The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

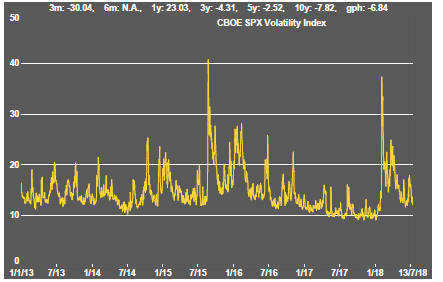

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were reversed through 2016 and 2017 although sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

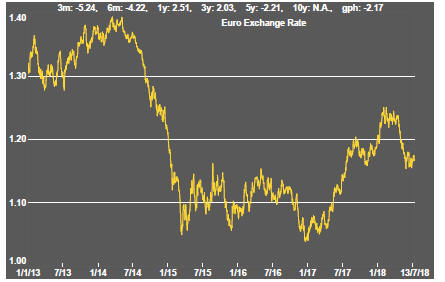

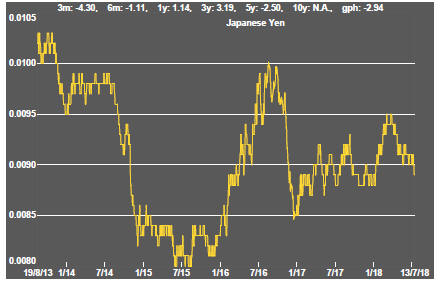

The strength of the US dollar exchange rate since mid 2014 had added an unusual weight to US dollar prices. Reversal of some of the currency gains has been adding to commodity price strength through 2017.

Signs of cyclical stabilisation in sector equity prices has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development has passed its most difficult phase with the appearance of a stronger risk appetite.

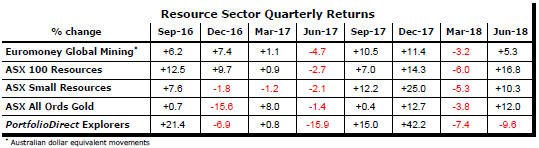

Resource Sector Weekly Returns

Market Breadth Statistics

52 Week Price Ranges

Equity Markets

Equity markets were generally firmer during the week led, in the US, by technology stocks.

A tug of war between the effects of improved earnings and the disruptive influence on trade of US attempts to increase its share of goods movements persisted. The US administration confirmed its intention to add to the Chinese imports subjected to tariffs.

Much of the political commentary surrounded the trip to Europe by US president Donald Trump and the adverse impact of his comments on relations with western leaders.

The UK government foreshadowed a new set of proposals by which to manage its transition out of the EU amid political ructions among Conservative politicians split between those wanting a clear break with the customs union and those wanting to maintain a close link.

Despite the political upheaval, markets appeared sanguine about the ultimate impact. For the time being at least, the implied conclusion is that disagreements will be bridged eventually.

Resource Sector Equities

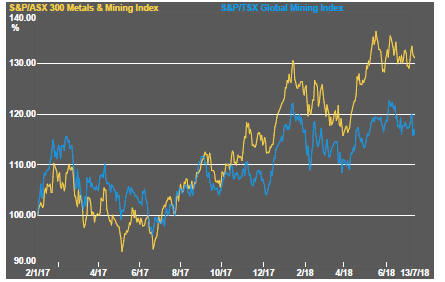

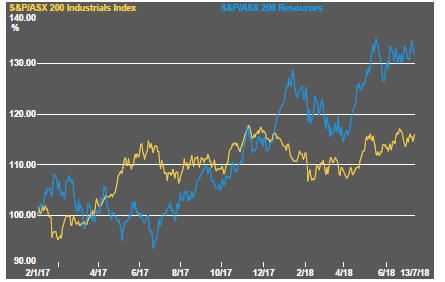

Material sector prices remain within their uptrend while hovering near the lower bound of the range, in contrast to recent movements in industrial raw materials, amid declining momentum.

Market leaders within the mining sector faced headwinds associated with the threats to global trade disruption and, more broadly, from revisions to global growth prospects arising from non trade factors such as low productivity growth.

For the first time in several weeks, smaller stocks performed better than the larger stocks in the sector.

