The Current View

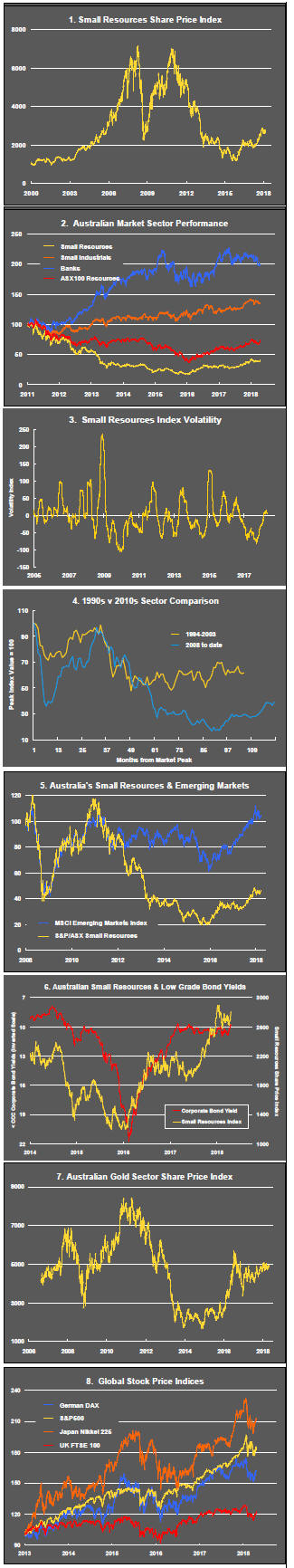

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were reversed through 2016 and 2017 although sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

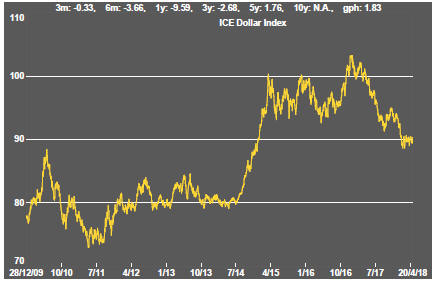

The strength of the US dollar exchange rate since mid 2014 had added an unusual weight to US dollar prices. Reversal of some of the currency gains has been adding to commodity price strength through 2017.

Signs of cyclical stabilisation in sector equity prices has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development has passed its most difficult phase with the appearance of a stronger risk appetite.

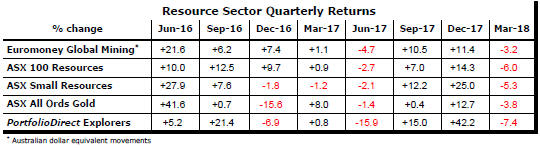

Resource Sector Weekly Returns

Market Breadth Statistics

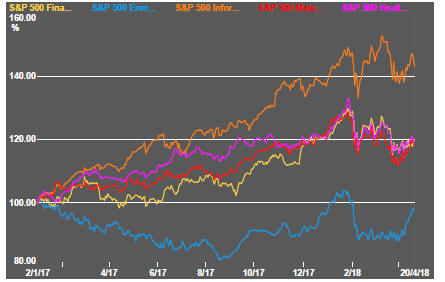

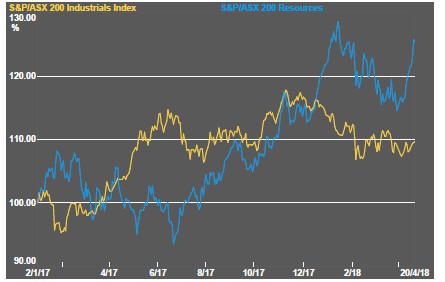

Equity Markets

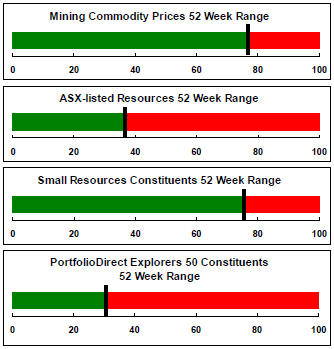

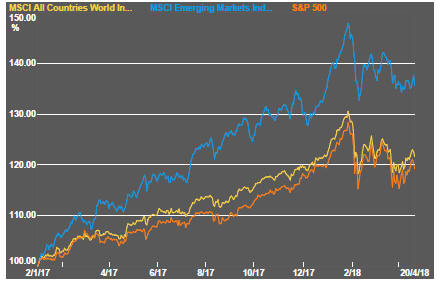

Talk of a global trade war and its potential impact on growth remained prominent but earnings loomed larger as a positive market influence.

