The Big Picture

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

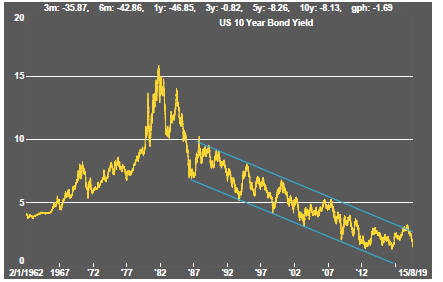

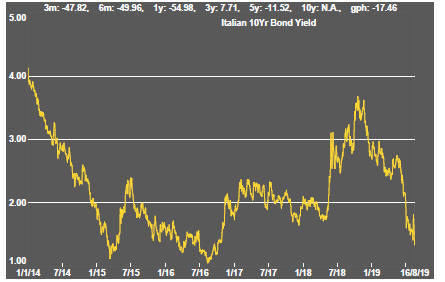

Recession talk intensified as the US government bond yield curve inverted and yields on the bonds of major currencies remained negative.

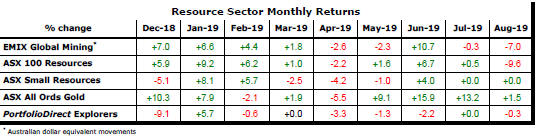

The headline resource sector equity indices fell although, once again, the smallest stocks in the sector primarily engaged in exploration showed greater resilience, albeit after having suffered unprecedented weakness since of the cyclical peak in sector market conditions in early 2011.

Despite rising anxiety reflected in more equity price volatility, markets were generally orderly. Much of the incremental volume of trading appeared to be driven by algorithms triggered by news or specific events rather than being considered decisions by investors.

The equity market mood was improved by comments from German government officials suggesting a willingness to use fiscal policy to improve the growth outlook and by steps in China to facilitate a stronger rate of bank lending.

US-China trade relations added to the volatility again as US President Donald Trump decided to postpone implementation of higher tariffs on Chinese imports. The expressed rationale for the apparent about-face was to avoid an adverse pre-Christmas impact on US consumers. The seemingly flimsy excuse suggested that the US administration had not initially anticipated Christmas recurring in 2019. The reasoning also belied the constant refrain from the tariff-loving US president that the taxes on imports do not affect US consumers adversely.

Argentina sent a shock through markets as the electoral process leading to 2020 presidential elections foreshadowed a loss by the pro-business incumbent and the return of left-leaning parties to government. The Argentinean currency decline raised the prospect of another debt default and contagion among developing countries faced with declining currencies.

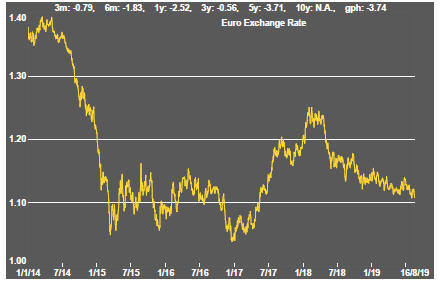

A weaker Chinese yuan had quickly led to accusations from US authorities of currency manipulation by the Chinese government and raised fears of an outbreak of tit-for-tat currency devaluations disrupting global financial markets. In what might have been a warning shot by China to show the damage it could inflict, its central bank did not permit any further significant currency movement.

Among other geopolitical pressure points with an impact on markets, Brexit remained unresolved and Hong Kong pro-democracy demonstrations took on a more violent tone. Trump seemed to link resolution of the trade conflict with China to a settlement with the Hong Kong demonstrators, at one point. Meanwhile, conflict with Iran, denuclearisation of the Korean Peninsula and the Syrian civil war all seemed to lose significance.

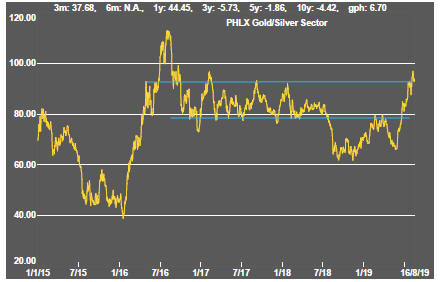

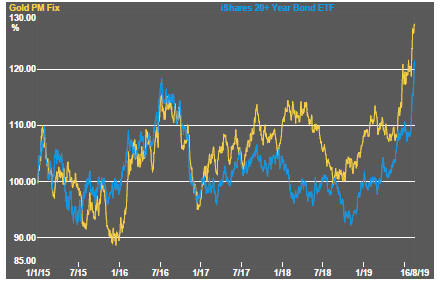

A six-year high in the price of gold remains consistent with changes in prices of other financial assets rather than a more fundamental structural shift specific to the gold market. On the evidence so far, the gold price appears likely to track bond prices but is at risk of reversing the gains which have been made if financial markets decide that the pessimism about global growth implicit in bond prices has gone too far.

While the gold price move has been consistent with moves in bond yields, the link between yield movements and the copper price appears to have broken. The copper price has changed little as sentiment about growth has deteriorated leaving the prospect of a future adjustment when one or other of the bond or copper markets concludes that a mistake has been made.

Despite the extent of the rise in the gold price, the role of bullion as a safe haven from the prospect of government default appears to have been of minor importance. So confident are investors about the future credit of governments that they have been happy to lend cash for as long as 30 years without any reward for risk.

The yield spread between government and corporate bonds widened suggesting that the move in yields is a consequence of the weight of money in pursuit of a limited range of security offerings.

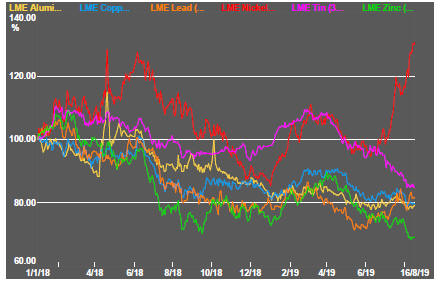

Daily traded nonferrous metal prices again changed little against a backdrop of large swings in prices of bonds, equities, foreign exchange and other commodities. The nickel price outperformance persisted. Tin and zinc prices have remained conspicuously weaker than the prices of the other metals.

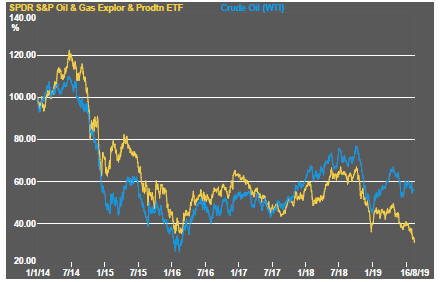

Stable crude oil prices did not benefit the prices of oil exposed equities which were driven by a combination of generally weaker equity markets and scepticism among equity investors about the resilience of oil prices as supply potential rises and demand growth declines.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

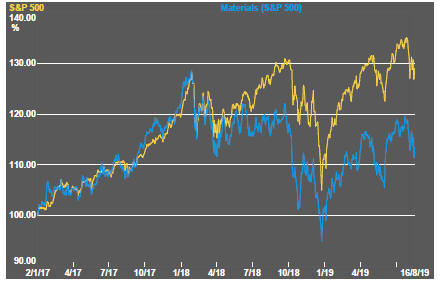

Equity Market Conditions

Resource Sector Equities

Interest Rates

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

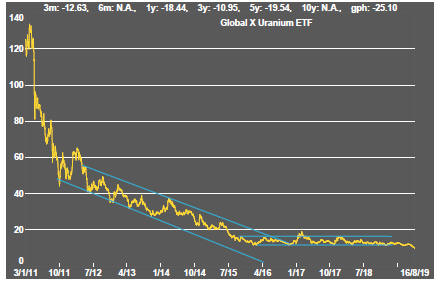

Uranium