In the Australian context, the relative performance difference may be partly explained by the beginning of a new financial year and the passage of seasonally weak trading in June.

Gold related equities moved lower although Australian gold equities remained on an uptrend, helped by their earnings and valuation leverage to a weaker Australian dollar.

Interest Rates

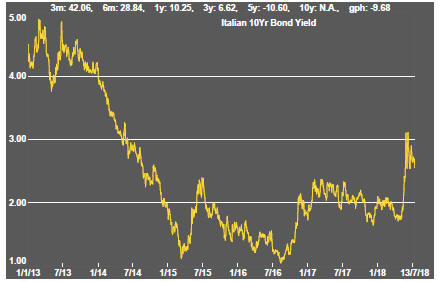

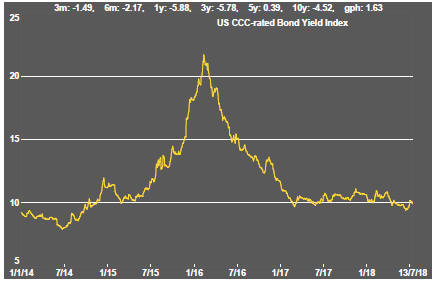

The downward bias to market interest rates has persisted despite the US central bank being in the midst of pushing short rates higher and European monetary authorities foreshadowing similar moves in the UK in the near term and, later, for the euro group.

US 10 year bond yields remained under the 3% barrier helping to shore up equity market prices.

Lower German yields are acting as a constraint on US government bond yields despite the assumed near certainty of several further interest rate rises by the Federal Reserve ahead of likely future policy tightening in Europe.

Low rated corporate bond yields have edged higher but remain at cyclically low levels.

Exchange Rates

The US dollar has retained its upward bias although the strength of the move has diminished.

The Chinese currency has moved dramatically, A move lower by the Chinese yuan will give export oriented Chinese companies some breathing space against pressures from a tariff battle with the US government and may convey a warning to the US about how China might react to further tariff based measures by the USA.

Currencies are now at risk of being dragged into the war of words on trade with a rising US dollar acting as a drag on corporate competiveness even as the US administration is attempting to give industry a boost.

Developing country exchange rates continued to face downward pressure. Individual differences in the causes of currency weakness have merged into a theme into which the Australian dollar has been pulled.

The Australian currency appears to have fallen out of an upward trend which dated from early 2016 as it has become a victim of the potential trade disruptions.

Commodity Prices

The general upswing in commodity prices since mid 2017 had been given added impetus by stronger crude oil prices.

Momentum has diminished recently leaving prices within the bounds of a cyclical trough, albeit at the upper end.

The flip side of the benefits for commodity producers and exporters of higher commodity prices is the cost pressure now being experienced by users of agricultural and raw material commodities. Reporting companies have been suggesting this as a source of margin compression.

Business surveys closely watched by central banks are showing signs of upward pressure on selling prices as a result of higher raw material prices.

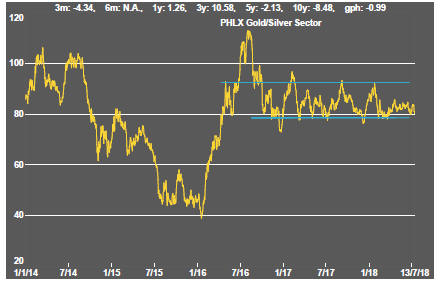

Gold & Precious Metals

Looked at against broader financial market conditions, gold had been overvalued.

Gold prices which had been running ahead of financial market conditions have, more recently, been falling even as bond yields have been moving lower, signalling an appetite for safe haven financial products.

Across the precious metal sector, prices have broken through the bounds of prior trading ranges.

Gold and palladium price uptrends have been broken. Platinum prices fell below the lower bound of a two year trading range. Silver prices have proved the most resilient only by falling least.

The divergence in trend between Australian and north American gold related equities remains evident with US markets more aligned with a sceptical view of the near term future of precious metal prices and the Australian market helped by a weaker Australian dollar.

Nonferrous Metals

Metal prices headed lower in a highly correlated move amid signs of poorer than previously expected growth outcomes and, somewhat related, concerns about the effect of a trade clash between the US government and most of its major trading partners.

