The Big Picture

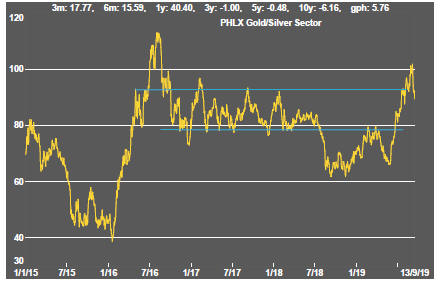

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

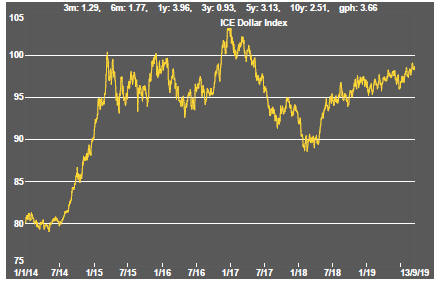

A strongly positive tone returned to the equity market as tensions over global trade and monetary conditions both eased.

On the trade front, conciliatory gestures from both sides of the US-China dispute raised hopes of a reconciliation although the facade of an agreement has given way quickly on previous occasions to threats of escalation.

Markets have become increasingly convinced that the US Federal Reserve would cut interest rates when it next meets although divisions persisted, not least within the central bank board itself, about the magnitude of the reduction.

Macro data from the USA continued to show solid outcomes on the consumer front accompanied by evident weakness in business investment and industrial production.

The Fed will have to grapple with this dual track economy in deciding whether to put more emphasis on the consumer or the risks posed to business as it assesses the need, or otherwise, for additional monetary stimulus.

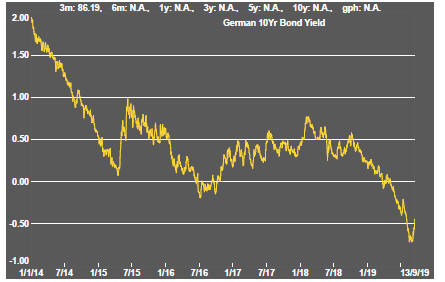

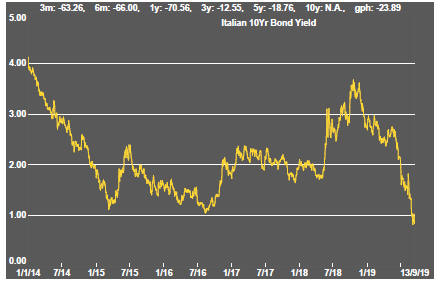

While markets waited for the Fed to meet, European policy-makers initiated a program of quantitative easing. Fears of recession, which rose after US short term interest rates moved ahead of yields on longer dated securities, diminished as US yields gave back some of their reductions.

Debate continues about whether an inverse yield curve remains a harbinger of recession or is connected to distortions arising from central bank interventions in the pricing of securities since the 2008-09 financial crisis.

The rising yields on longer dated government securities buoyed the financial sector earnings outlook, helping sustain the broader market.

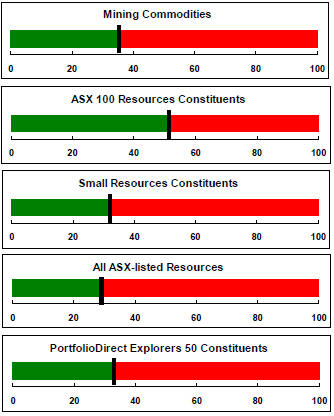

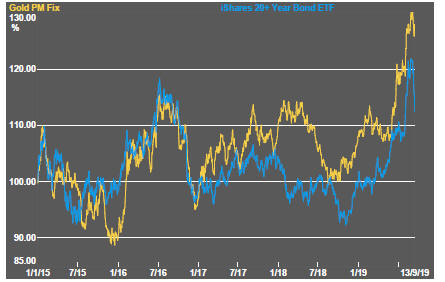

Lower government bond yields impacted gold prices which turned lower just as they had risen when yields were falling.

