The Big Picture

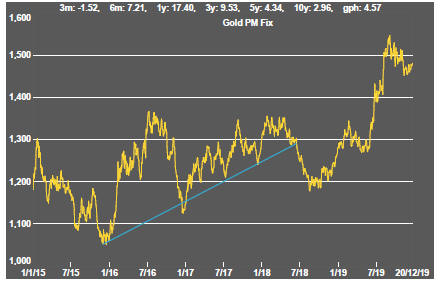

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 as global growth accelerated although, for the most part, sector prices did little more than revert to 2013 levels which had once been regarded as cyclically weak.

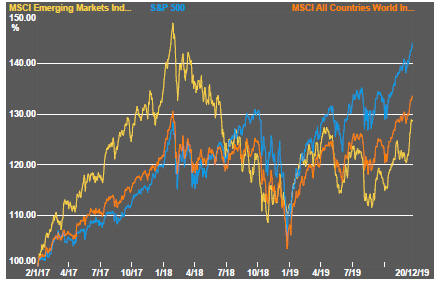

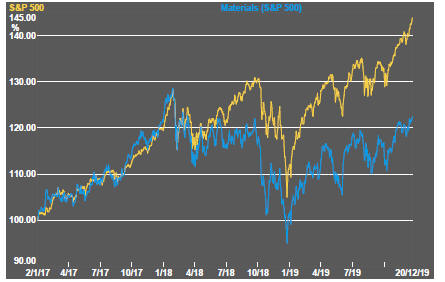

Global growth, having peaked in late 2017, the sector has been in cyclical downswing since early 2018.

With a median decline in prices of ASX-listed resources companies since the beginning of 2011 of 89% (and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

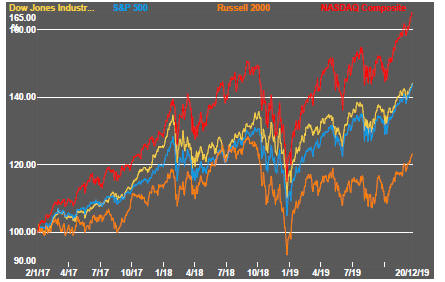

US equity benchmarks hit new records at the end of the week as confidence about the growth outlook gained ground.

Market volatility measures subsided after a brief flurry in prior weeks adding to signs that investors had become less worried about the outlook.

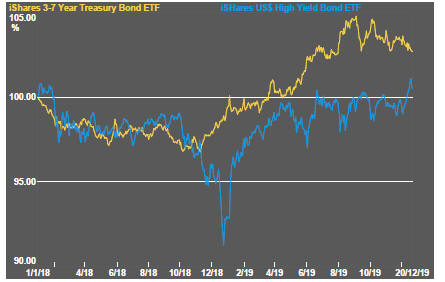

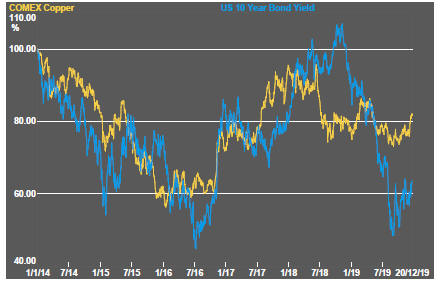

Government bond yields edged higher even as high yield corporate bond prices have been rising. Both are signs of ebbing pessimism about the growth outlook.

The US government affirmed that a trade agreement with China will be ready to sign in early January. The Chinese government has also taken additional steps to stimulate its economy and open access.

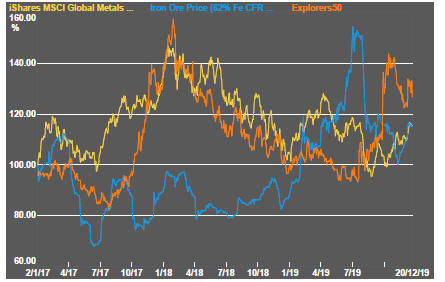

Also consistent with better growth prospects has been a rise in the copper price which had shown little sign of change for several months. Higher government bond yields had a negative impact on gold and silver prices.

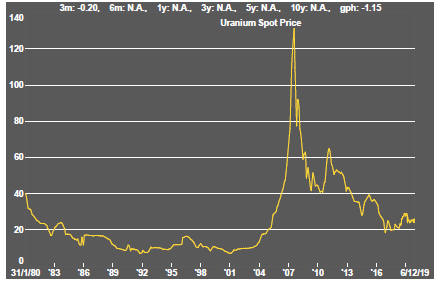

Prices of mining commodities were generally higher during the week although only palladium and uranium prices, among the key equity drivers among the metal commodities, are set to finish the year higher than they had been at the end of 2018.

Both palladium and uranium price moves have been associated with supply-side events rather than changes in the prospects for demand.

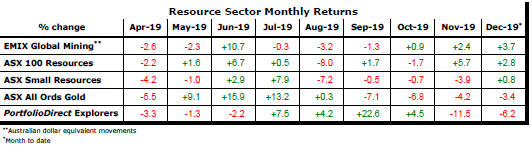

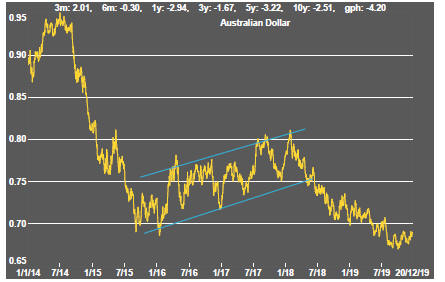

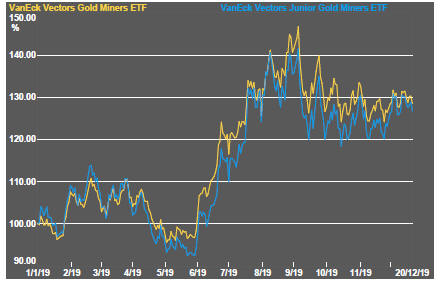

The main sector equity benchmarks are now at the highest levels for several months. The global mining index remains within a range which dates from the beginning of 2018. The BHP and Rio Tinto dominated Australian indices appear to have performed better following a weaker Australian dollar.

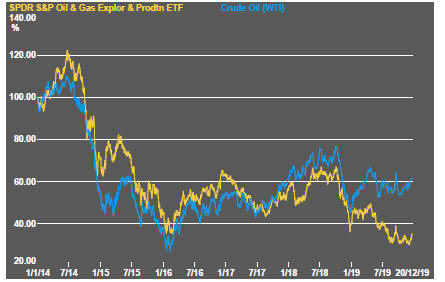

Consistent with rising crude oil prices, the energy sector made gains during the week. Exploration and development stock prices remained near cyclically low levels dating from early 2016 but the combination of reduced risk aversion among investors and OPEC commitments to keep a lid on production produced a long-delayed spark of life in sector prices.

The easing in yields on the riskiest corporate bonds is a favourable sign for miners looking for development finance although they still found funding hard to obtain even when yields were at lower levels than those prevailing presently.

Lithium exposed stocks pushed higher after appearing to make a cyclical turn during the third quarter of 2019 and following a decline which started at the beginning of 2018. Even so, the change has been largely consistent with the improved pricing among the largest stocks in the sector rather than a specifically battery meta related change in sentiment.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium