The Big Picture

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 as global growth accelerated although, for the most part, sector prices did little more than revert to 2013 levels which had once been regarded as cyclically weak.

Global growth, having peaked in late 2017, the sector has been in cyclical downswing since early 2018.

With a median decline in prices of ASX-listed resources companies since the beginning of 2011 of 89% (and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

US and global equity markets moved generally higher as nervousness over the course of monetary policy and future international trade conditions played a lesser role. In US markets, the latest round of corporate earnings results helped sustain market prices.

The International Monetary Fund (IMF) released its review of the world economy, warning that risks were high as it cut its growth forecasts for 2019 and 2020. As an anticipated slowdown in growth has been widely acknowledged, the market impact of the IMF revisions was limited. In any event, the forecasts implied some modest improvement in growth in the year ahead than in 2019.

Chinese economic growth over the year to the end of September 2019 fell from a quarter earlier. The slowdown came with an official commentary which forthrightly highlighted the difficult economic conditions faced by the country.

The slower headline growth was mainly due to weakness in the March quarter. Stronger growth since then is more equivocal about the extent of a slowdown. Quarterly Chinese growth rates display a pattern of compensating surges after occasionally sharply lower quarterly growth outcomes. The same has happened this year although the momentum of the surges in successive years has been diminishing.

The less strong growth rebounds suggest reduced effectiveness of Chinese policy which is relying on fiscal and monetary initiatives rather than market reforms which were such a potent source of growth in earlier years.

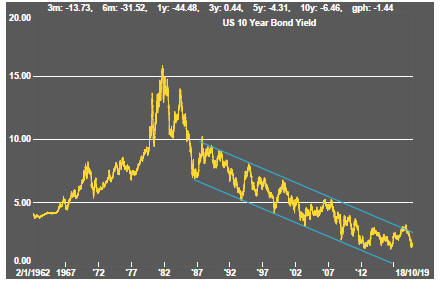

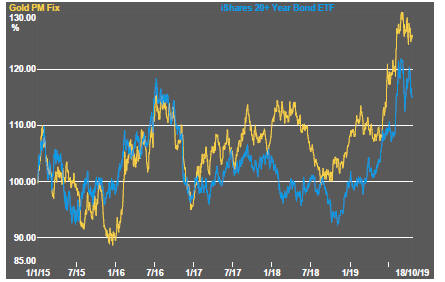

In financial markets, bond yields continued to move higher helping to sustain sentiment about the outlook for banking stocks as beneficial spread movements contributed to positive earnings expectations.

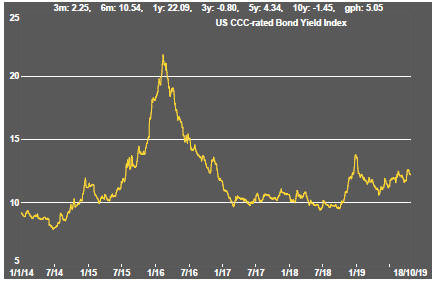

Corporate yield movements were signalling more adverse conditions for higher risk borrowers, including those in the resources sector.

Resource sector equity prices weakened, against the trend in broader equity market conditions.

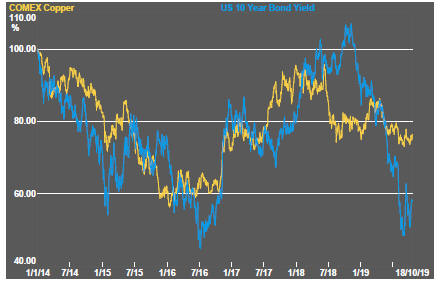

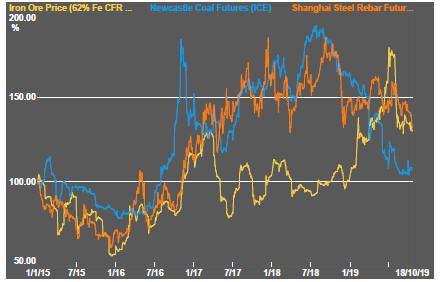

Mining-related commodity prices were mixed but broadly positive. A weaker nickel price during the week was the notable exception after a period of exceptional strength. Overall, metal prices continued to display surprising resilience against a backdrop of pessimism about the global growth outlook. Metal price volatility has remained subdued.

Crude oil prices firmed but have remained in line with the trading range of the past several months. The related equity prices have remained on a weakening trend significantly undershooting the performance of the crude oil price itself.

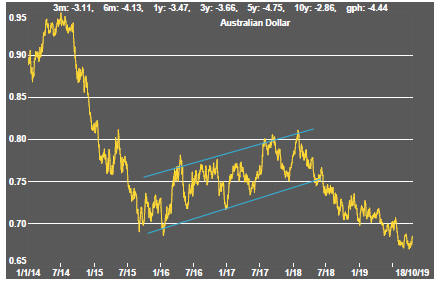

The Australian dollar has strengthened modestly, adding some downward pressure to Australian resource sector equity prices.

Some weakening in the US dollar will have contributed to stronger metal price outcomes. The prospect of better trade outcomes, with a US-China trade deal having been foreshadowed, will have also reduced demand for a safe haven currency.

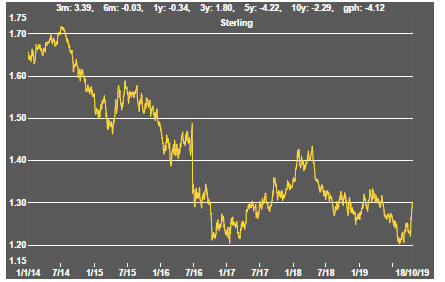

The euro and sterling benefitted from confirmation of progress toward an agreement between the UK and EU governments about the terms of an exit by the UK from the European political union.

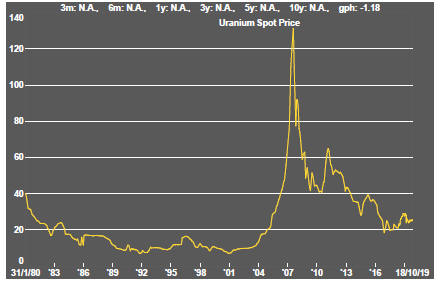

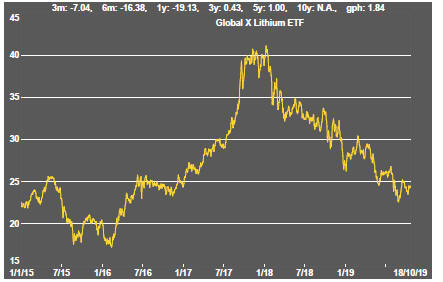

There has been no significant sign of improved sentiment within the non-oil energy related equity segment encompassing cobalt, lithium and uranium.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium