The Big Picture

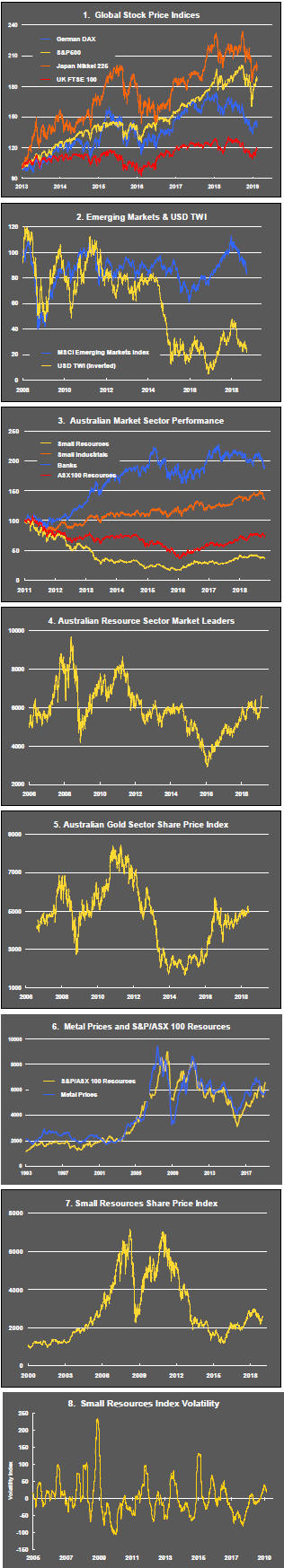

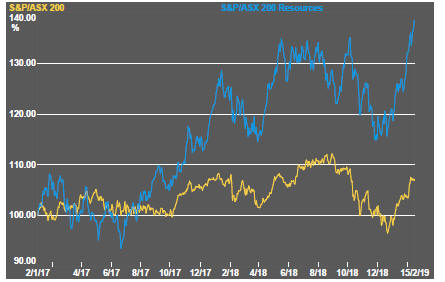

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

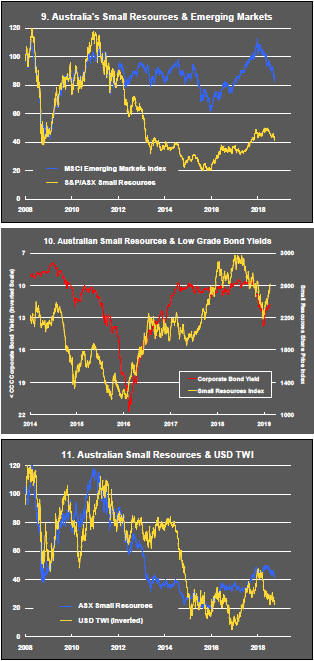

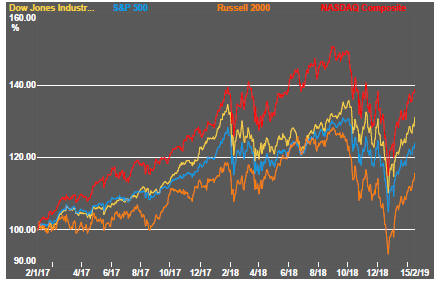

Recovery from the extraordinarily weak equity market conditions in December continued with US markets leading the way as gains in emerging market equity prices lost momentum.

Improved equity prices have come despite niggling doubts about a global growth slowdown. Markets appear to have inferred that the evidence of a global slow down is no worse than what had been anticipated with US, Europe, Japan and China all heading toward longer-term sustainable rates of growth which had been widely acknowledged by forecasters for many years.

A report from the US Department of Commerce on retail industry conditions in December was an unexpected negative shock which implied a sharper deceleration in US growth then had been anticipated. The size of the swing was so large, however, that analysts questioned its validity since it ran contrary to reports from companies, such as Amazon, which had already released details of their December trading outcomes.

Optimism about ongoing China-US trade negotiations buoyed markets and modified some of the more negative connotations from other data. Chinese and US officials are conducting several rounds of meetings leading to the March deadline when US tariffs on Chinese goods are scheduled to rise.

