The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

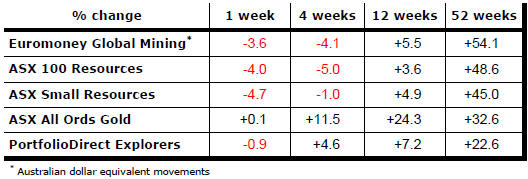

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

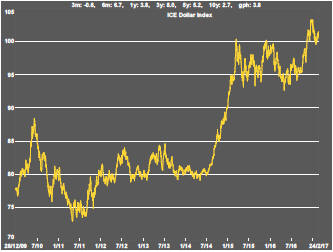

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Market Breadth Statistics

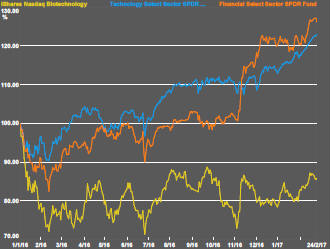

Donald Trump continues to receive the benefit of the doubt as the main U.S. equity market indicators break new records but not all sectors are participating.

The ongoing rise in the US market is about a re-pricing of financial sector and technology stocks. Other parts of the market have shown patchier or less sustained outcomes.

Industrial sector stocks have generally failed to perform in line with the market after a brief flurry in the immediate aftermath of the Trump election.

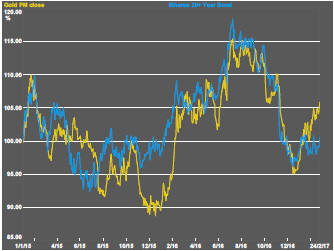

Gold prices have broken the link with, more stable, bond prices for the time being. Gold seems to be anticipating a rise in inflation whereas bond prices appear less concerned, at least for the time being, about that possibility.

The more aggressive pace of interest rate rises expected in 2017 implies re-emerging downside risks for the gold price if it has already taken into account the possibility of any higher inflation rates connected to stronger growth outcomes..

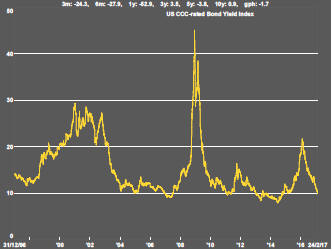

Yields on lower rated corporate bonds have continued to track lower suggesting improved funding access for mining juniors although, as the chart of the small resources share price index in the right hand panel illustrates, equity investors have remained reluctant to re-price stocks in the mining sector to reflect the changed financial market condtions.

A strong US dollar environment persists with the balance of risks still pointing to the upside with higher interest rates and stronger growth than outside the USA..

The more optimistic view about global growth, including Chinese growth holding up better than expected, has helped sustain commodity prices at higher levels than experienced in late 2015.

As the chart of the cyclical positioning on page 1 shows, prices are generally ahead of historical averages for this point in the chronology of cycles but the momentum has eased suggesting prices might have taken full account of changed conditions and may need a fresh catalyst to carry the cycle further.

Oil is one of the commodities whose price has appeared to lose momentum. Oil and gas related equities which show the same recovery from depressed cyclical conditions in late 2015 as other parts of the resources industry appear to have lost momentum.

The uranium sector continues to attract new investor interest looking to take advantage of the bottom of the cycle leverage in a sector which has lagged other parts of the resources industry. As with other parts of the industry, prices are losing momentum although the segment remains a laggard within the industry.

As a general rule, prices within the exploration end of the market remain heavily subdued despite instances of lithium, cobalt and zinc exposed companies showing strong gains..

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.