The Current View

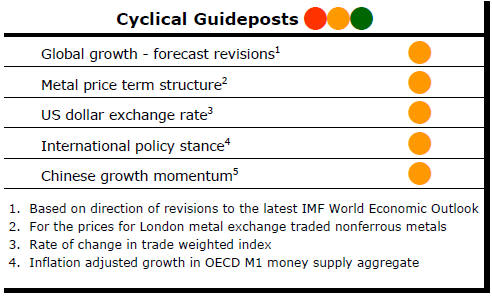

The PortfolioDirect cyclical guideposts suggest that the best possible macroeconomic circumstances for the resources sector will involve a sequence of upward revisions to global growth forecasts, the term structure of metal prices once again reflecting rising near term shortages, a weakening US dollar, strong money supply growth rates and positive Chinese growth momentum.

All of the five guideposts are "flashing amber" with the potential for at least one to switch to red shortly suggesting the cycle is now struggling to make headway.

Has Anything Changed? - Updated View

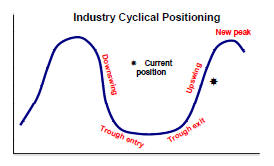

From mid 2014, the metal market cyclical position was characterised as ‘Trough Entry’ with all but one of the PortfolioDirect cyclical guideposts - the international policy stance - flashing ‘red’ to indicate the absence of support.

Through February 2016, the first signs of cyclical improvement in nearly two years started to emerge. The metal price term structure reflected some moderate tightening in market conditions and the guidepost indicator was upgraded to ‘amber’ pending confirmation of further movement in this direction.

As of early December 2016, the Chinese growth momentum indicator was also upgraded to amber reflecting some slight improvement in the reading from the manufacturing sector purchasing managers index. Offsetting this benefit, to some extent, the policy stance indicator was downgraded from green to amber.

At the end of July 2017, the exchange rate guidepost was upgraded to green.

As 2017 ended, there were emerging signs of economic forecasters beginning a sequence of growth forecast upgrades prompting a revision of the global growth guidepost to "green".

Three quarters of the way through 2018, global growth appears to have peaked and the US dollar is on the rise both warranting guidepost downgrades.

Cyclical Position

The level and direction of metal prices are consistent with the historical average this far into a cycle. A more detailed analysis of metal price cyclical duration is available here.

Time, of itself, is not important but the sequence of adjustments which are typical of a commodity price cycle and contribute to changed prices and expectations does take time.

The question now is whether there is enough momentum to carry the industry through a more prolonged upswing phase of the cycle. More often than not, progress stalls around this point.

A pullback is not a necessary outcome but an alternative result would most likely require some combination of higher global growth than currently anticipated, U.S. dollar weakness or more supportive monetary policies. Each of these three key influences is moving through a transitional phase with none currently pointing in the right direction.

Global Growth - Forecast Revisions

Forecasters are flashing warning signs that global economic growth might have already peaked.

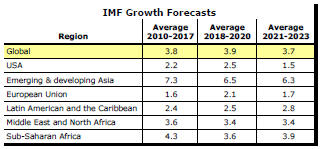

In releasing the regular half yearly World Economic Outlook on 17 April, the IMF research director described the world economy as showing broad based momentum but kept the Fund’s global growth projections at 3.9% for both 2018 and 2019.

In updating its growth forecasts in July, the Fund focused on the risks to growth. Decimal rounding left the 2018 growth forecast unchanged but the Fund economists warned of a higher than 50/50 chance that the forecasts will be revised down when it releases its next World Economic Outlook in October.

Generally upbeat assessments of the world economy rely

heavily on what happened in late 2017 rather than on what lies ahead. Global

growth accelerated in 2017 from 3.2% to 3.8%, the strongest increase since

the recovery from the financial crisis during 2010. Improving growth

outcomes in the second half of 2017 underpinned rising metal usage

following an otherwise lacklustre first half.

The strongest increases in metal usage typically occur when global GDP growth is accelerating.

From an equity market perspective, rising growth projections are usually a prompt for strategists to raise sectoral fund allocations.

In January 2018, the World Bank announced that it had raised its global GDP growth forecast for 2018 from 2.9% to 3.1%, largely reflecting what had already happened in 2017.

The forecast for 2019 was also raised - from 2.9% to 3.0%. The revisions imply a slower outcome in 2019 than in 2018.

The upgrades to the global growth outlook by the two international organisations ostensibly contained some of the best news for the mining industry since 2010.

The not so good news is that 2017 is nearly as good as it gets, in the eyes of the Fund and the World Bank.

The

full

IMF analysis in April points to no difference in average growth rates in the next six

years than in the last six years. Key regions of the world – the USA,

Europe and emerging Asia – face a downward trending growth outlook.

The

full

IMF analysis in April points to no difference in average growth rates in the next six

years than in the last six years. Key regions of the world – the USA,

Europe and emerging Asia – face a downward trending growth outlook.

Unusually low productivity growth in most advanced economies, reflecting low business investment spending and governments with little enthusiasm for reform agendas, are constraining how quickly global output can expand.

Legislation to cut taxes in the USA is adding a fiscal stimulus in the near term but whether tax cuts support productivity enhancing capital spending in the next several years to sustain a stronger growth base is less certain.

Meanwhile, a threatened departure from the trade liberalisation forces of the past several decades precipitated by the US administration seeking to capture a larger share of world trade endangers global growth prospects and, ultimately, the prosperity of the mining industry.

