The Big Picture

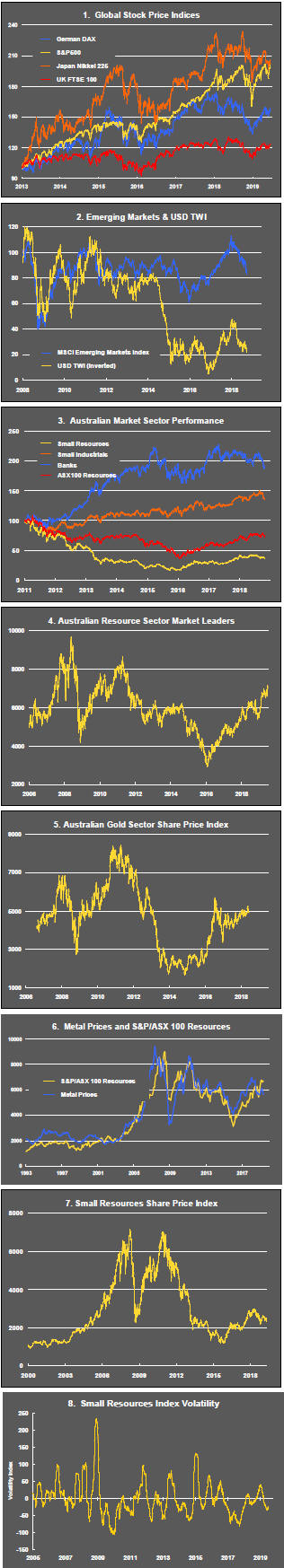

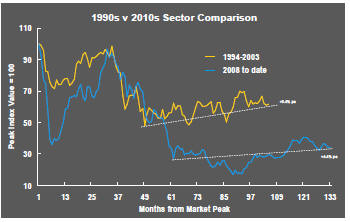

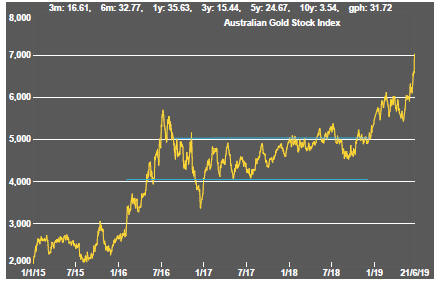

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

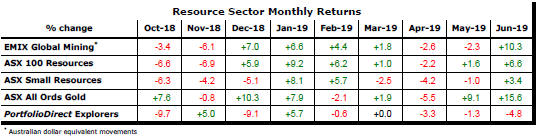

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

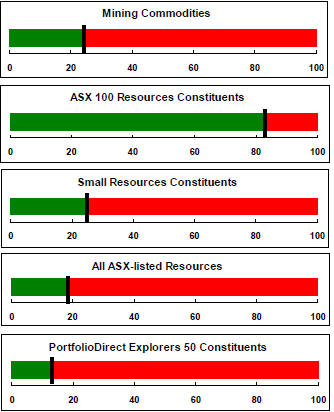

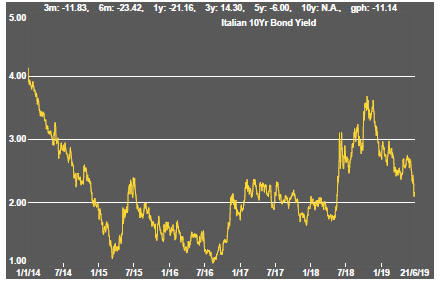

The Federal Reserve succumbed to pressure from financial markets as it all but promised a rate cut in July without having the data to justify such a move.

Addressing the media after the latest meeting of the Fedís policymaking committee, Fed chairman Powell referred to global crosscurrents which had changed the minds of committee members about the appropriate course of policy over the coming year.

Despite the apparent about face, Fed governors wanted to see how the evidence of a growth slowdown (and a small downward move in inflation) would play out over the next few weeks.