Reports of flagging smartphone sales had damaged the technology sector outlook by the end of the week contributing to the broad based decline in the markets. All 11 S&P500 sectors declined on Friday.

The energy sector showed strength during the week, boosted by rising crude oil prices.

The mining sector was helped by the perceived impact on aluminium and nickel supplies of the new round of US sanctions against Russian business people with links to the government.

The leading resources stocks made strong gains, within the Australian market, in response to the sanctions affect and well ahead of a modest rise in industrial share prices.

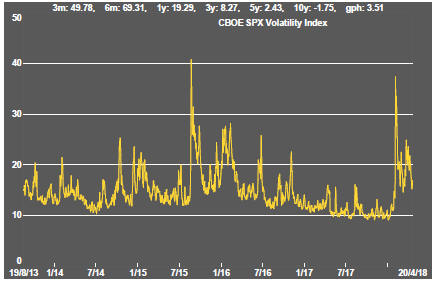

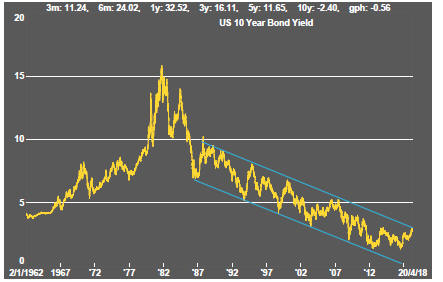

Interest Rates

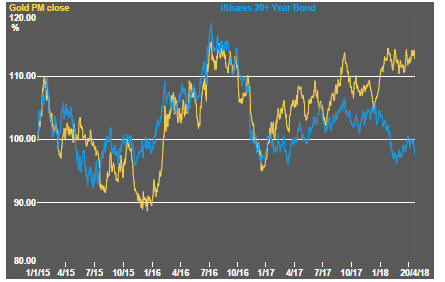

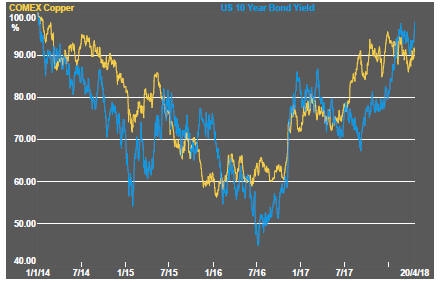

The interest rate picture remains the product of a tug of war between the likelihood of rising inflation and the continuing demand for high quality fixed interest securities.

The absence of any dramatic reappraisal of interest rate directions had been contributing to a favourable equity market environment. That link appeared in danger of being broken on Friday when US 10 year bond yields edged closer to the 3% mark which has started to assume symbolic importance as a guidepost to the direction of equity prices.

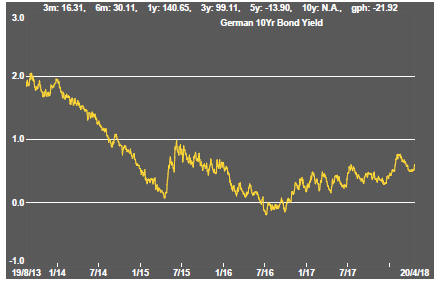

The rise in German yields highlighted that the change in financial market conditions is not being driven entirely by US economic and political conditions but, more broadly, by confidence about the growth trajectory in the advanced economies.

Although growth expectations might have played a role in framing the change in yields, growth stocks outside the mining sector did not appear to benefit.

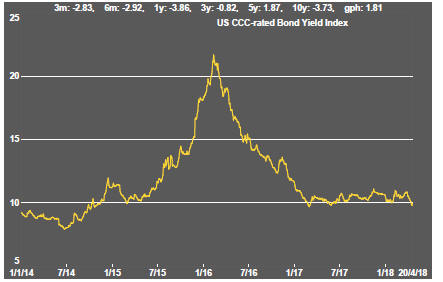

Key indicators of the availability of finance for mining sector projects suggest no significant change in the conditions which have prevailed over the past year. High risk debt prices rose.

Exchange Rates

The downward directional shift in the US dollar has stalled amidst competing views about relative growth rates, fears about disruption to trade patterns and the funding requirement of the US government.

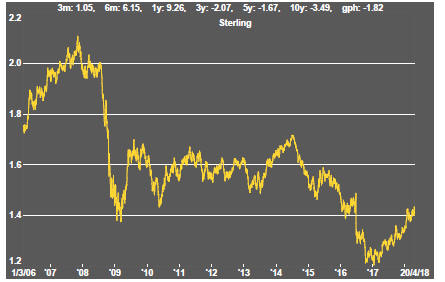

Sterling showed strength as expectations rose that the Bank of England would shortly raise interest rates in response to rising inflation although the Governor of the Bank did suggest that need not happen imminently.

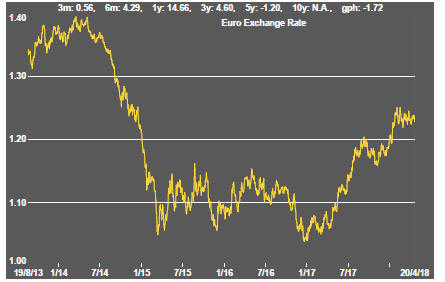

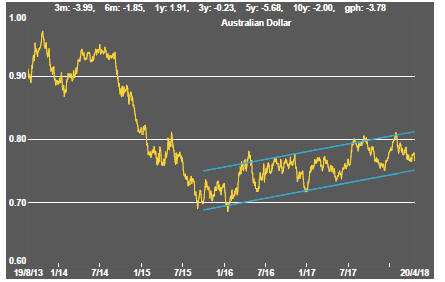

The gentle upward drift in the Australian dollar could remain intact as long as risks to global economic conditions remain lowered and commodity prices are in the upper end of the range of prices in the past year.

Within that trend, tightening monetary conditions in the USA and, later, in Europe could contribute to within-trend fluctuations.

Commodity Prices

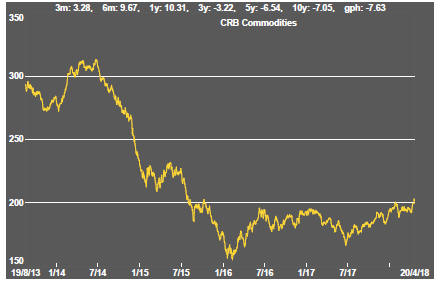

The general upswing in commodity prices over the past year remains within the bounds of a cyclical trough suggesting still stronger economic activity will be needed to carry prices higher. Unusually strong gains in the past fortnight have reflected higher crude oil prices.

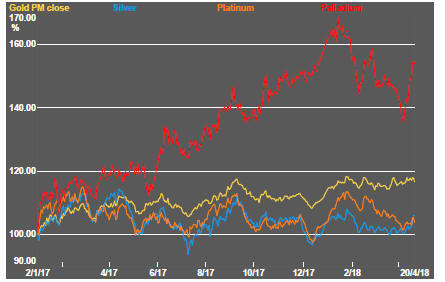

Gold & Precious Metals

Gold bullion prices remained toward the upper end of their recent range despite the fall in bond prices which, more often than not, would signify a fall in bullion prices.

Silver prices which have been at an extreme low relative to gold prices drew attention with a strong rise amidst forecasts of a likely reversal in the gold/silver price ratio toward historical averages.

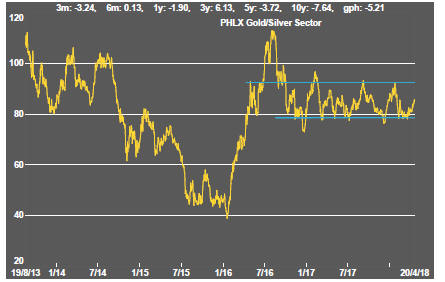

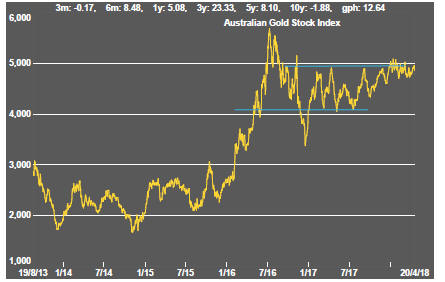

US precious metal equities traded higher after having been near the bottom of their medium term trading range. Australian gold equity prices remained close to the upper end of their trading range.

Nonferrous Metals

Prices of the main daily traded nonferrous metals had become increasingly correlated as a broadening consensus about the lowered risks to world economic activity emerged - until the new US sanctions against Russian business interests dramatically impacted aluminium and nickel prices.

Copper prices did not react to the re-pricing of financial assets as one might expect to occur eventually if the higher bond yields reflect a positive reconsideration of the growth outlook.

