The Big Picture

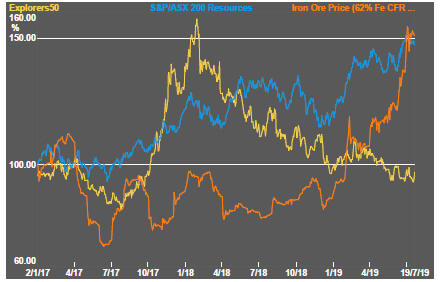

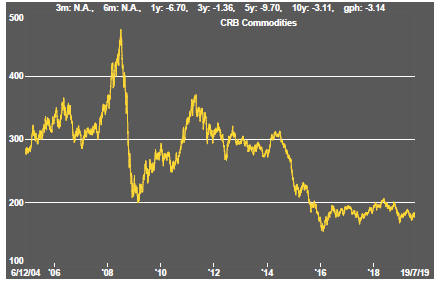

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

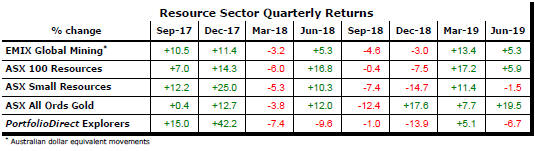

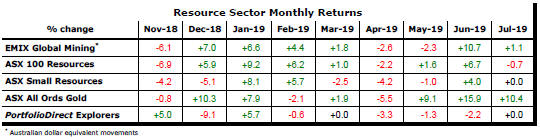

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

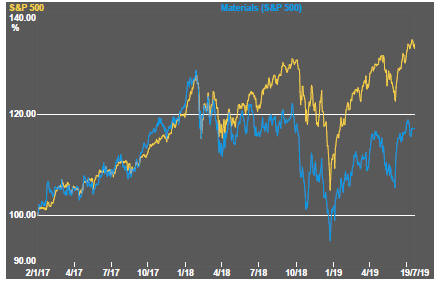

Global equity prices generally finished on a down note albeit, in the case of US markets, near record levels.

Implied volatility measures indicated investors were little worried about future conditions, having been persuaded about the near certainty of supportive monetary policy changes.

Comments from the head of the Federal Reserve have reinforced expectations of a monetary policy shift at the end of July.

Despite the near universal expectation of a rate cut, Fed governors used the last few days before their pre-meeting public comment blackout period commenced to make competing remarks about of the policy outlook. Equivocal comments about the need for an adjustment seemed at odds with the widespread expectation within financial markets that a change would be made.

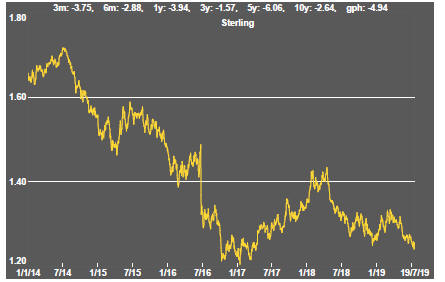

The uncertain economic impacts of global trade disputes had already been cited by the Federal Reserve chairman as an influence on the Fedís monetary policy thinking. There were no signs of a resolution to the most prominent source of trade disruption - antagonism between the USA and China - or to lesser conflicts, including unresolved future trading arrangements between the UK and the European Union.

Among the international cross currents influencing the Fed to make a pre-emptive and precautionary cut in rates has been an intensifying dispute in the Middle East between Iran and the USA with western nations shipping oil from the region being caught in the crossfire.

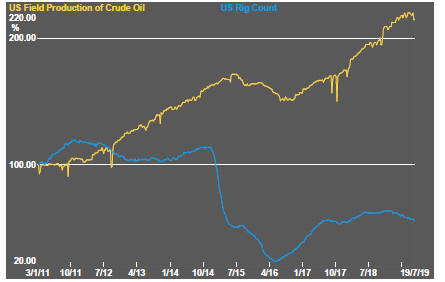

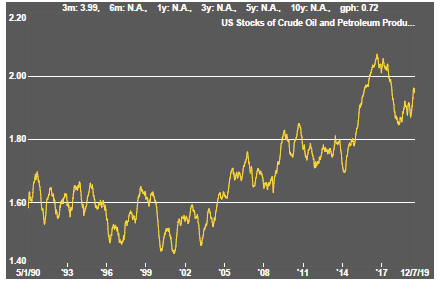

Despite several dramatic and war-like events in and around the Gulf of Hormuz, crude oil prices remained remarkably stable possibly reflecting global market balances and the diminishing relative importance of Middle East oil exporters after US production has risen so dramatically.

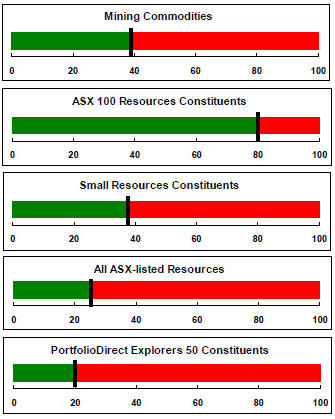

Rising confidence about a Federal Reserve rate cut helped spur cyclical investments, including mining stocks.

The mining leaders have benefited from generally favourable equity market conditions as well as the strongest iron ore prices since 2016. Those companies without iron ore exposure - or gold - lagged the investment returns from market leaders.

