The Big Picture

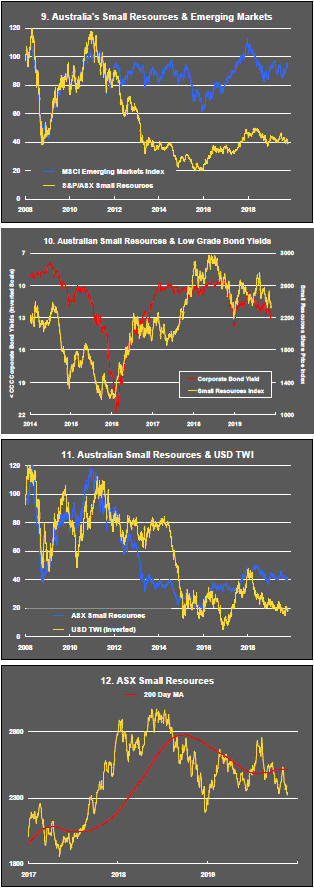

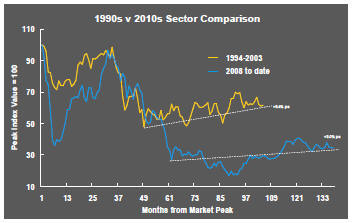

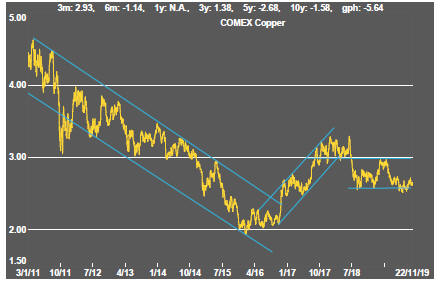

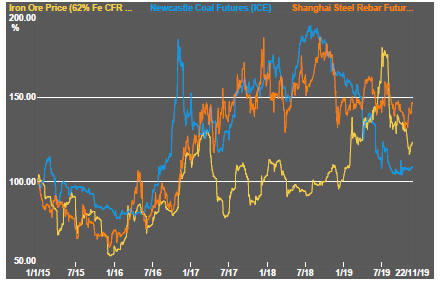

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 as global growth accelerated although, for the most part, sector prices did little more than revert to 2013 levels which had once been regarded as cyclically weak.

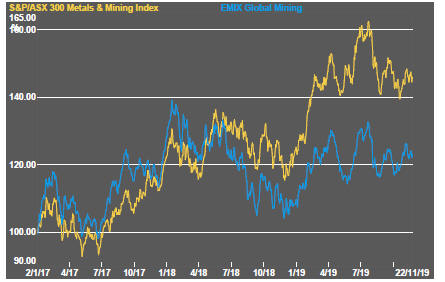

Global growth, having peaked in late 2017, the sector has been in cyclical downswing since early 2018.

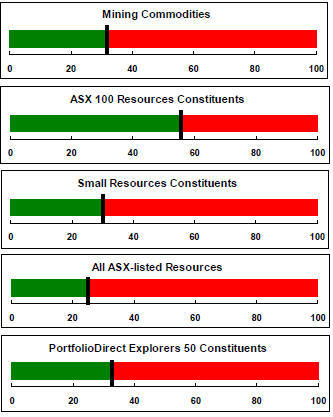

With a median decline in prices of ASX-listed resources companies since the beginning of 2011 of 89% (and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

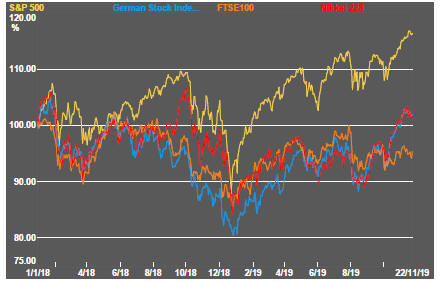

The three major US equity price indices made new records although the index of smaller stocks again hit the ceiling which has prevailed throughout 2019.

The US-China trade dispute remained unresolved despite frequent claims by US officials and President Trump that a signed agreement is imminent. Trump refused to say that US tariffs would be rolled back, in response to reports that this was part of the deal being worked on by officials.

US consumer sentiment data has lost some momentum and the monthly survey of purchasing managers pointed to ongoing manufacturing weakness. Even so, both were better than expected. The contraction in new manufacturing export orders stopped. US economic growth appears to have stabilised after moderating through 2019, giving equity prices a foundation from which to move higher.

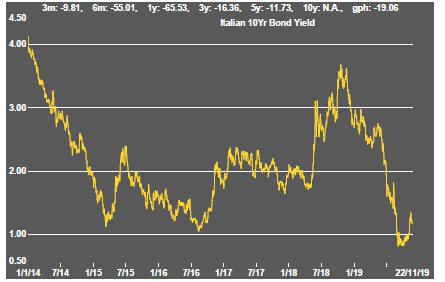

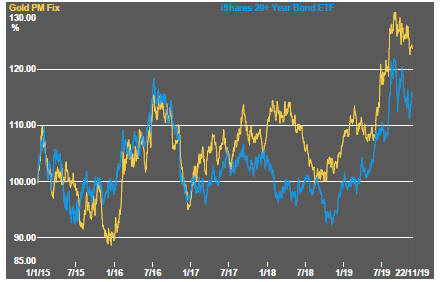

Government bond yields also finished the week pointing to a firming in the growth outlook after having slid lower in the first few days.

Commodity price outcomes were mixed. Nickel prices continued to retreat from their recent peak levels. Zinc prices fell by a similar amount. Copper and tin prices rose as did coal and iron ore prices.

