The Big Picture

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

Large daily swings in US equity prices again typified the week which ended on a down note as monetary policy and trade policy intersected in an unexpected manner.

A swing towards safety characterised the week with investors seemingly ready to entrust their cash to governments without any compensation for risk.

Investors had been waiting for Federal Reserve chairman Jerome Powell to speak on Friday at the annual gathering of central bankers at Jackson Hole in Wyoming. Powell more or less indicated that the Fed would do what was needed to sustain the US expansion, leaving the impression that there would be another Fed Funds rate cut in September and perhaps more after that.

In speaking, Powell had to thread a needle between those on the central bank’s policy committee wanting a more accommodating stance and those happy to sit without any further policy moves, at least for the time being.

The unusual split among Fed governors had become more evident in the minutes of the July meeting released during the week as well as in a series of interviews with governors leading up to the chairman's address.

Meanwhile, an increasingly angry and aggressive US president compared Powell to Chinese president Xi as an “enemy” as he criticised his central bank head for not easing policy (seemingly in the mistaken belief that the Jackson Hole conference was a policy meeting of the Fed).

Coinciding with the Jackson Hole meeting, the Chinese government announced it would impose tariffs on a range of US imported goods. Trump responded by hiking the tariff rate on goods already earmarked for US tariffs.

The impression of policy-making pique destabilised equity prices which had earlier responded positively to Powell’s comments.

Since the Fed had already referred to trade disruption as a source of employment risk, the events on Friday should solidify the chances of further rate cuts in the month ahead (in the absence of a dramatic reversal in approach by either the US or Chinese sides).

Growing concerns about a slowdown in global growth maintained the downside bias in government bond yields although, later in the week, the momentum had stalled in a possibly temporary reaction to the size of the move in a very short space of time.

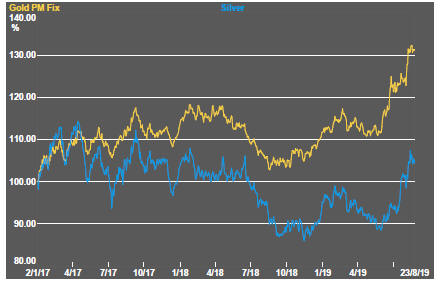

The gold price continued to track bond prices. The copper price once again appeared unresponsive to growing fears elsewhere about a global growth slowdown.

Daily traded nonferrous metal prices, as a whole, tended lower but showed little change in the light of the dramatic swings in financial market sentiment. Coal and iron ore prices showed a similarly modest downward bias.

The crude oil price stabilised but oil related equity prices continued to press lower as scepticism about the ability of producers to match their output to global needs prevailed.

The spread between government yields and higher risk corporate bond yields continued to widen although the change in relative prices did not come with any significant deterioration in financing conditions do corporates.

The principal mining sector equity price indices reflected the broader equity price trends and the recent weakness in iron ore prices which impacts most heavily on the market leaders dominating the indices.

Against the trend in the headline indices, prices of exploration stocks pushed higher albeit having underperformed the leaders and making gains from historically low levels.

Price indicators for companies engaged in battery metals production remained week. Uranium price indicators also weakened.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

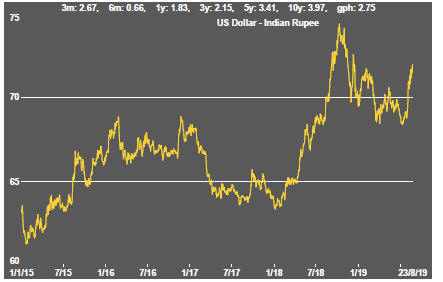

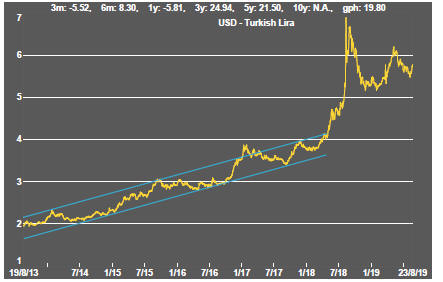

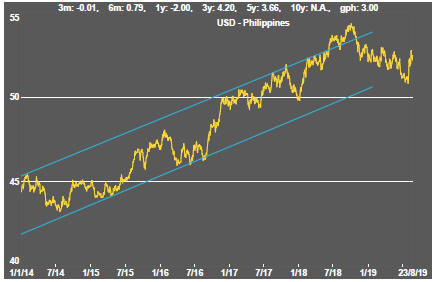

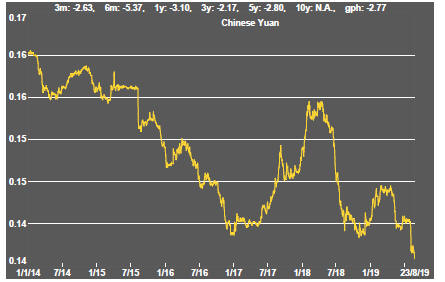

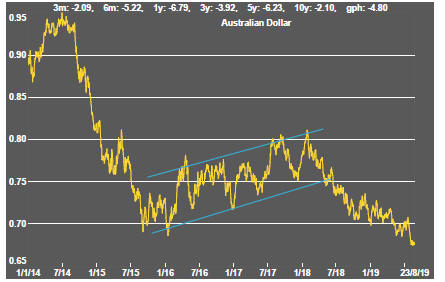

Exchange Rates

Commodity Prices Trends

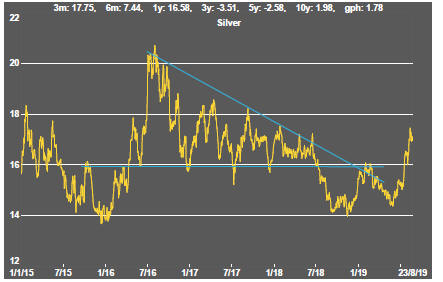

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

Oil and Gas

Battery Metals

Uranium