The scepticism about the growth trajectory embedded in bond yield movements is now also being reflected more clearly in copper prices which have broken below their 12 month trading range amid market talk of large speculative position liquidations - always a common occurrence near cyclical turning points in this market.

Industry statistics continue to signal that higher prices have been driven by unusually weak demand mitigated by lowered production rates leaving them at risk of reversal as supplies from elsewhere respond to the price incentives to produce more.

Bulk Commodities

Relatively weak first quarter Chinese GDP growth had suggested a ramp up in activity through the remainder of 2018 if China was going to meet its growth target which, in a centrally controlled economy in which leaders are trying to maintain credibility, is a reasonable assumption.

The difficultly of achieving its targets has now been acknowledged by Chinese officials who have conceded that second half growth may not be as strong as had been expected.

Iron ore prices have failed to reflect the ongoing expansion in Chinese manufacturing output although coal and steel prices had been climbing.

Oil and Gas

Crude oil prices have fallen again although they remain near late 2014 levels.

Prices had reached the highest levels in several years before breaking lower after comments from major producers that a production increase might be contemplated and reports of Russian president Vladimir Putin saying that a $60/bbl oil price would be adequate.

The sharp market response to the slightly more bearish tone might have led to some reconsideration of any plans to push output higher.

While a meeting of OPEC members decided to expand production, the size of the increase was less than had been expected.

The push by the US administration to re-impose economic sanctions on Iran is also working to put upward pressure on oil prices to the point that some producers are becoming concerned about an adverse effect on demand.

The Iranians have been lobbying European countries to prevent more widespread application of sanctions but the likelihood of relief appears slim as long as funds must circulate through US banks.

US production, in any event, continues to rise and is now matching output from Russia and Saudi Arabia.

Despite the change in tone within crude oil markets, related equity prices have been muted in their responses, implicitly signaling scepticsm about the sustainability of price rises.

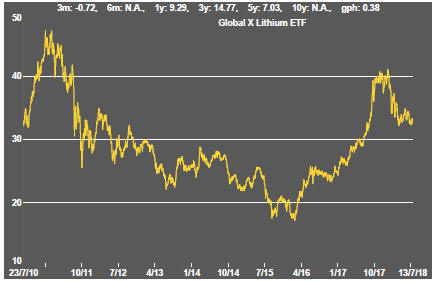

Battery Metals

Eighteen months of rising lithium-related stock prices gave way to a period of market reassessment as a lengthy pipeline of potential new projects raised the prospect, although not conclusively, of ongoing supplies being adequate for expected needs.

Potential lithium producers have been able to respond far more quickly to market signals than has been the case in other segments of the mining industry where development prospects have been slowed by reticence among financiers to back development.

Movements in lithium related equity prices have been aligned more closely with overall sector equity prices in recent weeks.

Battery metals remain a focal point for investors with recent attention moving to cobalt and vanadium.

Doubts about a peaceful transfer of political power in the Democratic Republic of the Congo (and an Ebola outbreak) had added a dimension to cobalt prices lacking in other metals caught up in the excitement over transport electrification. Improved political conditions have left cobalt prices at risk of some retracement.

In the longer term, cobalt is the most vulnerable of the battery related metals to substitution with high prices likely to stimulate research in that direction.

Uranium

The uranium sector is in the midst of forming a prolonged cyclical trough as market balances slowly improve. Power utilities are still not prepared to re-enter the market for contracted amounts of metal to meet longer term needs. A slight upward bias in prices was evident in the past month.

Slightly higher equity prices from time to time, in the hope of improved conditions, have not been sustained but could be repeated as speculation about improved future demand ebbs and flows.

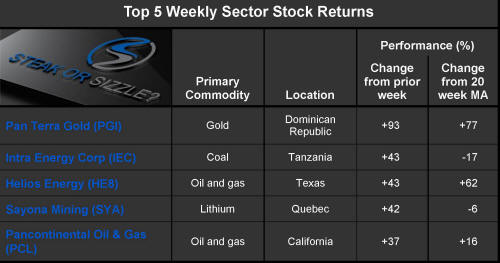

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.