Another approaching deadline with economic growth implications - the exit of the UK from the European Union - is being treated optimistically by investors who appear to be assuming an agreement will be struck at the very last moment to smooth the departure of the UK from the European bloc.

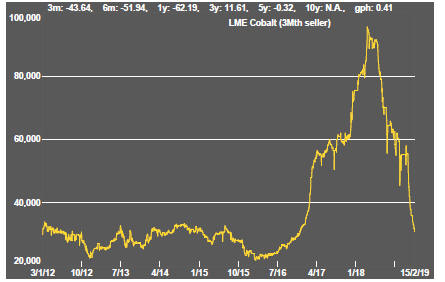

At a micro level, evidence is mounting that motor vehicle manufacturers are starting to reappraise how they re-organise production in anticipation of a full-scale move toward electric car manufacture. The changeover could impact raw material producers negatively insofar as short-term changes in production of internal combustion engines reduce demand no matter how strong the subsequent swing toward higher demand for battery related metals.

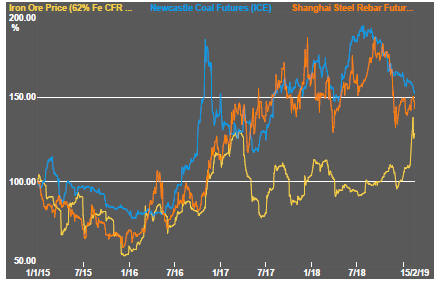

Iron ore prices stood out over the past fortnight among the key commodity prices as risks to market disruption rose following accidents at Vale production centres in Brazil.

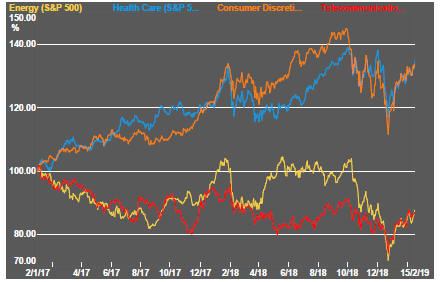

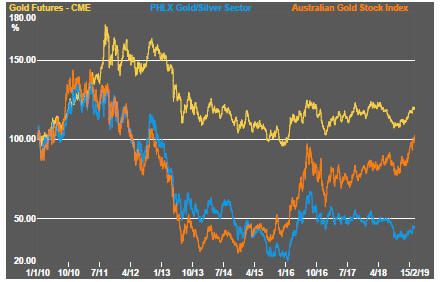

Gold prices have stalled after a strong recovery which coincided with changed expectations about interest rates.

With lowered European growth expectations, German bond yields have reverted to levels which had prevailed through much of 2015-2017. German yields will remain a drag on US yields, despite a markedly different growth picture for the two economies.

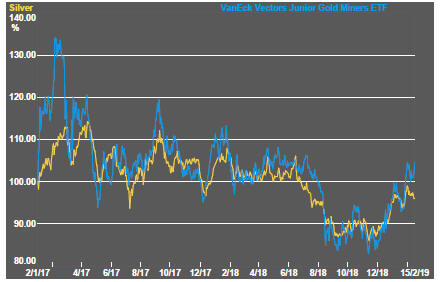

While gold prices have returned to early 2018 levels, silver prices are battling stronger headwinds and making less progress.

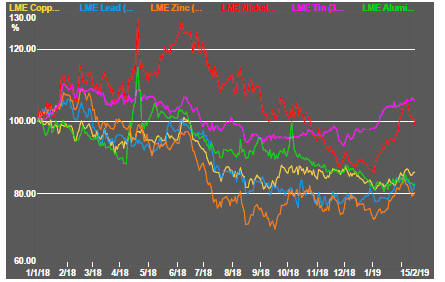

Lower US bond yields have endorsed the outlook implied by falling metal prices over the course of 2018 which are showing signs of a modest cyclical downswing.

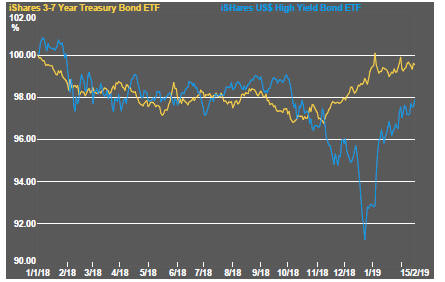

As US government bond prices have stabilized at a higher level, riskier corporate debt prices - often a sign of stronger appetites for early stage mining stocks - have continued to rise.