Near the top of the list of relevant factors will be the outcome of a planned meeting between U.S. president Donald Trump and Chinese president Xi Jinping. Investors are hopeful that differences over trade policy will be resolved but will most likely be satisfied with nothing more than abandonment of the mutual threats to escalate tariffs.

With further trade restraints out of the way, it is hard to see why the Fed should rush into a sequence of rate cuts, other than as a response to the demands of financial markets to keep stoking a potential asset bubble.

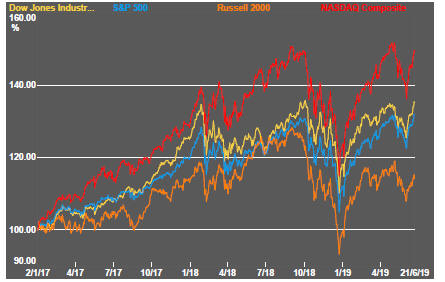

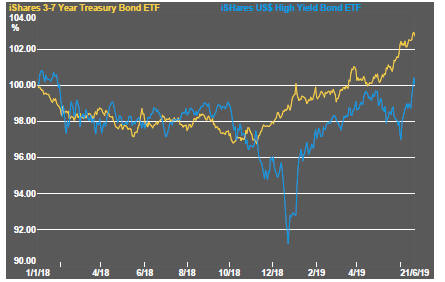

The Fed pronouncement, consistent with what markets had been expecting, buoyed equity and bond prices even as activity rates remained in doubt. And, despite an array of uncertainties, the level of volatility priced into equities declined.

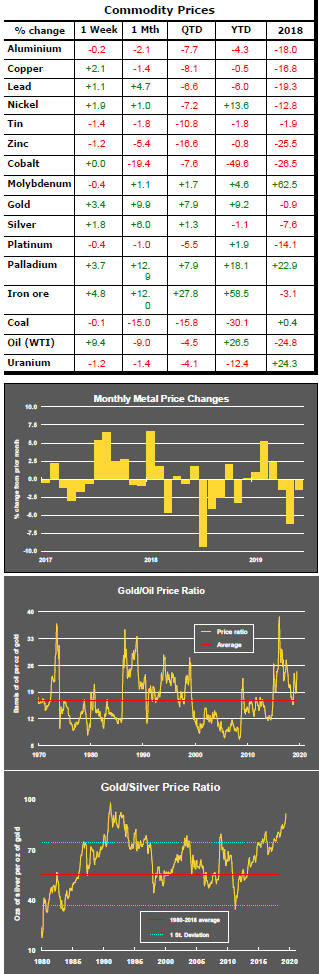

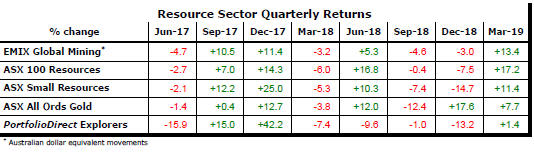

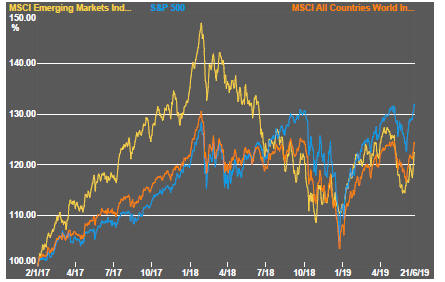

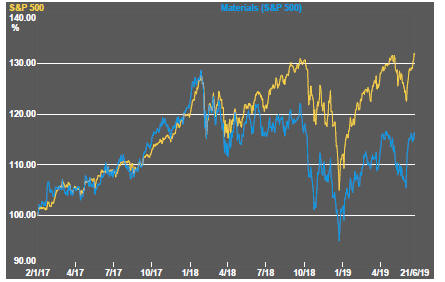

Generally strengthening equity prices, rising gold prices, higher iron ore prices (and a weaker Australian dollar for Australian-based investors) produced an acceleration in headline mining sector returns.