Bulk Commodities

Bulk commodity prices had moved lower with signs of lessening Chinese economic momentum after the first quarter.

Increased Chinese steel production in the first quarter of 2018 has resulted in larger inventories. The inventory climb and threat of tariffs affecting Chinese steel demand have dragged steel prices lower and raised risks for metallurgical coal markets.

A slight reversal of those near term trends has been evident in the past two weeks.

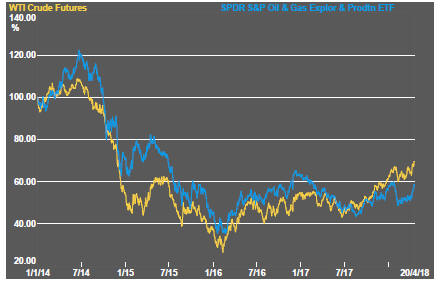

Oil and Gas

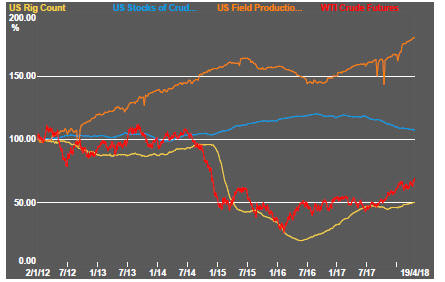

Rising US production, partly in response to higher prices, had been seen as a burden on expectations about the likelihood of further oil price rises.

US producers are also now able to profitably hedge anticipated production contributing to the ongoing rise in their output.

On the other side of the ledger, inventories have been declining and global supplies have remained constrained through both voluntary and involuntary actions. Fears of deteriorating political conditions in the middle east have also elicited a higher risk premium.

Donald Trump's complaint about high oil prices being artificial did not appear to influence anyone.

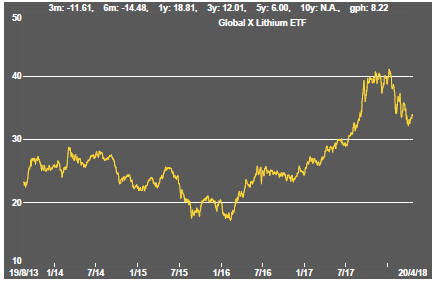

Battery Metals

Eighteen months of rising lithium-related stock prices has given way to a period of market reassessment as a lengthy pipeline of potential new projects raises the prospect of ongoing supplies being adequate for expected needs.

Potential lithium producers have been able to respond far more quickly to the various market signals than has been the case in other segments of the mining industry.

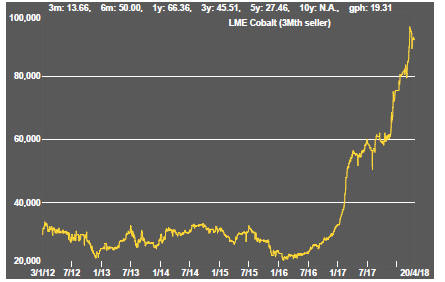

Battery metals remain a focal point for investors with recent attention moving to cobalt and vanadium.

Uncertainty over how a peaceful transfer of power can occur in the Democratic Republic of the Congo has added a dimension to cobalt prices lacking in other metals caught up in the excitement over transport electrification.

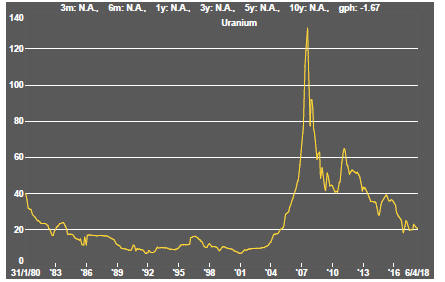

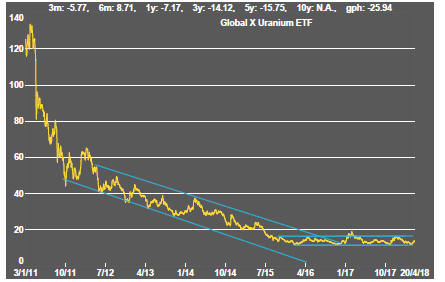

Uranium

The uranium sector is moving along the bottom of its long term trading range in the absence of more meaningful signs that power utilities are prepared to re-enter the contract market to negotiate their longer term needs.

Slightly higher equity prices in the last week could be attributed to speculative trading since uranium prices have moved slightly lower since the end of March.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.