The Big Picture

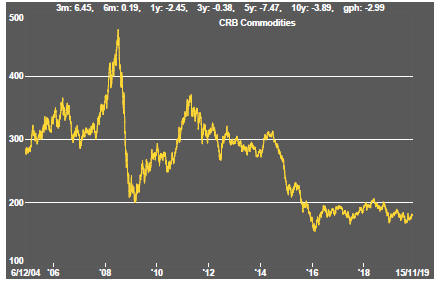

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 as global growth accelerated although, for the most part, sector prices did little more than revert to 2013 levels which had once been regarded as cyclically weak.

Global growth, having peaked in late 2017, the sector has been in cyclical downswing since early 2018.

With a median decline in prices of ASX-listed resources companies since the beginning of 2011 of 89% (and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

The main US equity indices again pushed to record levels although smaller stocks have lagged the larger end of the market. The Russell 2000 share price index has repeatedly failed to break through current levels at several attempts during 2019.

Market volatility has remained low, signalling little anxiety about valuations or the potential impact of external events.

The mining sector did not participate in the generally stronger equity market conditions.

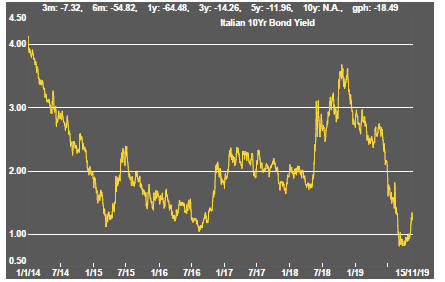

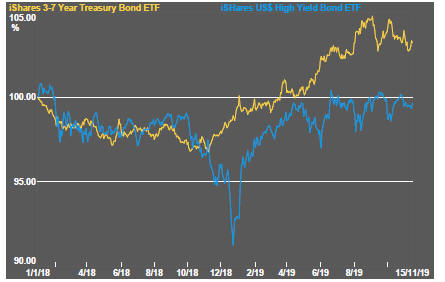

Lower bond yields during the week brought back concerns about slower global growth although the yield reductions were minor following previously dramatic rises across the main markets in recent weeks.

Mixed messages about the progress of US-China trade talks again influenced markets. Presidential counsellor Larry Kudlow foreshadowed that an agreement could still be reached by the date of the originally planned APEC meeting in Chile. That seemed overly optimistic but, nonetheless, was an important confirmation that talks continued despite unspecified hold-ups.

Equity prices are implicitly signalling that the worst of the fears about growth are over. Retail sales and industrial production statistics from the USA reinforced the pattern of consumption strength and business uncertainty which has prevailed for some time. Business sector investment weakness has not impacted employment significantly, at least so far. Offsetting manufacturing weakness has been a relatively strong services sector.

Gold prices which had tracked falling bond prices in recent weeks were moving higher at the end of last week in response to a slight reversal in the yield trajectory.

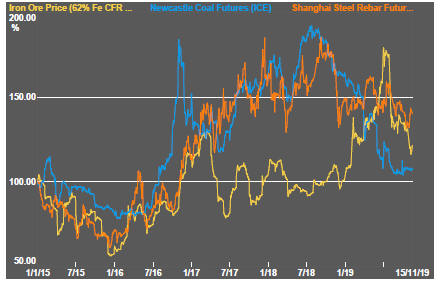

Industrial metal prices were generally lower during the week. Iron ore prices recaptured some recent losses. Metal prices continue to signal a subdued growth picture but not a dramatic downturn.

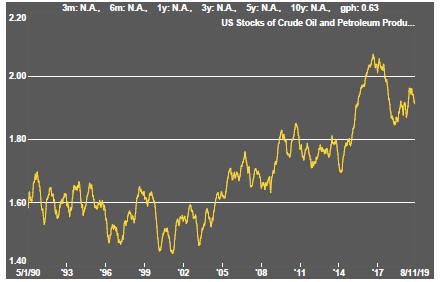

Crude oil prices rose slightly. Official forecasting groups have pointed to a market close to balance in 2020. A falling US rig count is expected to have an impact in 2020 although opinions differ about whether US production growth can persist in the longer term. The related oil and gas exploration and production equities remain relatively depressed implying ongoing investor scepticism about the future balance of the market.

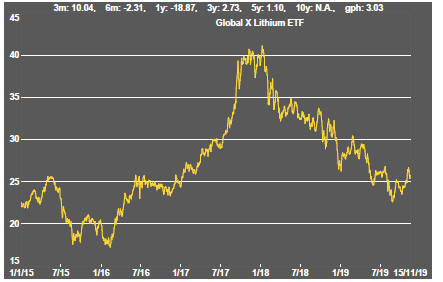

Battery metal related investments have largely tracked movements in broader equity market sector indices.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

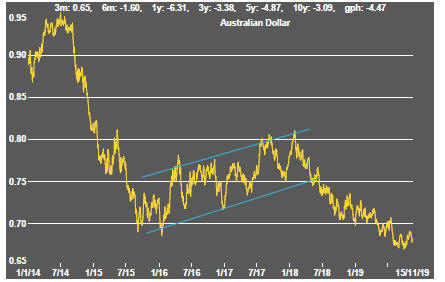

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

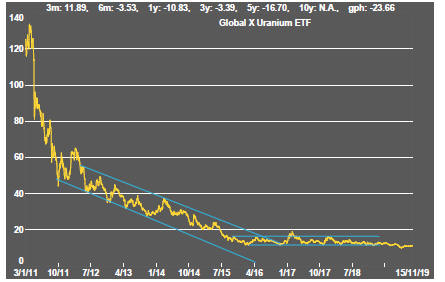

Uranium