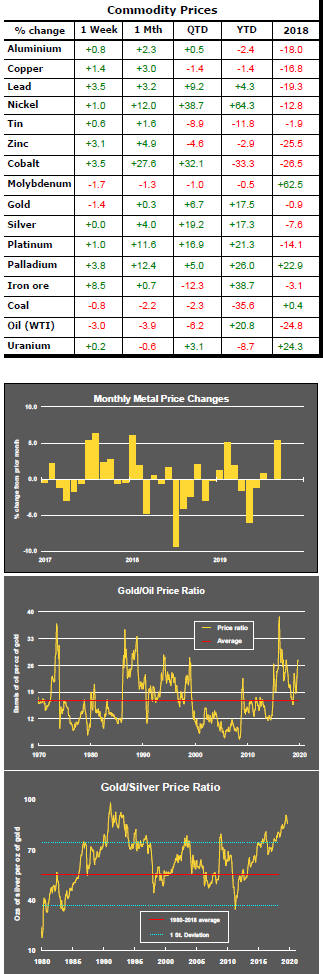

Lowered trade disruption risk perceptions added strength to metal market prices although the strong nickel price rise of recent weeks stalled.

The apparent contradiction between movements in bond yields and copper prices in recent weeks was partially reconciled with the reversal in bond prices.

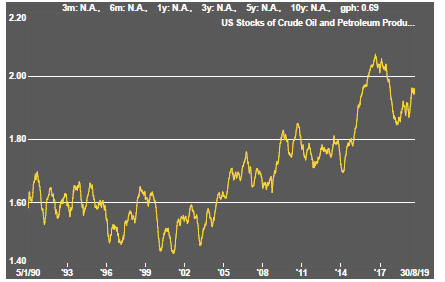

Oil prices edged slightly higher prior to the attack on Saudi oil production facilities on Saturday which is likely to have a more dramatic effect on prices although softening demand and historically high US production is likely to ease the impact.

Parts of the mining industry exposed to the battery metals trade made gains partly in line with the broader market but also after large losses within the lithium-graphite-cobalt spaces.

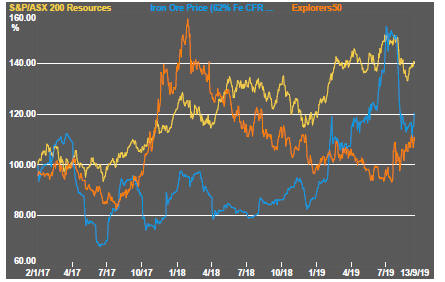

The upturn in pricing of exploration stocks continued despite some easing in gold market conditions.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