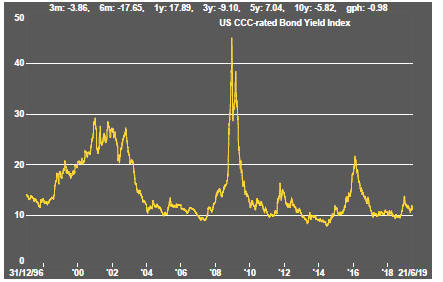

The exploration end of the market - numerically its largest part - remained a conspicuous laggard in what has become a liquidity fuelled equity market.

Historically cheap money does not appear to have benefited exploration companies which now rely heavily on improvements in real activity and, with that, clearer evidence of a need for more metal output. Otherwise, markets are inclined to discount possible future shortfalls in their pricing of exploration equities.

The iron ore price, affected by ongoing strong steel production and supply problems, might be the exception to the liquidity fuelled sequence of price rises.

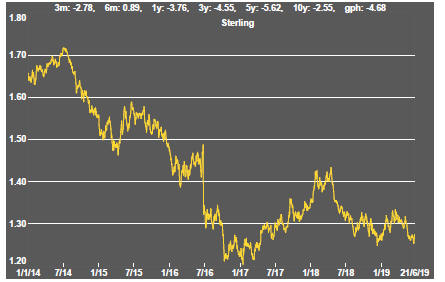

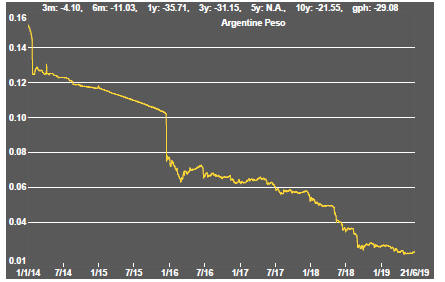

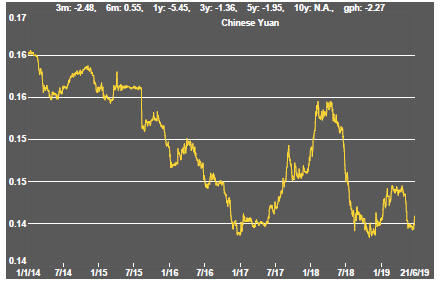

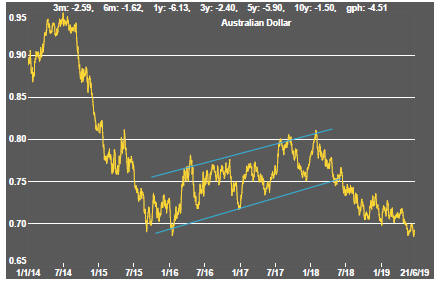

Once again, currencies tended to be relatively stable against the backdrop of some material changes in financial market conditions.

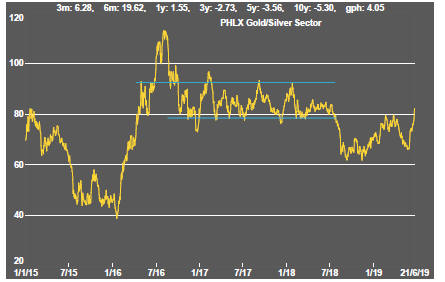

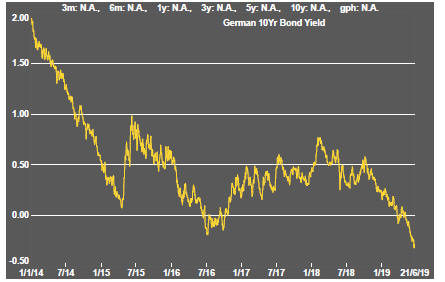

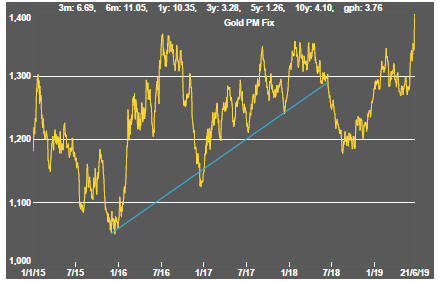

While chatter about the need for safe havens has been employed to explain a rise in the gold price, the broader financial market does not appear to have priced in higher risk. Much of the gold price rise can be explained by the shift in government bond yields which warranted an increase in bullion prices based on changes in relative prices.