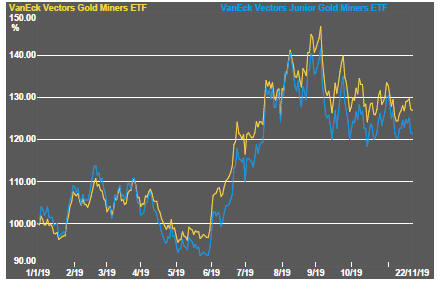

The downward bias in the indexes of major global miners persisted. Current levels are little changed from those at the start of 2019 despite the broader strength of equity prices, including cyclical companies outside the mining industry.

Volatility measures suggested that investors remain optimistic about market conditions, refusing to price in significant external risks to the current market ascent.

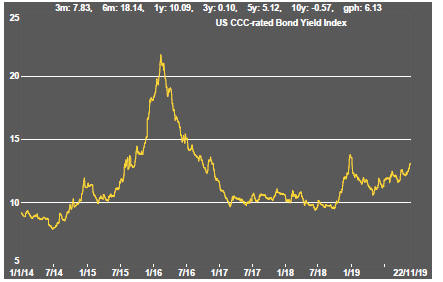

Yields on low rated corporate bonds continued to climb. While the prices of equities for corporate leaders continue to rise, smaller companies are being generally priced for greater risk. Rising yields on high risk corporate debt are suggesting that financial conditions for small miners are getting tougher.

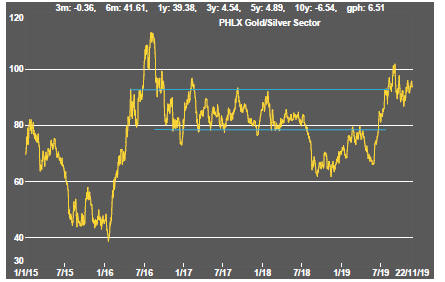

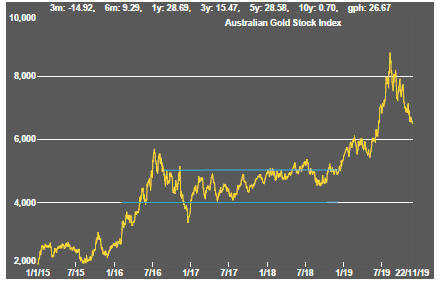

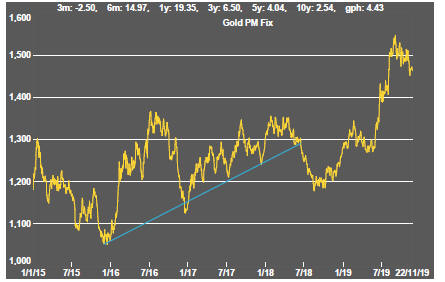

Gold and silver prices remained under the influence of financial markets with both displaying a negative bias as bond yields have moved higher.

Higher Bond yields have not been reflected in industrial metal prices. Copper prices, in particular, have shown little response to the stronger growth outlook implied by financial market movements.

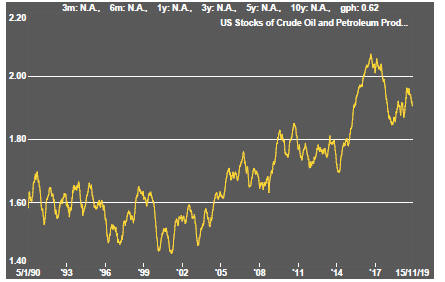

Crude oil prices changed little and although they have risen by more than 25% since the start of 2019, the return on related equities has been negative.

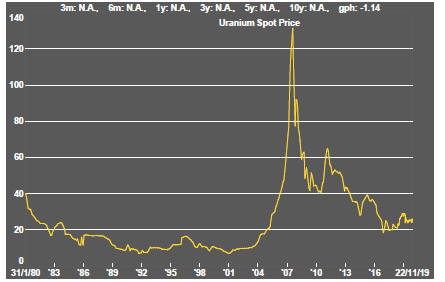

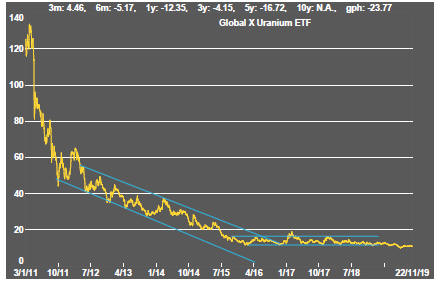

Cobalt and uranium prices have stabilised but, like much of the mining sector, remain cyclically weak.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

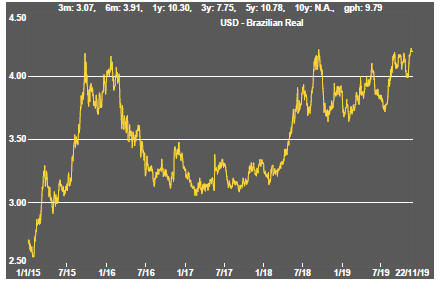

Exchange Rates

Commodity Prices Trends

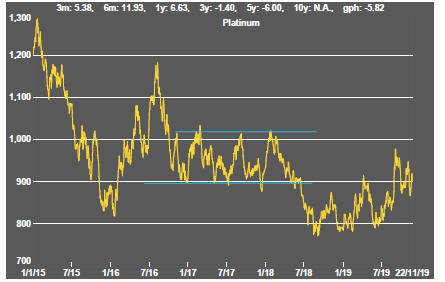

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium