The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

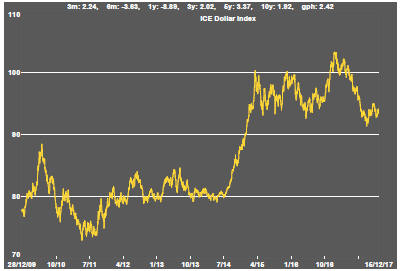

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Resource Sector Weekly Returns

Market Breadth Statistics

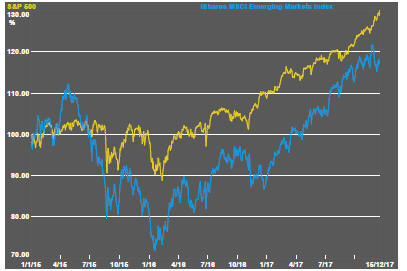

The records continue to tumble with reassurances from analysts that tax cuts in the USA will make valuations more attractive. Optimism rose that an agreed bill would be signed off by President Trump before the holiday recess.

The dip in emerging market equity prices was partially bought back. Emerging market equities may face greater volatility as uncertainties about the impact of tax cuts on US growth start to filter into interest rate and exchange rate moves and, with that, the direction of capital flows.

The US dollar moved higher at the end of the week as passage of the US tax legislation became more likely.

The tendency toward a stronger Us dollar has put a cap on US dollar denominated commodity prices.

The upper end of the recent trading range has coincided with prices which had prevailed through 2016. Better prices remain consistent with being in the trough of a cycle and having made little headway against the losses over the 18 months from mid 2014 when prices headed toward the bottom of the cycle.

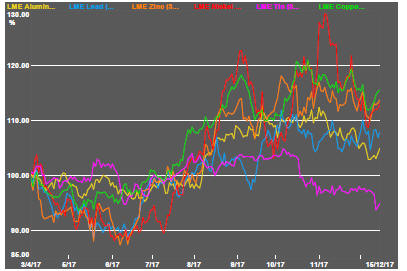

Daily traded metal prices finished the week on an up note with slightly more optimistic sentiment about global growth prospects although all the major prices were below the peak levels reached earlier in the fourth quarter.

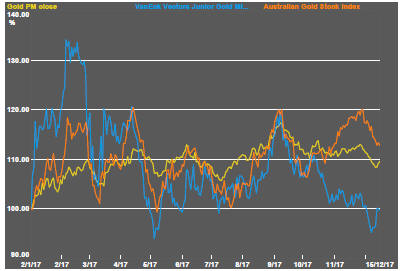

The link between bond and gold prices broke down earlier in the week as higher bond prices (lower yields) were accompanied by falling bullion prices.

The fall in gold prices coincided with the emergence of bitcoin from the shadows of financial markets into the mainstream with trading being made available on reputable futures exchanges.

A persistent break in the link between gold prices and financial markets might also suggest a divergence in opinion about the likely growth and equity market impacts of the US tax law changes which moved from uncertain to highly likely during the week.

By the end of the week, however, the gold price was edging higher as bond prices also rose.

The disparity between the prices of Australian listed gold stocks ad those on North American exchanges has persisted although the gap had narrowed as the latter recovered somewhat from near the lowest levels experienced during 2017.

Crude oil price have stalled around the levels prevailing two years ago after having benefitted from both voluntary supply cuts and involuntary disruptions.

Prices remain in a tug of war between the beneficial effects of production cuts by some of the world's major producers, including the owners of Aramco who hope to float the Saudi state owned producer in 2018, and the potential negative influence of US producers reacting to higher prices with increased production.

Uranium related equity prices continue to travel near the bottom of their cyclical trough although recent announcements about supply cuts among the largest producers have injected a slightly more optimistic tone. Prices are now tending again toward the upper end of the trading range which has persisted for two years.

Iron ore prices have responded to improved Chinese steel industry profitability but the leverage appears to have been reducing suggesting some profit rebuilding among the manufacturers and a lack of economic clout among the miners keen to make sales.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.