The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were reversed through 2016 and 2017 although sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

The strength of the US dollar exchange rate since mid 2014 had added an unusual weight to US dollar prices. Reversal of some of the currency gains has been adding to commodity price strength through 2017.

Signs of cyclical stabilisation in sector equity prices has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development has passed its most difficult phase with the appearance of a stronger risk appetite.

Resource Sector Weekly Returns

Market Breadth Statistics

Stabilisation of equity markets continued with the consequences of higher inflation being quickly discarded as lowered risks to growth and improved earnings appear to have become more important drivers of investment decisions.

Markets remain prone to a reappraisal of the interest rate outlook but appear to have been reassured by the statement from the new Federal Reserve chairman that he intends to continue the gradualist approach outlined by his predcessor.

Investors will be listening closely to the answers to questions from US legislators when new chairman Jerome Powell appears before them for the first time in the coming week and, next month, in the first press conference after the FOMC presumably decides to raise the Fed Funds rate once again.

At least three rate rises are now expected during 2018 with each potentially disrupting markets which have already shown how susceptible they are to very rapid movements as machines and humans try to react faster than their comepttiors.

The three decade downtrend in US government bond yields is on the verge of ending with inflation moving higher, short term interest rates being raised and near term government deficits rising.

On the other hand, rates may have risen by enough to take account of likely changes in outlook.

The downside risk to yields - and a continuation of the historically long downtrend - will now depend on growth being slower than currently expected which is not out of the question with most of the advanced economies having already hit what appears to be their growth potential and policy accommodation being reversed.

German yields which have helped anchor US rates have moved lower over the past week.

The US dollar decline has stalled although there is still ample downside depending on how the tug of war between capital flows and interest rate effects play out.

If the US was to be producing unambiguously stronger growth outcomes than the rest of the world, dollar appreciation could resume.

If the US is growing sufficiently strongly to support better growth outcomes elsewhere, the dollar could resume its long term decline as capital investment outside the US gains in attractiveness.

The Australian dollar remains toward the upper end of its trading band and in a gentle upward drift. Relative interest rate moves should be detracting from its performance but the perceived connection of the currency with commodity markets is likely to keep it edging higher while prices remain near the peaks for the current cycle.

The general upswing in commodity prices has reached a potential resistance level and remains within the bounds of a cyclical trough.

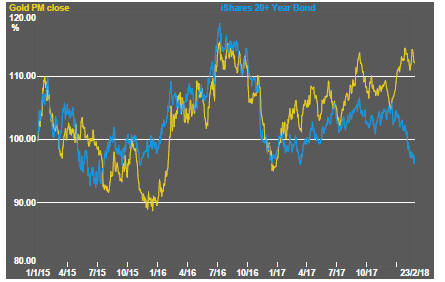

The gold price has been subjected to a tug of war between the negative effect of higher bond yields and the positive influence of a weaker US dollar.

The net change in bullion prices has been relatively modest despite the sometimes unusually large swings in macro variables.

The prices of Australian gold related stocks have moved within a narrower range than their north American counterparts.

Both groups of stocks have shown less than historical leverage to higher bullion prices. The North American stocks have shown the stronger connection to weaker equity markets over the past month.

The forces which have contributed to higher bond yields would have normally had a positive effect on industrial raw material prices, especially for copper which has historically been sensitive to such factors.

The copper price might have been an early warning of the rise in bond yields which followed shortly after the copper price lift in the second half of 2017.

Prices of the main daily traded nonferrous metals have become increasingly closely correlated with a broadening consensus about the lowered risks to world economic activity.

Tin prices have lagged conspicuously over the past year but have showed a similar rise to that of other metals since late in 2017.

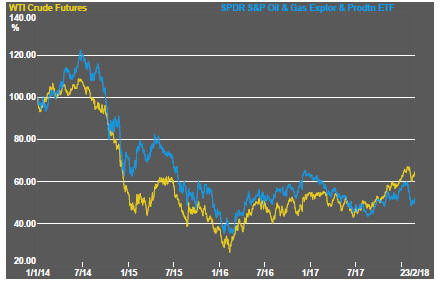

In a similar reaction to that evident among the gold stocks, equity prices for oil and gas explorers have been dominated by broader equity price movements rather than movements in the price of crude oil.

Higher crude oil prices in the past week have come with rising global demand and production rates remaining constrained.

The bulk commodity response to the change in macro conditions has been stronger within the coal market than for iron ore. The coal market will have been a beneficiary of increasingly constrained supplies with capacity being closed in Asia and development plans elsewhere under threat.

The uranium sector has reverted to near the bottom of the current cycle. Production cuts appear to have had little sustained effect on investor sentiment. This will change eventually but the adjustment time before a change in cyclical direction still appears many months away.

Meanwhile, the optimum investment approach appears to revolve around trading the ups and downs within a relatively narrow price range.

Eighteen months of rising lithium stock prices has given way to a period of market reassessment as a lengthy pipeline of potential new projects raises the prospect that ongoing supplies will be adequate for expected needs.

Potential lithium producers have been able to respond far more quickly to the various market signals than has been the case in other segments of the mining industry in which development timeframes in sometimes far tougher locations are becoming more prolonged.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.