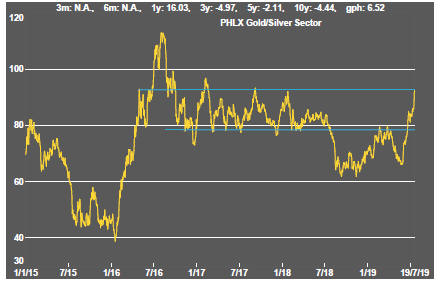

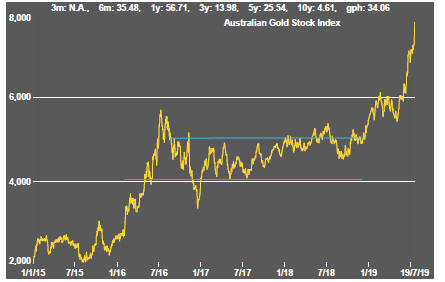

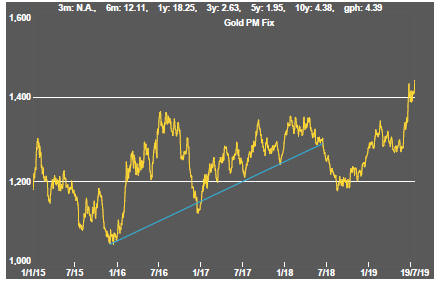

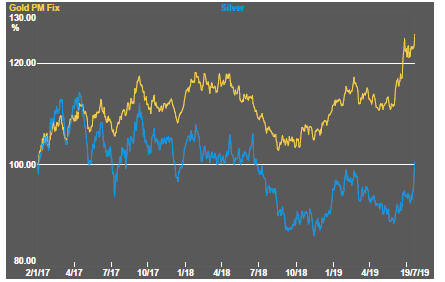

Gold related equities continued to benefit from higher bullion prices buoyed by expectations of the Federal Reserve validating lower market yields at its end of July meeting.

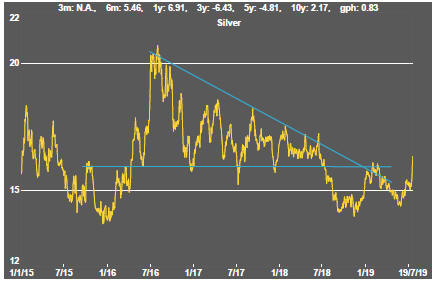

Silver prices, which had been historically weak relative to gold, finally commenced a sufficiently strong move higher to raise the possibility of a reversal in the gold/silver price trade.

The expectation of a spur to growth from lowered interest rates lifted daily traded nonferrous metal prices with nickel displaying unusual strength during the week. Nickel price volatility has historically been greater than for other metals.

Copper prices, usually a guidepost for changes in economic conditions, have remained relatively stable, belying expectations of an imminent improvement in global industrial activity.

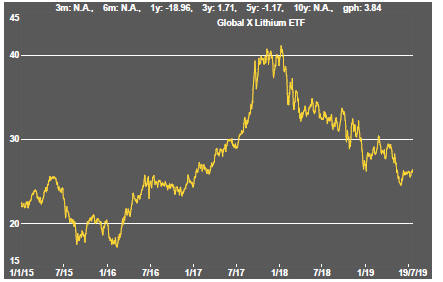

Battery metal and uranium market investment conditions remained weak despite widely held views about the sound prospects for those commodities arising from changes in the global energy mix.

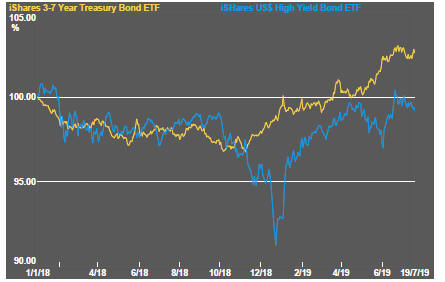

Funding conditions for higher risk investments worsened marginally.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

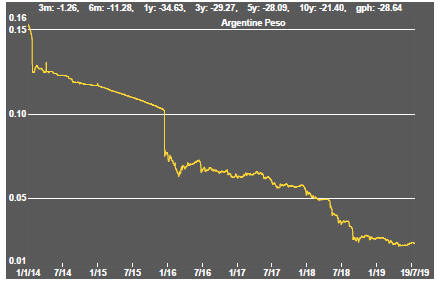

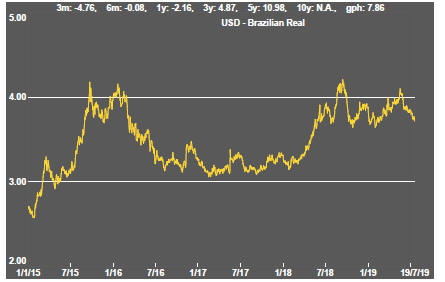

Exchange Rates

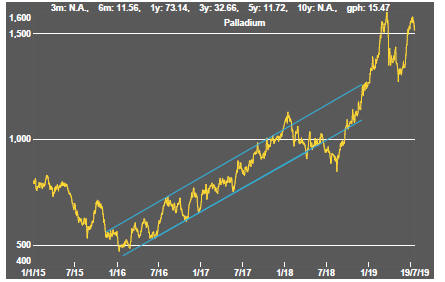

Commodity Prices Trends

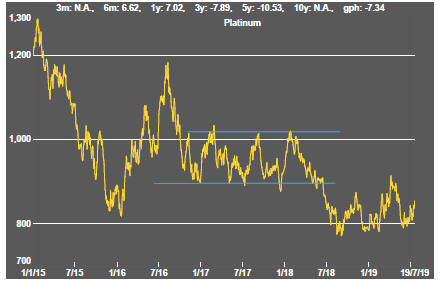

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium