The Big Picture

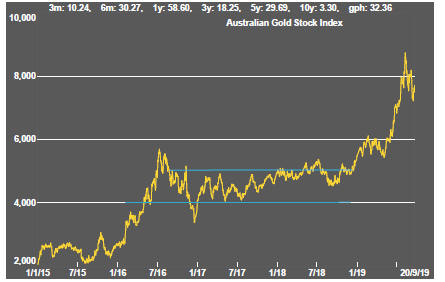

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

Federal Reserve policy and US-China trade talks again interacted to dominate equity price outcomes.

Second tier officials from China and the USA had gathered in Washington to further talks on trade in preparation for more senior level meetings in early October. This, with some recent conciliatory gestures from both sides, contributed a more positive market tone.

Equity markets weakened at the end of the week when Chinese officials cancelled a trip to farming areas in the USA in a move construed as a setback in the trade talks.

The Federal Reserve did, as expected, ease monetary policy by cutting the target Fed Funds rate by 0.25 percentage points.

After the decision, attention focused on unusually disparate views among Fed officials with some wanting to do more and others thinking no change was needed.

Fed chairman Powell characterised the latest move as a risk mitigation measure rather than a sign of ongoing easing while, at the same time, trying to make clear that more would be done if circumstances warranted greater easing. Powell’s balancing of language was another reflection of the internal differences among his colleagues.

Fears of an inverted yield curve signalling a recession appear to have dissipated for the time being as a driver of market sentiment, following a dramatic retracement in government bond yields.

The bond yield movement has negatively impacted the gold price. At the same time, non-ferrous metal prices have changed little despite constant talk of weakening global growth and wild swings in financial market conditions.

Resource sector equity prices gained ground with more optimism about trade outcomes and more supportive policy settings but were tipping lower by the end of the week. The exploration end of the sector produced the fifth consecutive weekly gain. While still weak in a historical context, the price action within the small end of the market suggests improved investor interest.

The US dollar has continued its upward drift as there are currently few alternative investment destinations deemed sufficiently safe in a world in which growth is slowing and large swathes of government securities have negative yields.

Following the attack on Saudi oil production facilities, the price of crude oil rose sharply although not to the extent that might have been expected given the geopolitical implications of the attack and the now proven vulnerability of the Saudi industry.

Saudi officials tried to ease the market impact by claiming that production would be restored within a few weeks.

The downward slide in battery metal market conditions appears to have halted more or less in line with broader sector outcomes. Cobalt prices have risen from their worst levels but remain consistent with prices from three years ago before the price more than doubled sparking a move into the space by large numbers of exploration companies.

The uranium segment continues to languish despite widespread optimism about future demand for the metal.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium