The Big Picture

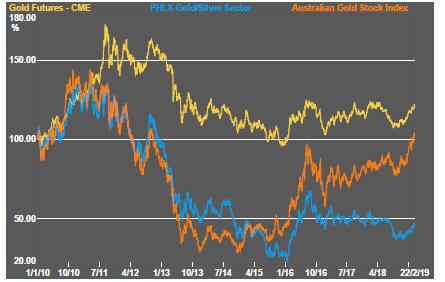

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

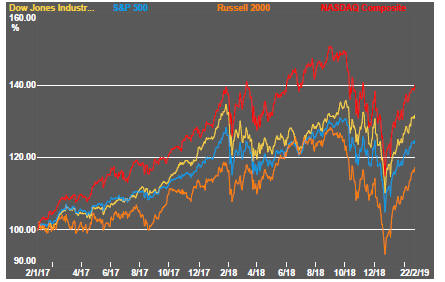

The post-Christmas stock price recovery continued amidst rising complacency about the economic outlook.

At the end of the week, comments from US and China trade negotiators assembled in the Oval Office with the US President stoked expectations of a Sino-US trade deal, potentially removing one of the stumbling blocks to maintenance of global economic growth and further rises in equity prices.

Global economic growth is almost universally expected to decline in the coming year but, so it seems, not by so much as to raise anxiety levels about the trajectory of equity prices. Importantly, the US Federal Reserve is now repositioning itself as being ready to support growth rather than capping it through tightening monetary conditions. That said, central banks elsewhere have considerably less flexibility to react to evidence of slowing growth.

In contrast to the anticipated loss of global growth momentum, metal prices rose. It seems that near-term sentiment about trade is overwhelming longer-term demand effects from slower growth, at least for the time being.

As the year progresses and trade frictions possibly become less important in the minds of investors, metal prices will face a potential adjustment to longer term trends in consumption. Statistics from both the International Lead Zinc Study Group and the International Copper Study Group are showing another year in 2018 of strangely weak growth in demand raising the possibility of a year or two of inventory building if global economic activity slackens.

Gold prices have returned to early 2018 and mid-2016 levels, running slightly ahead of financial market conditions. At this stage, the balance of risks has tilted toward an end to this run although, against this, markets are also edging toward the idea that US interest rates may reverse trend in 2019. Such a reassessment would undoubtedly benefit bullion prices.

The rise in copper prices in the past week has been running against of the message of subdued growth prospects contained in financial market price outcomes. This inconsistency implies some resolution, one way or another, in coming weeks.

Overall, much now depends on clarification about the growth outlook. Critical to that will be evidence about the US growth trajectory. There is a broad consensus among forecasters that peak growth for the US economy has passed for the time being. One school of thought suggests optimistically that the US economy settles into growth of around 3% a year. Others are expecting something around 2.5%. Others are cogently arguing that the potential is for something less than 2%.

Corporate bond price movements showed further improvement in risk appetite in a favourable indication of willingness to fund mining developments.

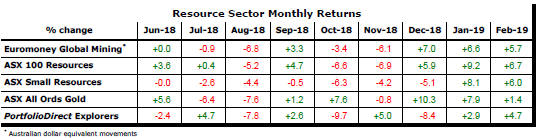

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

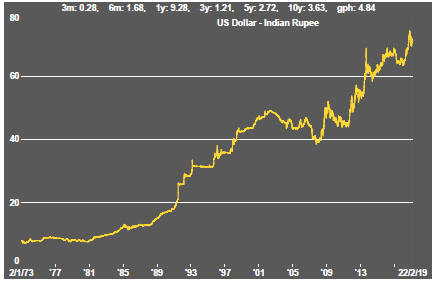

Exchange Rates

Commodity Prices Trends

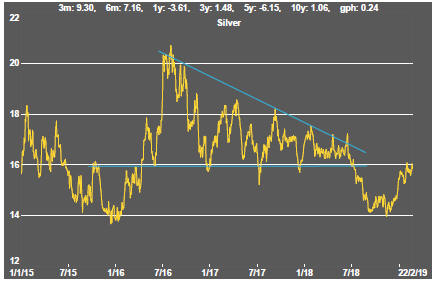

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium