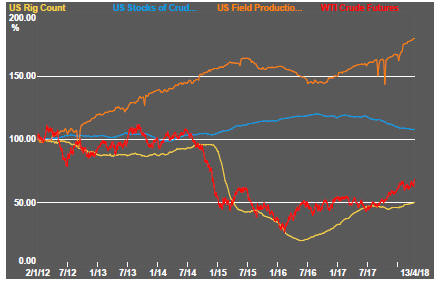

Rising US production, partly in response to higher prices, remains a burden on investor expectations about the likelihood of further oil price rises with continuing rises in oil rig productivity supporting higher output.

US producers are now able to profitably hedge anticipated production contributing to the ongoing rise in their output.

Battery Metals

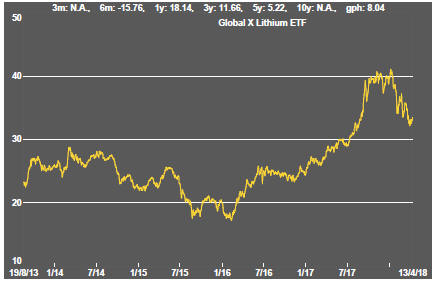

Eighteen months of rising lithium-related stock prices has given way to a period of market reassessment as a lengthy pipeline of potential new projects raises the prospect of ongoing supplies being adequate for expected needs.

Potential lithium producers have been able to respond far more quickly to the various market signals than has been the case in other segments of the mining industry.

Battery metals remain a focal point for investors with recent attention moving to cobalt and vanadium.

Uncertainty over how a peaceful transfer of power can occur in the Democratic Republic of the Congo has added a dimension to cobalt prices lacking in other metals caught up in the excitement over transport electrification.

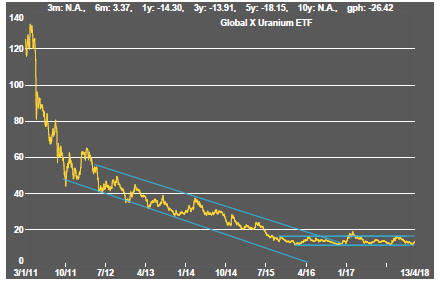

Uranium

The uranium sector is once again moving along the bottom of its long term trading range in the absence of more meaningful signs that power utilities are prepared to re-enter the contract market to negotiate their longer term needs.

Slightly higher equity prices in the last week could be attributed to speculative trading since uranium prices have moved slightly lower since the end of March.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.