The Big Picture

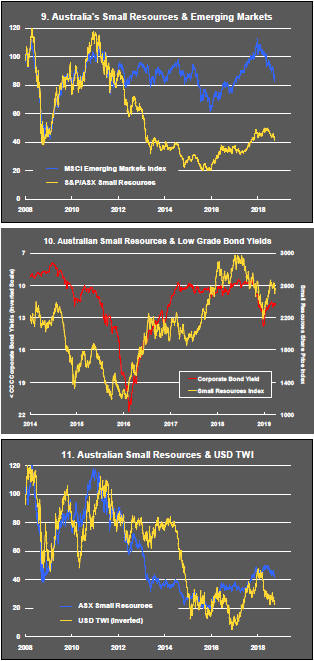

After recovering through 2010, a lengthy downtrend in sector prices between 2011 and 2015 gave way to a relatively stable trajectory similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of frequent macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable.

Relative stability in sector prices suggests a chance for individual companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

Still vulnerable cyclical conditions were aggravated in the second half of 2015 by a push from investors worldwide to reduce risk. Sector prices were pushed to a new cyclical low some 90 months after the cyclical peak in sector equity prices but these conditions were reversed through 2016 and 2017 although, for the most part, sector prices have done little more than revert to the 2013 levels which had once been regarded as cyclically weak.

With a median decline in prices of ASX-listed resources companies through the cycle of 89%(and 30% of companies suffering a decline of more then 95%), the majority of stocks remain prone to strong 'bottom of the cycle' leverage in response to even slight improvements in conditions.

In the absence of a market force equivalent to the industrialisation of China, which precipitated an upward break in prices in the early 2000s, a moderate upward drift in sector equity prices over the medium term is likely to persist.

The Past Week

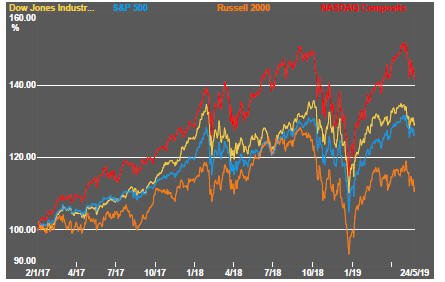

Falling bond yields and tumbling stock prices pointed to risk shedding amid widespread concerns about deteriorating global growth.

German yields have moved further below zero raising worries about the capacity of European monetary authorities to move against any more significant growth decline.

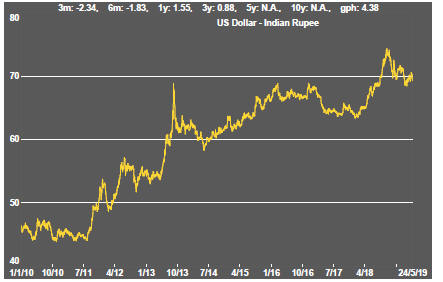

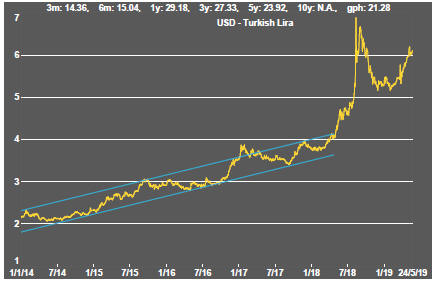

Adding to signs of a flight to safety has been a continuing upward bias in the direction of the US dollar.

US-China trade disagreements assumed more worrying overtones. The once expected deal has been complicated by the US government ban on Huawei doing business with American companies and, subsequently, President Trump introducing Huawei as an element in the trade discussions.

The prospect of a more politically oriented and cosmetic deal involving China taking larger quantities of US agricultural products no longer appears on the table. In rejecting the compromise approach preferred by China, the US government has raised both the probability of no deal as well as the probability of a wide ranging substantive deal.

The rising prospect of a binary choice is likely to play out over many months, possibly years.

European elections are about to usher in a lengthy period of uncertainty as new leaders are chosen. One of their tasks - to bring some order to the disarray surrounding the Brexit process - could also prove prolonged and detrimental to regional growth outcomes.

The chance of a unilateral departure from the European Union by the United Kingdom seems to have risen since elections for the European parliament despite the political consensus against unilateral withdrawal at Westminster, throwing added doubt on business investment outcomes.

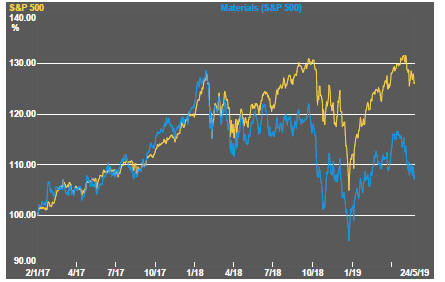

Daily traded metal prices retained their downward bias although, given the global growth uncertainties, the outcome to date could be construed as remarkably resilient for this point in the cycle. Nevertheless, the sector momentum is consistent with a downward cyclical trajectory with up to a year to run.

Higher iron ore prices and an Australian currency at the lowest level against the US dollar in three years is helping equity prices for Australian miners, most especially the market leaders and gold producers most likely to be priced by international investors.

The performance gap between crude oil prices and the prices of oil and gas exploration and production companies highlights continuing scepticism on the part of equity investors about growth and earnings prospects within the sector with a correspondingly lowered emphasis on the consequences of supply disruptions.

Gold prices have changed little in the face of relatively large moves in the bond prices suggesting a rising chance of a near term upward move in bullion prices.

Sector Price Outcomes

52 Week Price Ranges

The Steak or Sizzle? blog LINK contains additional commentary on the best performed stocks in the sector and the extent to which their investment outcomes are underpinned by a strong enough value proposition to sustain the gains.

Equity Market Conditions

Resource Sector Equities

Interest Rates

Exchange Rates

Commodity Prices Trends

Gold & Precious Metals

Nonferrous Metals

Bulk Commodities

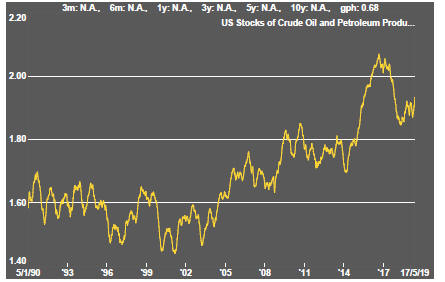

Oil and Gas

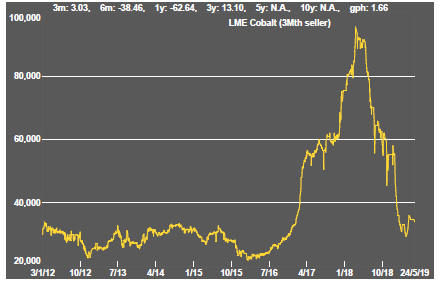

Battery Metals

Uranium