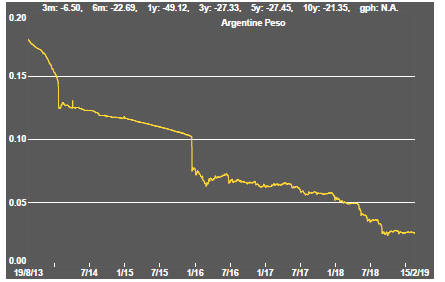

Exchange rates have tended to remain stable after the large moves which occurred during 2018 while growth and policy prospects were both being reappraised.

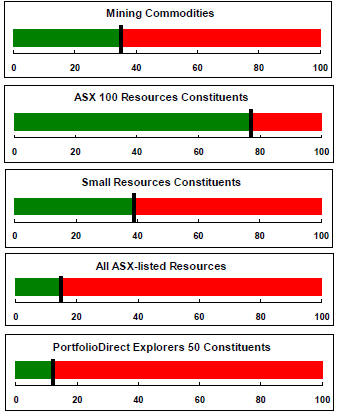

Sector Price Outcomes

52 Week Price Ranges

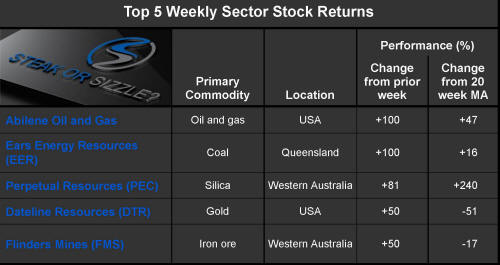

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

Exchange Rates

Commodity Prices Trends

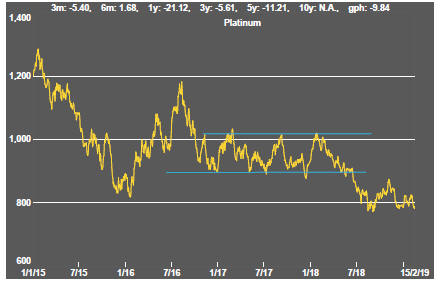

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

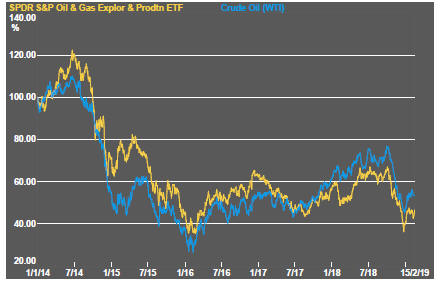

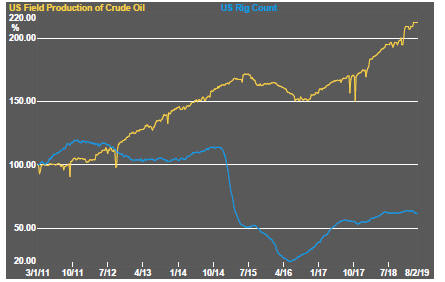

Oil and Gas

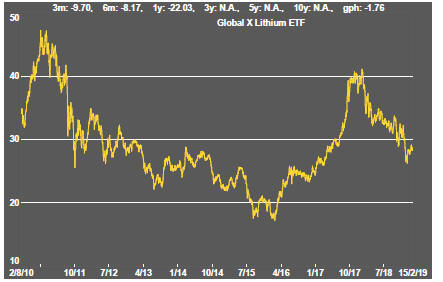

Battery Metals

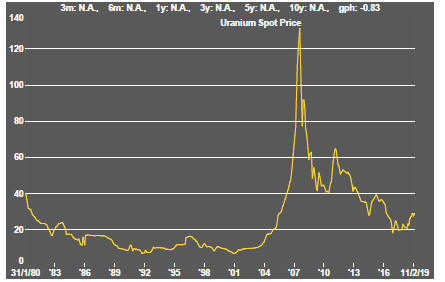

Uranium