The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

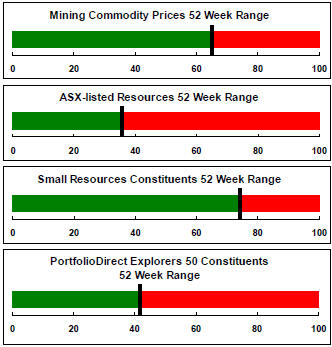

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were reversed through 2016 and 2017 although sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

The strength of the US dollar exchange rate since mid 2014 had added an unusual weight to US dollar prices. Reversal of some of the currency gains has been adding to commodity price strength through 2017.

Signs of cyclical stabilisation in sector equity prices has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development has passed its most difficult phase with the appearance of a stronger risk appetite.

Resource Sector Weekly Returns

Market Breadth Statistics

Equity Markets

The threat of a global trade war rose to prominence after a round of new tariffs targeting Chinese imports to the USA was foreshadowed.

The trade war impact has been hard for analysts to model both at a macro level and from a corporate viewpoint. Among the uncertainties is whether threatened tariffs are likely or simply a negotiating ploy to get better access to Chinese and European markets for selected US industries.

At a corporate level, potentially detrimental effects on earnings from tariff effects are possibly more than offset by higher earnings after recent tax changes.

The threat by President Trump not to sign the omnibus spending bill passed by the US Congress, after his advisers had said he would do so, also had a destabilising effect and gave added weight to a sense that the president had begun to take a more aggressive posture in resetting his agenda.

Facebook became the target of irate politicians for mismanagement of private data and failing to understand the seriousness of the concerns being expressed about its behaviour.

More broadly, investors have become concerned that the freewheeling growth of social media companies may be fading as politicians with a direct interest in the dissemination of private data ramp up stricter regulations.

While these problems have largely arisen in a US political context, they have affected markets globally.

Although sectors such as energy and utilities have held their ground in an absolute or relative sense, they have been too small to overcome the much more heavily weighted sectors such as information technology and financial services in the US market.

The mining sector generally followed the broader market lower.

Interest Rates

The inflation fears of a few weeks ago appear to have dissipated especially since the latest monthly US labour force statistics (for February) reverted to the long term pattern of strong employment gains with only modest wage increases.

Newly appointed Federal Reserve chairman Jerome Powell delivered the first interest rate rise under his watch. The subsequent press conference was noteworthy for being one of the shortest conducted by a Fed chair.

Unlike his predecessors who were top flight economists who could speak comfortably about some of the more obscure aspects of policy, Powell was much more to the point and unwilling to diverge very far from the script about what the Fed intended and what might divert it from the stated course.

The questioning by journalists about policy largely revolved around the link between inflation and labour market conditions which continues to defy the conventional wisdom about when higher wages growth should have commenced.

Policymakers now freely admit to not fully understanding why the unemployment rate has fallen as low as it has without an inflation impact.

Under questioning about the forecasts of the Fed governors, Powell also advised against emphasising their updated forecasts, saying they could easily change.

The recent rise in bond yields has remained within the bounds of the decades long downtrend in yields. While downside expectations are limited, the absence of a break above the downtrend will have gone some way to ease tensions about the impact on equity prices of tighter monetary conditions. A break above trend may have more dramatic consequences for equity prices.

Low grade corporate bond yields continue to edge up very slightly but, taken as a sign of financial conditions for miners, remain consistent with favourable funding conditions.

Exchange Rates

The downward directional shift in the US dollar has stalled amidst competing views about relative growth rates, fears about disruption to trade patterns and the funding requirement of the US government.

The newly legislated tax cuts and an omnibus spending bill tailored to get enough votes in both houses of the US Congress suggest longer term downside consistent with a history of a weakening currency occasionally punctuated by unsustained cyclical rises.

The gentle upward drift in the Australian dollar could remain intact as long as risks to global economic conditions remain lowered and commodity prices are in the upper end of the range of prices in the past year.

Within that trend, tightening monetary conditions in the USA and, later, in Europe could exert more downward pressure as they occur contributing to within-trend fluctuations.

In the near term, trade disputes between the USA and its major trading partners in Canada, Mexico, Europe, Japan and China could add headwinds for any country potentially caught in the crossfire, including Australia.

Commodity Prices

The general upswing in commodity prices over the past year remains within the bounds of a cyclical trough suggesting still stronger economic activity will be needed to carry prices higher.

Gold & Precious Metals

The gold price has been subjected to a tug of war between the negative effect of higher bond yields and the positive influence of a weaker US dollar. Overlaying those macro factors more recently has been anxiety about the rising trade rivalry between the USA and Europe and China.

The net result of the various factors driving prices has been a sharp rise in gold bullion prices during the past week.

Prices of Australian gold related stocks have moved within a narrower range than their north American counterparts. Australian prices still sit toward the upper end of the range of outcomes over the past year. In contrast, North American prices are around the lower end of their range.

Both groups of stocks have shown less than historical leverage to higher bullion prices. The North American stocks have shown the stronger connection to financial market conditions over the past month.

Within the precious metal complex, palladium prices remain well ahead of relatively stable gold, silver and platinum prices despite the upward move facing the strongest headwinds in over a year.

Nonferrous Metals

Prices of the main daily traded nonferrous metals had become increasingly correlated with a broadening consensus about the lowered risks to world economic activity.

Tin prices have lagged conspicuously over the past year but showed a similar rise to that of other metals (and a more recent decline) since late in 2017.

All prices have tended lower as concern about disrupted international trade patterns have intensified and as (still minor and ambiguous) signs of weakness in Chinese activity rates have had an effect.

Bulk Commodities

Bulk commodity prices tipped lower in the past week.

Demand for iron ore has remained at cyclically high levels but with little change over the past four years in global steel production, the scope for significant tightening in market conditions is more limited than for coal.

The coal market will have been a beneficiary of increasingly constrained supplies with capacity being closed in Asia and development plans elsewhere under threat despite rising demand from energy suppliers and steel producers.

Oil and Gas

In a similar reaction to that evident among the gold stocks, equity prices for oil and gas explorers have been dominated by broader stock market movements rather than movements in the price of crude oil.

Higher US production remains a burden on investor expectations.

Battery Metals

Eighteen months of rising lithium-related stock prices has given way to a period of market reassessment as a lengthy pipeline of potential new projects raises the prospect of ongoing supplies being adequate for expected needs.

Potential lithium producers have been able to respond far more quickly to the various market signals than has been the case in other segments of the mining industry.

Battery metals remain a focal point for investors with recent attention moving to cobalt and vanadium.

Uncertainty over how a peaceful transfer of power can occur in the Democratic Republic of the Congo has added a dimension to cobalt prices lacking in other metals caught up in the excitement over transport electrification.

Uranium

The uranium sector is once again moving along the bottom of its long time trading range in the absence of more meaningful signs that power utilities are prepared to re-enter the contract market to negotiate their longer term needs.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.