The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low. These conditions were largely reversed through the first half of 2016 although sector prices have done little more than revert to mid-2015 levels.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

Has Anything Changed?

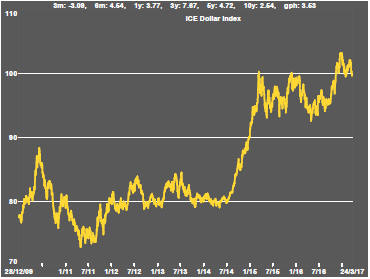

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Market Breadth Statistics

Abandonment of health insurance reform by the U.S. Republican Party after a seven year campaign to get rid of the so-called Obamacare health care plan dominated much of the week.

The implications of taking the reform bill off the table went beyond health care policy. The change in tack raised questions about the ability of the Republican Party to govern.

With tax changes and infrastructure proposals still to be addressed legislatively, the initial market reaction was negative.

Equity investors have recently been inclined to see any glass as half full. By the final trade of the week, the commentary had switched from there having been a political failure to how a quick shelving of healthcare reform would allow the U.S. Congress to raise tax policy and other business friendly issues on the priority scale. Market sentiment improved noticeably.

Over the last two months, disparities in US sector performance have become more evident leading to an overall loss of momentum.

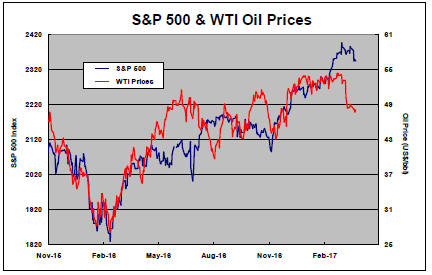

The financial services sector (shown in the blue line in the chart above) which had been leading the charge has fallen sharply. Technology stocks (in red) have retained their upward trajectory. Materials sector prices (in orange) which had been perceived as a beneficiary of the Trump election have barely changed since the new president's inauguration. Energy stocks (in yellow) have been in a downtrend since his election although this outcome has had less to do with domestic politics than perceptions of oil market balances.

Iron ore and copper prices have been moving broadly in concert over the past three years although, most recently, the copper price has appeared to lose momentum even as iron ore prices have pushed higher .

As the commentary on page one suggests, there are some fundamental reasons to explain why further copper price gains may be limited.

Similarly, the data suggest that iron ore demand from steel producers will have already hit their peak without a significant change in the macro picture to drive metal demand.

Throughout most of March, a slide in the U.S. dollar has supported dollar denominated prices but the exchange rate remains historically elevated with continuing upside risks as the Fed moves to raise interest rates, at least initially, ahead of central banks elsewhere.

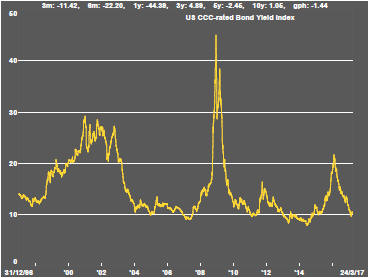

Although probably not material presently, lower rated corporate bond yields have started to rise after having pushed lower over the past year. Nonetheless, the moves in the last week suggest that the momentum toward riskier assets, including mining sector equities, may have dissipated somewhat.

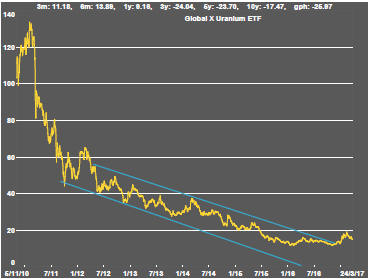

Uranium market expectations have reversed after a short lived rally which lifted equity prices from near their cyclical troughs but left them with insufficient momentum to surpass early 2015 prices.

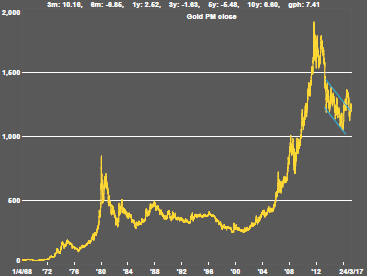

A longer term view of the gold bullion price suggests a very similar picture is evolving presently to that which occurred in the early 1980s. Without a compelling reason to do anything else, prices were essentially flat for 20 years.

The potential for lower bond prices as the Fed normalises monetary policy reinforces the likelihood of a repetition of this scenario.

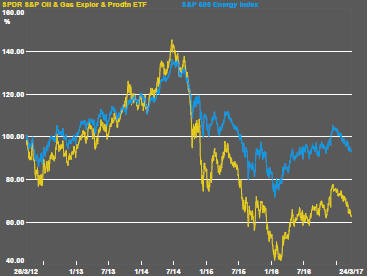

Upstream and downstream oil-related equities have been tracking lower with the explorers being more sensitive to weakening oil market conditions. The latter potentially offer greater leverage to improved conditions but the unresolved balance of the oil market leaves such a move presently premature .

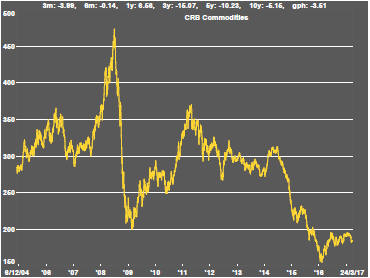

The overall momentum of commodity prices reflecting the broader global macro environment does not suggest to investors that significant shifts in funds allocations are warranted.

.

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.