Whatever the eventual outcome of the recent threats and counter threats over trade, the resulting uncertainties, left to fester, will retard business investment plans. Signs of this are already evident.

The most important missing piece in the progress of the metal price cycle – a stronger private sector investment commitment – is at risk immediately whatever the eventual impact on trade flows.

US Dollar Exchange Rate - Chart 2

Along with reduced risks to growth, a weaker U.S. dollar contributed to the upward trajectory in metal prices through 2017.

Over the past 45 years, a 1% fall in the US dollar trade

weighted index has come with an average rise of 3% in nonferrous metal prices.

The downward currency adjustment had reflected some reappraisal of relative growth rates, with more optimism about Europe, and the direction and pace of interest rate changes.

Diminished financial stability risks in Europe favoured the euro.

The

reduced need in a less risky macro

Some of these factors are now being unwound, at least temporarily.

The improvement to European growth has lost momentum.

Attention is again focusing on the likelihood of US interest rate changes

running ahead of moves in Europe.

Attention is again focusing on the likelihood of US interest rate changes

running ahead of moves in Europe.

Faltering emerging economies have also made investors more sceptical about their growth prospects and their currency upside.

Stronger US growth from a tax and spending driven fiscal stimulus may also contribute to a near term reappraisal of economic conditions in favour of the US dollar although US policies are not a sustainable source of upward currency pressure without structural changes to US growth potential.

In the years ahead, as distinct from the balance of 2018, slower growth than in 2018 and rising US debt are likely to drag the currency toward its longer term downward trajectory.

International Policy Stance - Chart 3

Global monetary policies had been set so as to support higher asset prices as a step toward raising demand and creating stronger employment markets. Commodity prices benefitted from the stronger liquidity flows into speculative markets as well as improvements in real output growth.

As some of the most favourable monetary conditions in modern history are wound back, the mining industry will be relying more heavily on output growth alone and, for that, on the willingness of governments to foster stronger productivity outcomes to raise global growth potential.

Stronger productivity growth will facilitate increases in wages and consumer

spending

with fewer worries about rising inflation pressures.

Stronger productivity growth will facilitate increases in wages and consumer

spending

with fewer worries about rising inflation pressures.

The greatest danger to a metal price cycle comes when monetary policy settings begin to tighten in response to higher inflation with an adverse effect on output growth and investment spending.

This far into the cycle, monetary policy settings would usually be tightening, sometimes quite aggressively. Policy settings are changing more gradually than in the past because competitive forces within labour markets are holding back inflation pressures.

While this beneficial effect on inflation has persisted for longer than anticipated, policymakers are working on the assumption of it coming to an end. Policy is already becoming less supportive as declining growth in US and global money supply attests.

Metal Price Term Structure - Chart 1

Some tightening in nonferrous metal price spreads was led by emerging backwardations in London Metal Exchange lead and zinc prices.

The tightening in spreads is modest by the standards of what is possible but overall physical market balances do not appear to be changing enough for the shift in premiums to move more dramatically.

The International Copper Study Group (ICSG) has reported

that demand for the metal in 2017 rose by 0.7%, the smallest annual increase in demand since 2009.

The International Copper Study Group (ICSG) has reported

that demand for the metal in 2017 rose by 0.7%, the smallest annual increase in demand since 2009.

The International Lead Zinc Study Group has reported that zinc usage has not changed significantly for four years.

Despite unusually slow growth in metal usage, market balances have been kept in check by declines in mine output.

Constraints on the supply side have helped deliver tighter market conditions than would otherwise have been experienced but these can be reversed. If the zinc mine production rate in December 2017 were to be replicated through 2018, for example, output would grow by nearly 9% in the current year.

With only moderately increasing rates of usage across the major daily traded metals, relatively narrow metal price spreads may indicate market conditions are insufficiently strong (and possibly subject to reversal if producers choose to do so) to carry the cycle significantly further.

Chinese Growth Momentum - Chart 4

Chinese manufacturing has enjoyed a prolonged expansion

during the past 12 months which has helped build positive sentiment for investments in the

mining sector (as illustrated in the fourth chart in the right hand panel).

China's official statistical agency reported that GDP had grown by 1.4%, or at an annualised rate of 5.7%, in the March quarter of 2018. The relatively slow pace of growth if maintained would have fallen significantly short of the growth targeted by Chinese leaders.

Chinese growth is destined to head lower in coming years but China has consistently met annual statistical goals in recent years through periodic growth surges. The same is occurring in 2018 although the effort required to do this year after year becomes progressively harder and policymakers are likely to gradually guide expectations lower.

Officials have estimated that the Chinese economy grew by 1.8% in the second quarter of 2018. Official purchasing managers statistics for manufacturers since February also suggest a recovery from an apparent slowing in activity in the early weeks of 2018.

Current Chinese growth rates remain highly dependent on bank lending despite widespread agreement that the flow of funds is creating longer term distortions which will need addressing.

More accommodating policy settings than have been in place for the past

several years are highly unlikely, biasing any cyclical

risks for raw material markets to the downside.

More accommodating policy settings than have been in place for the past

several years are highly unlikely, biasing any cyclical

risks for raw material markets to the downside.

The restructuring of the Chinese economy with a resulting contraction in the contribution to Chinese GDP of investment spending will have a generally detrimental effect on raw material demand.

Chinese steel production in 2017 was higher than in 2016 but little different from four years earlier.

Other signs of subdued momentum have been evident in statistics released by the International Copper Study Group and the International Lead Zinc Study Group.