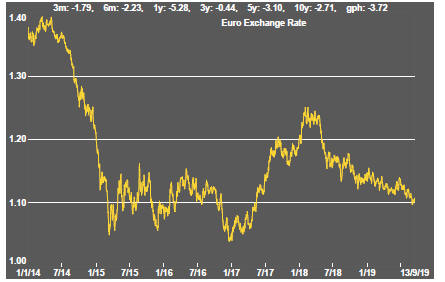

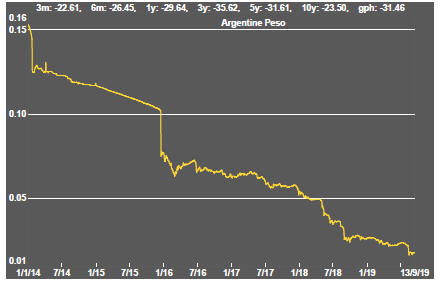

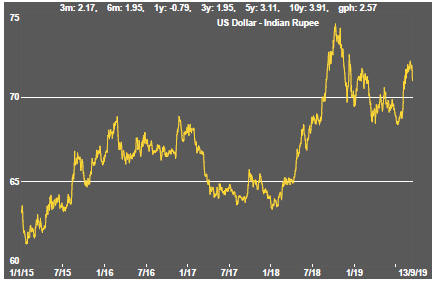

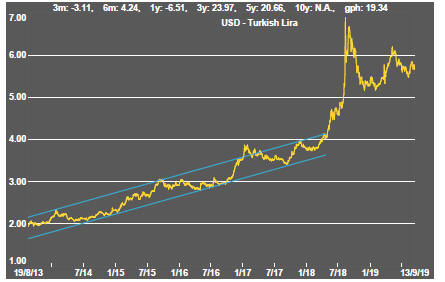

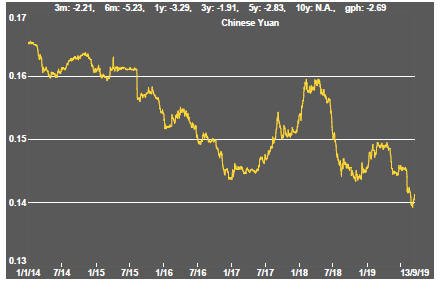

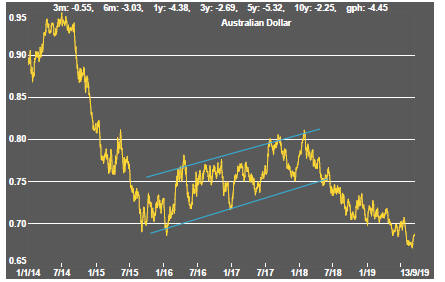

Exchange Rates

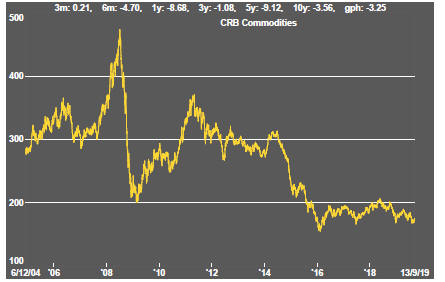

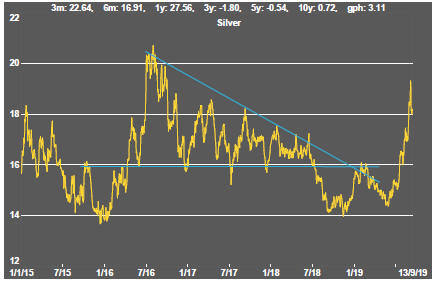

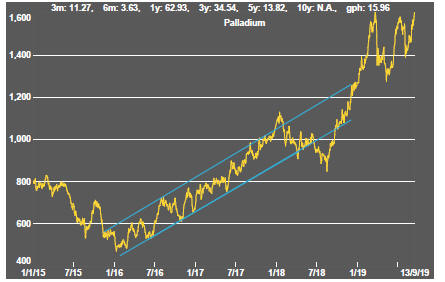

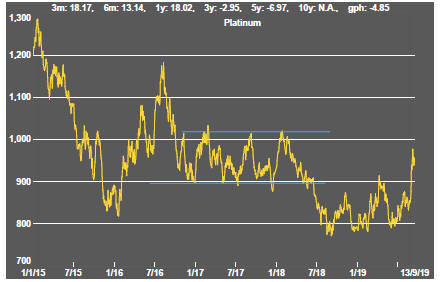

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

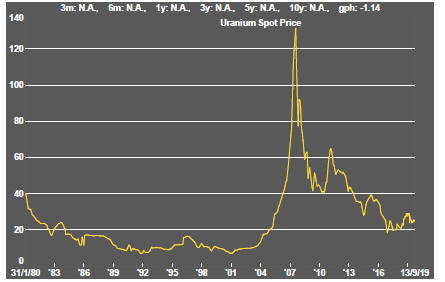

Uranium