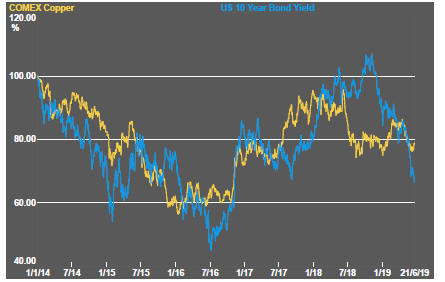

Daily traded nonferrous metal prices showed a modest improvement after the Fed meeting but their price trend remains consistent with slightly weaker global economic conditions.

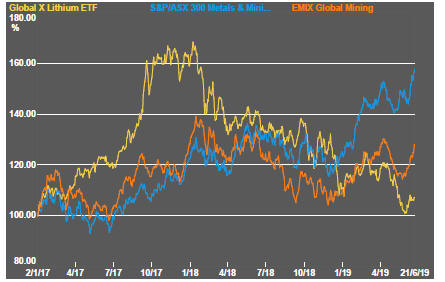

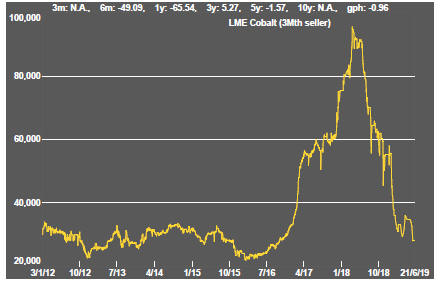

The battery metals segment of the industry, potentially the part of the industry least reliant on cyclical improvement, has continued to underperform the broader sector indicators.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

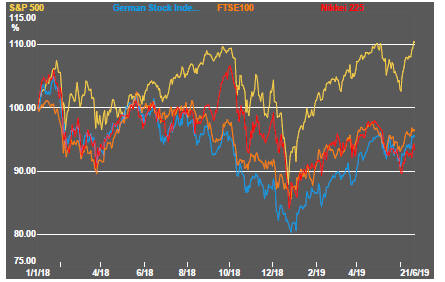

Equity Market Conditions

Resource Sector Equities

Interest Rates

Exchange Rates

Commodity Prices Trends

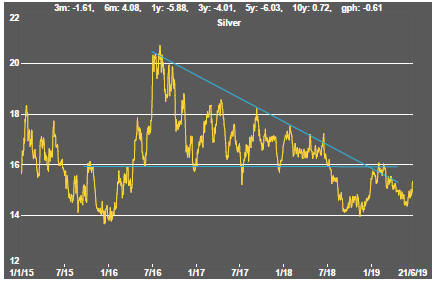

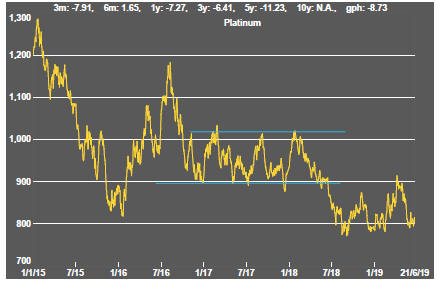

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

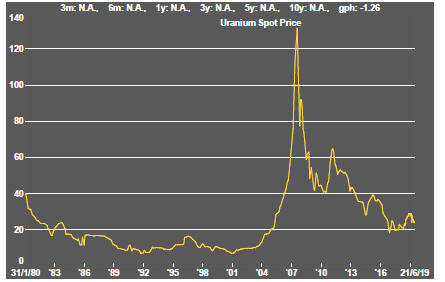

Uranium